The video below is a capture from the London Live Session group 2 held on September 8th by Daud Bhatti. Daud presented Elliott Wave count of Natural Gas, counted the swings and explained our trading strategy.

Natural Gas (NG #F) trading strategy

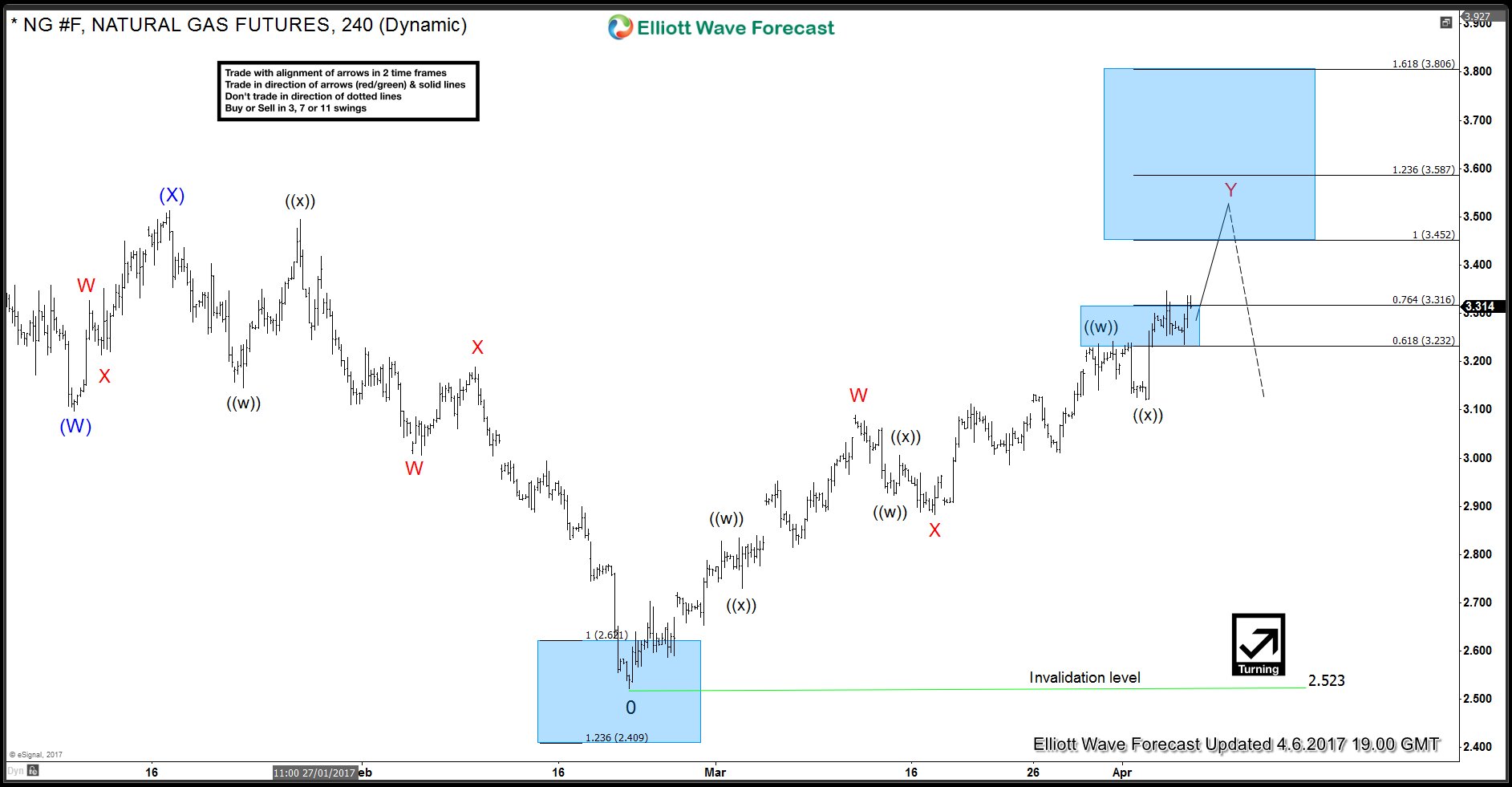

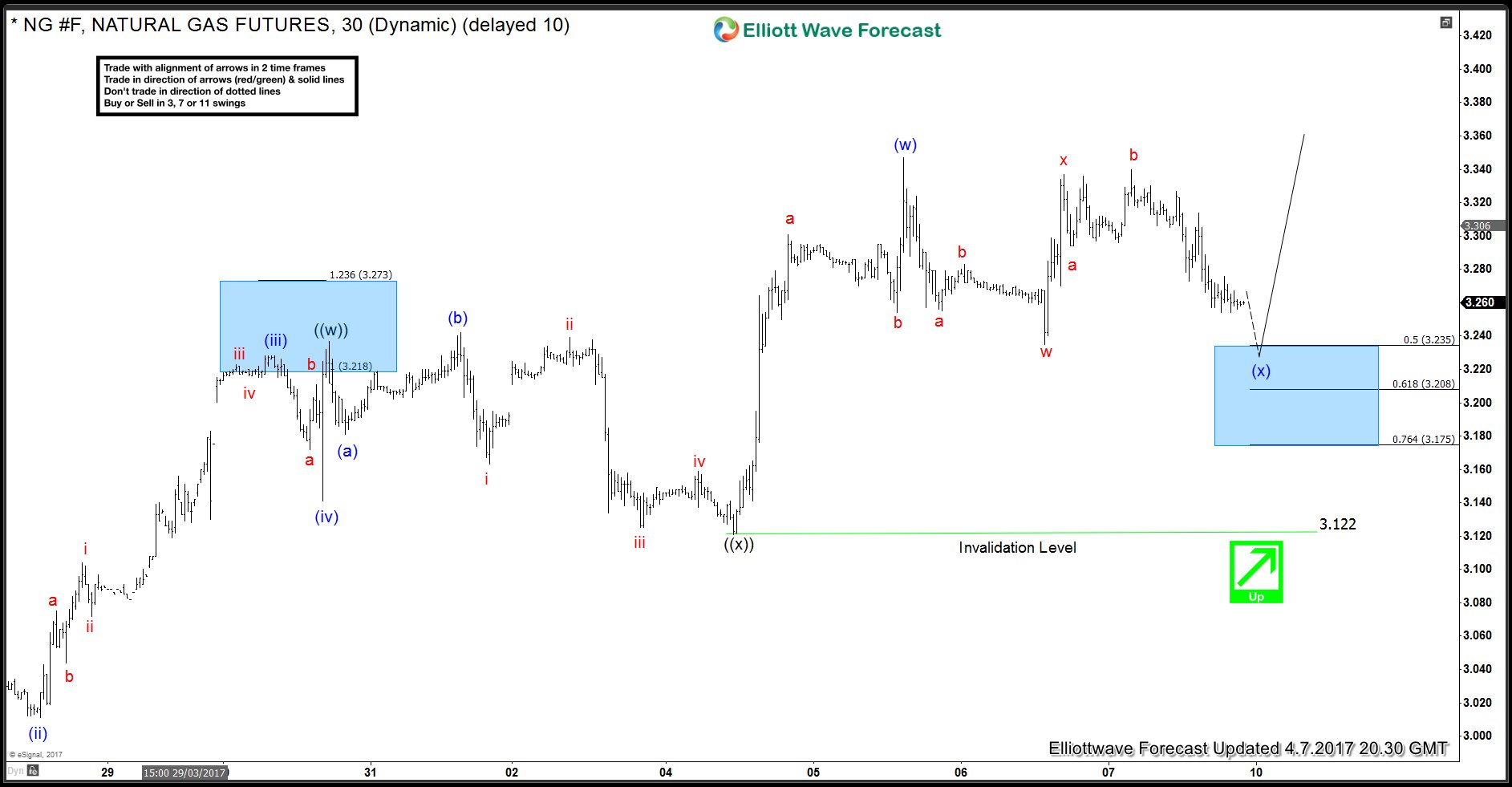

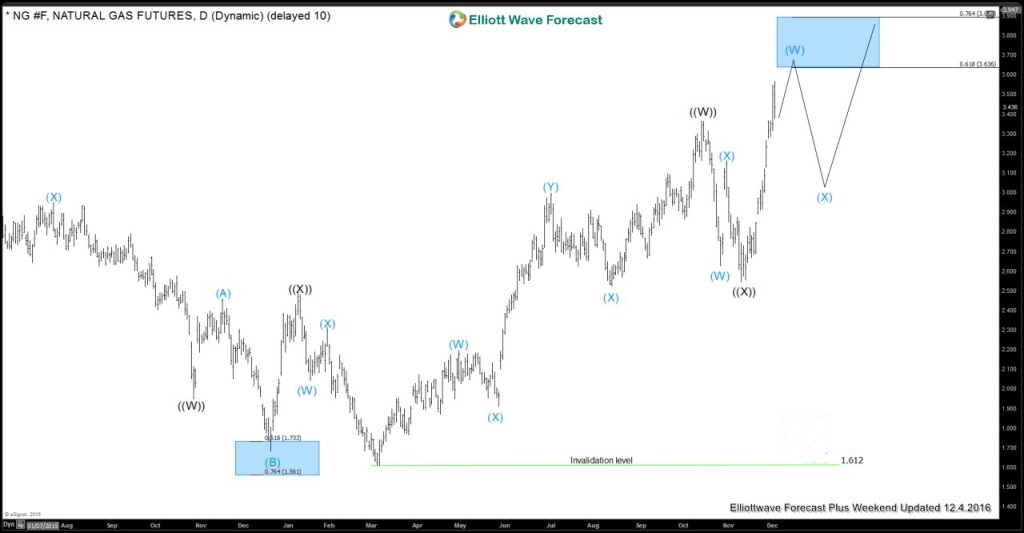

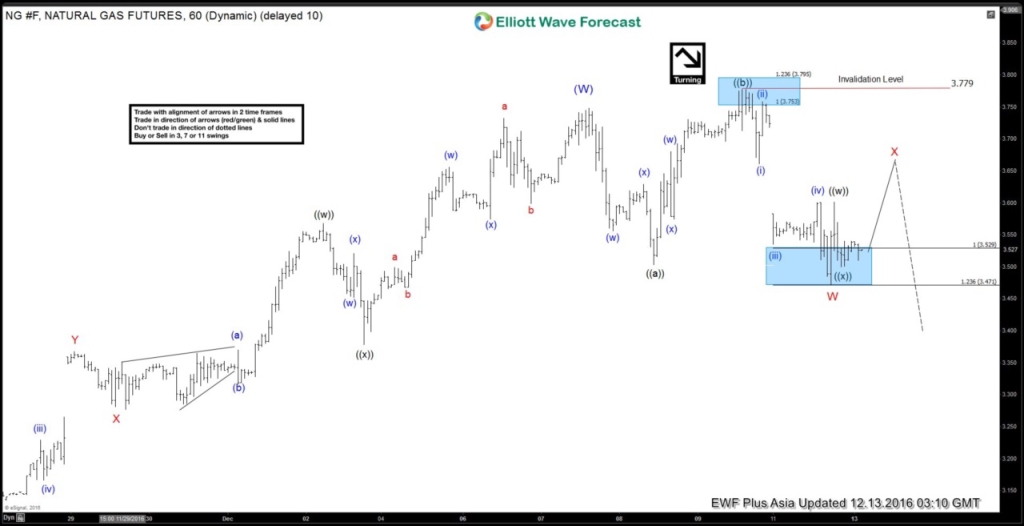

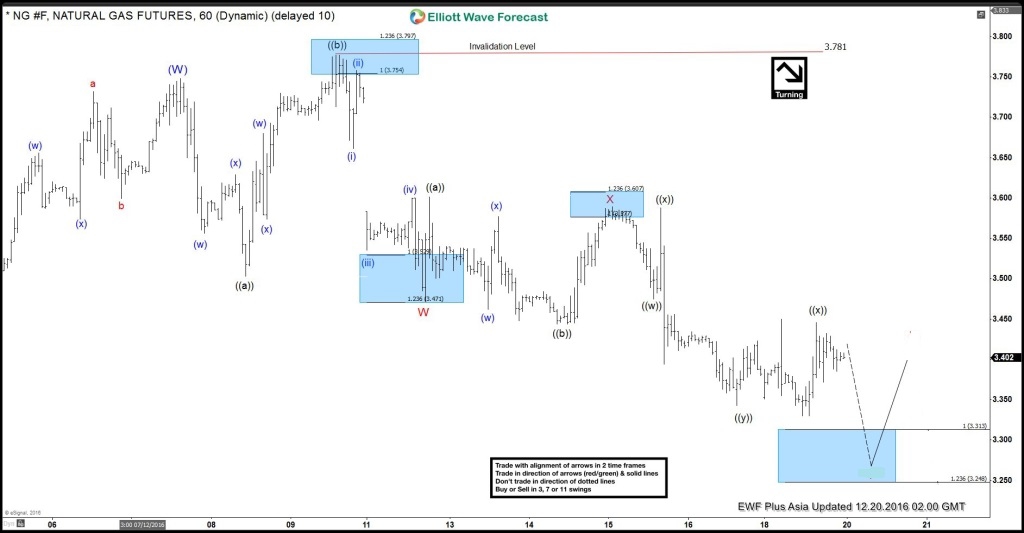

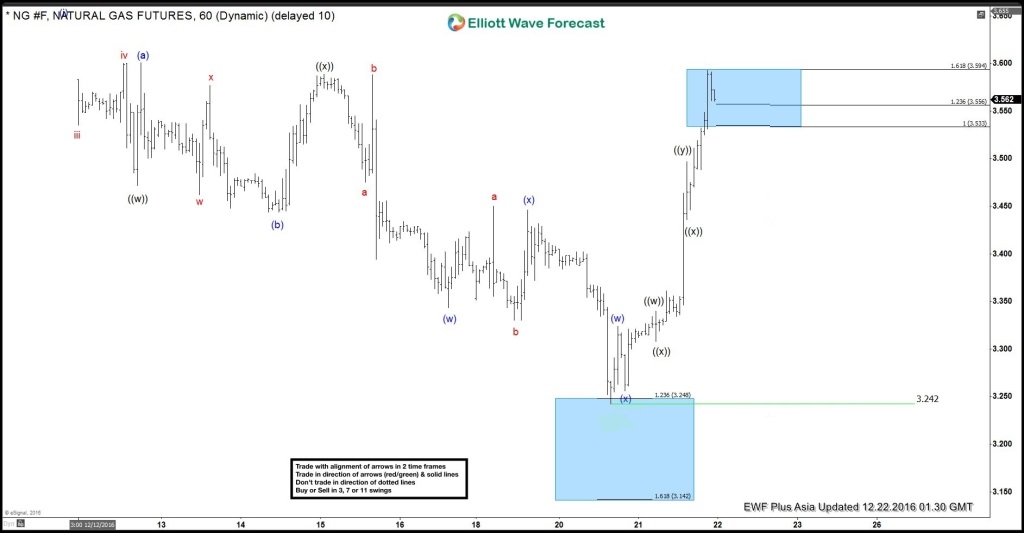

