Last year, our live trading room provides 69% return annually across the 3 groups that we cover. In Live Trading Room, we scan the market everyday to find any tradable setup. We believe every serious traders need to have a good trading system with specific rules. A complete system must include the following: 1. Conditions […]

-

FTSE calling the rally & buying the dips

Read MoreThe video below is a short capture from London Live Analysis session held on 09/30 by EWF Senior Analyst Daud Bhatti. Daud presented Elliott Wave count of FTSE, explaining the swing sequences and calling the short term x red pull back completed at 6769.9 low. The index was showing incomplete bullish Elliott Wave structure in […]

-

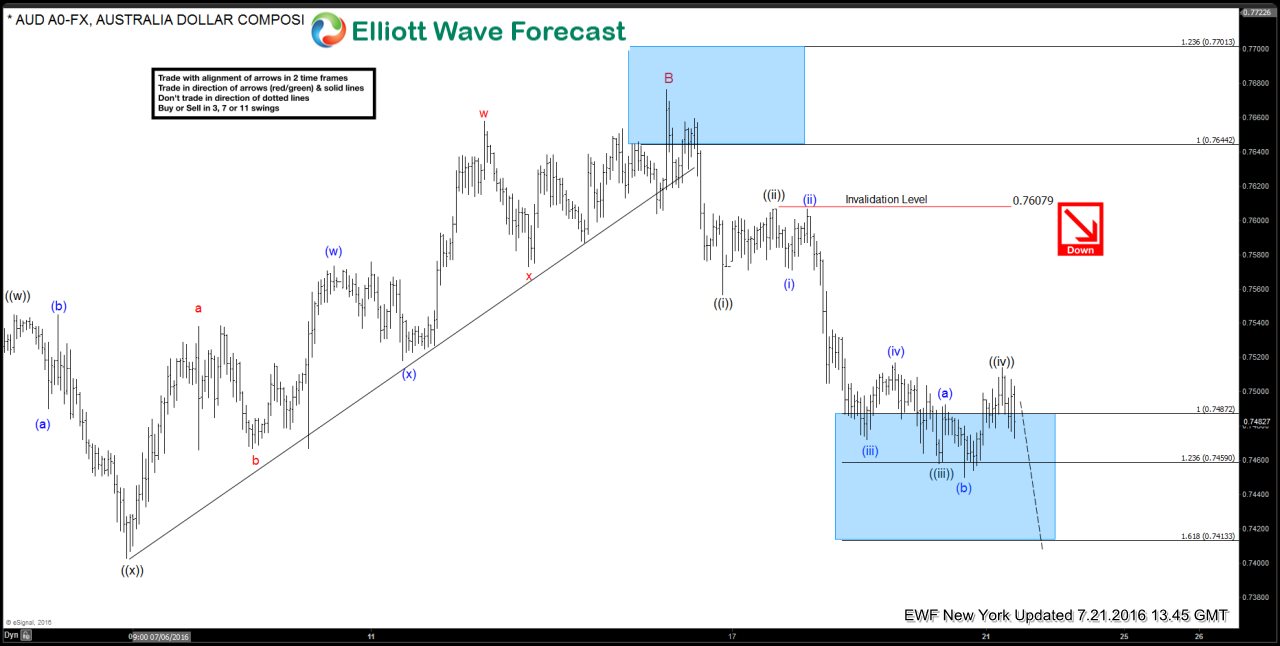

$AUDUSD – Extended Shorts in a Continuation Setup Part 2

Read MoreHere is a quick video blog post from one of our resident traders Dan Hussey on a recent AUD/USD setup he tweeted about! Follow Dan on twitter @DanielHusseyJr to hear more great ideas and get his trading ideas first hand. This setup was a short term example of a continuation setup that utilizes a truly […]

-

$AUDUSD – Extended Shorts in a Continuation Setup Part 1

Read MoreHere is a quick video blog post from one of our resident traders Dan Hussey on a recent AUD/USD setup he tweeted about! Follow Dan on twitter @DanielHusseyJr to hear more great ideas and get his trading ideas first hand. This setup was a short term example of a continuation setup that utilizes a truly […]

