Royal Gold (NASDAQ: RGLD), founded in 1991, is a global leader in precious metals royalty and streaming. With interests in 194 properties across 20+ countries, it manages gold, silver, copper, lead, and zinc assets. This article evaluates its bullish Elliott Wave framework and highlights potential paths for further growth.

Following 5 years of consolidation in a sideways range, RGLD has decisively surged to new all-time highs within a robust impulsive wave (III) structure. The weekly chart reveals a nesting formation to the upside, therefore, it’s suggesting a third wave extension is likely to unfold, reinforcing the stock’s bullish trajectory.

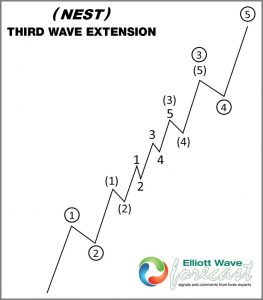

The chart below illustrates the Nest formation, showcasing the I-II series leading up to the wave III extension. Certainly, identifying and capitalizing on a breakout within a nest is among the most rewarding opportunities for Elliott Wave traders.

Third Wave Extension

You can learn more about Elliott Wave Patterns at our Free Elliott Wave Educational Web Page

Remember, the market is dynamic, so the presented view may have changed in the meantime. You can also ask for live updates in our Live Trading Room, where our expert analysts provide next buying opportunity based on new market data.

RGLD Weekly Chart

RGLD is expected to continue its rally through a series of 4th and 5th waves, completing its entire cycle from 2020 within a 5-wave advance above $200. Once this cycle concludes, a larger degree correction is anticipated. In the meantime, we expect the daily pullback to remain supported. After that, buyers are likely to seek long entries, positioning themselves against the December 2024 low of $130.6. This level serves as a critical support point in the ongoing bullish progression.

The following video offers a technical outlook based on RGLD Elliott Wave Daily and Weekly cycles :

The preferred strategy is to consider buying the stock after it forms a 3, 7, or 11 swings sequence from the peak. Using our extreme Blue Box system will help identify the optimal entry points, providing clarity and precision in your trading decisions. Explore our system to gain deeper insights into this methodology.

Discover the potential of Stocks & ETFs investing with our Exclusive 14-Day Trial.

✅Master the art of trading our Blue Boxes using the 3, 7, or 11 swings sequence

✅Access 78 instruments analyzed across 4 different time frames

✅Join Live Trading & Analysis Sessions hosted daily by our Expert Analysts

✅Enjoy 24-hour chat room support and much more

Take the opportunity to explore fresh ideas and sharpen your trading skills. Start your journey today!