Currently the price is showing 5 swings from the 08/4 low (2.753 low) suggesting another leg up to complete 7 swings sequences. In short term we expect the price to make another marginal swing lower to retest the trend line, as Daud explained. Due to incomplete bullish sequences , we knew that the commodity will offer intraday long opportunities in 3,7,11 swings , targeting 3.217-3.192 area. Buying zone comes at 2.904-2.874, when invalidation level is 2.849.

Let’s take a quick look at the capture below:

Shortly after, Natural Gas made proposed swing down and reached buying zone at 2.904-2.874. It found buyers there and gave us nice rally in 7th swing higher as we expected. Eventually it has reached the target at 3.127 area, giving us nice profits.

Keep in mind market is dynamic. If you’re interested in the future path of Natural Gas ( NG #F) or in any of the other 78 instruments we cover, join us now. You can find Elliott Wave analysis in the membership area of EWF. If not a member yet, Sign Up for Trial now.

Elliott Wave Forecast

Through time we have developed a very respectable trading strategy. It defines Entry, Stop Loss and Take Profit levels with high accuracy and allows you to make position Risk Free, shortly after taking it, protecting your account. If you want to learn all about it and become a professional Trader, join us now for only $9.99.

You will get access to Professional Elliott Wave analysis in 4 different time frames. 5 Live Analysis/Trading Sessions done by our Expert Analysts every day. 24 Hour Chat Room support, Market Overview, Weekly technical videos and much more. Welcome to Elliott Wave Forecast.