-

Quantum Mechanics and Trading

Read MoreLet’s start by getting one thing straight: trading is not easy. There are so many pitfalls and traps that people create for themselves, even before they look at a chart. That’s right; most traders are setup to fail before even considering the validity of their system, or their style of trading. This is mainly because, […]

-

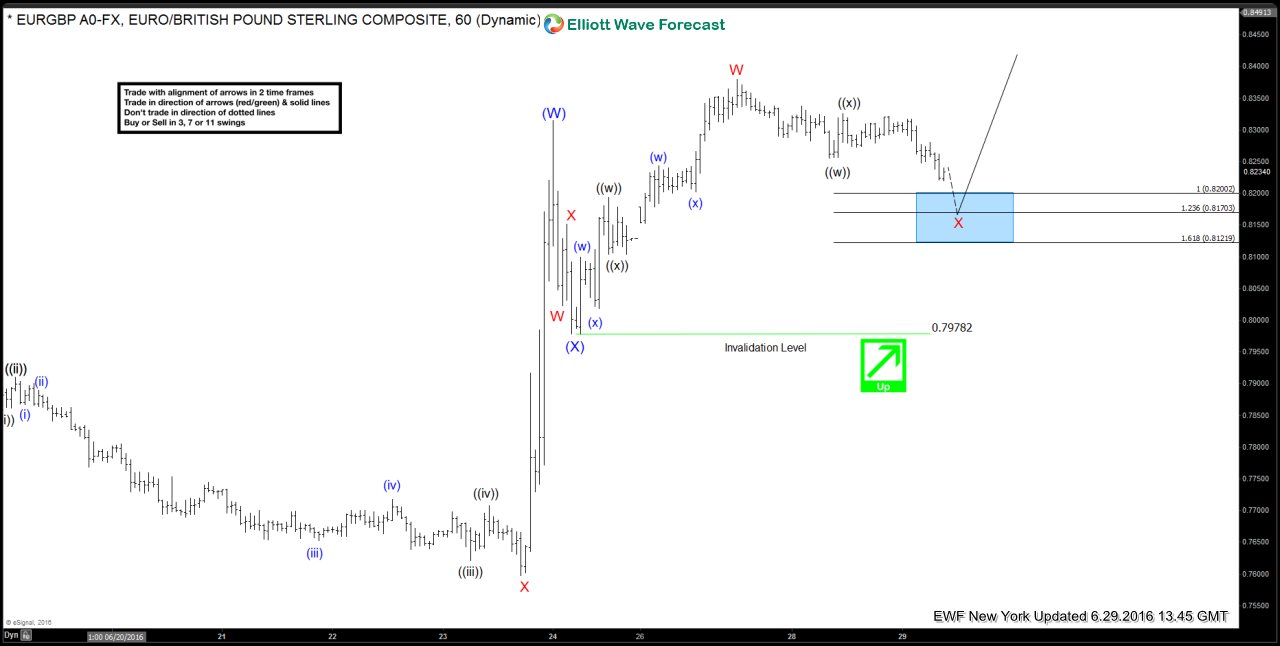

EURGBP Strategy Of The Day (6/27/2016)

Read MoreHere is Strategy Of The Day presented to clients on 6/27/2016. Long EURGBP 6/27/2016 EURGBP is showing an incomplete bullish sequence up from July 2015 and also from May 2016 lows which means the sequence is bullish against 0.7978 (6/24) low and against 0.7563 (5/25) low. Therefore, our strategy is to buy dips in 3, […]

-

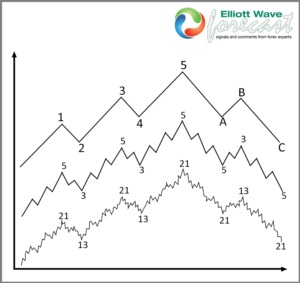

Trend: Applying the concept the trend is your friend

Read MoreTrend: Applying the concept the trend is your friend Many traders like to trade every single swing in the market. In reality, unless you trade as a High Frequency Trading machine or you are a market maker, it is almost impossible to trade every single swing. After years of trading and suffering shallow bounces and losing some money, I realized it is better […]