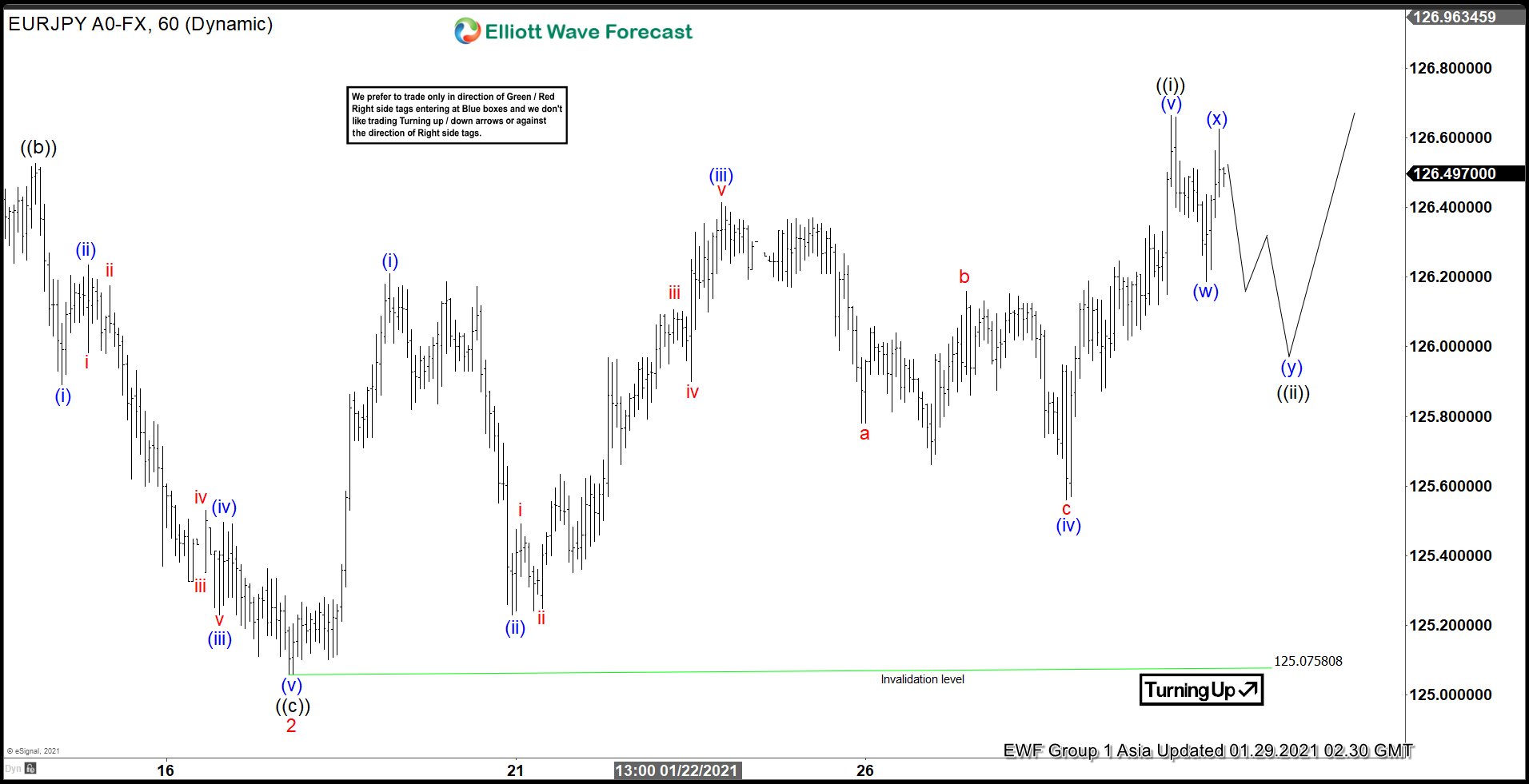

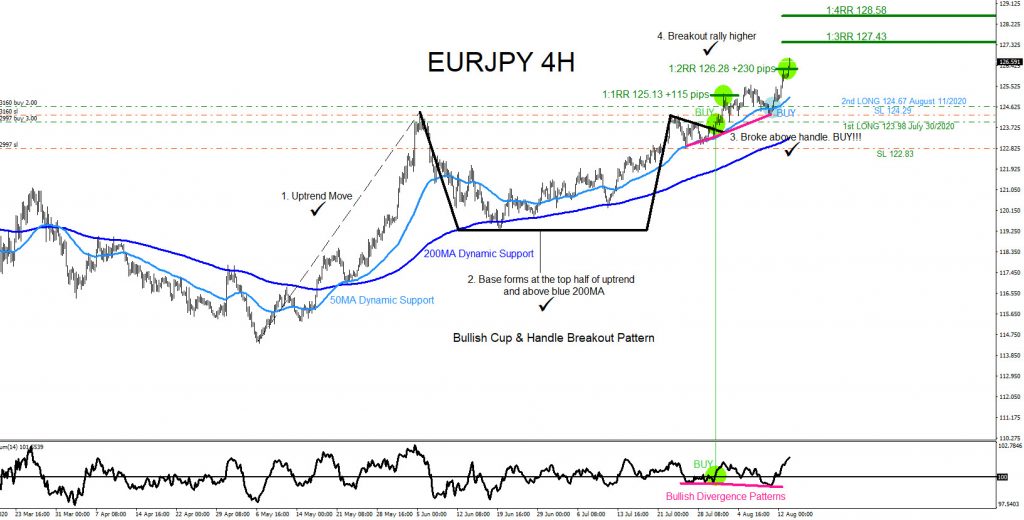

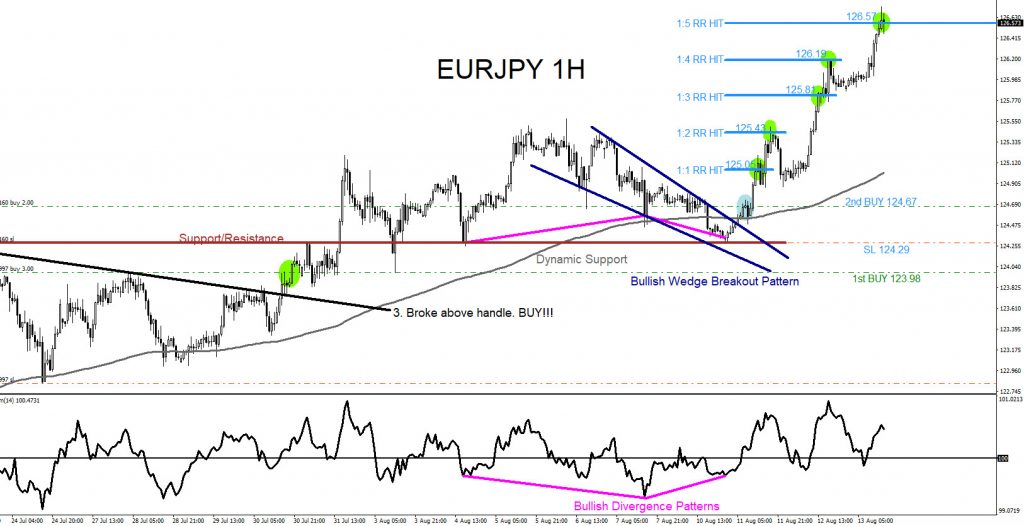

Short Term Elliott Wave View in EURJPY suggests the decline to 125.07 low ended wave 2. Pair has started to turn higher in wave 3 as an impulsive structure. Rally from wave 2 low unfolded as 5 waves leading diagonal and ended wave ((i)) at 126.66. Up from wave 2 low on January 18, wave (i) ended at 126.21 and pullback in wave (ii) ended at 125.23. Pair then resumed higher in wave (iii) towards 126.41 and pullback in wave (iv) ended at 125.56. The final leg higher in wave (v) ended at 126.66 and this also completed wave ((i)) in higher degree.

Wave ((ii)) pullback is now in progress to correct cycle from January 18 low before the rally resumes. The internal subdivision of wave ((ii)) is proposed to be unfolding as a double three. Wave (w) ended at 126.18 and bounce in wave (x) ended at 126.62. Expect another leg lower to end wave (y) of ((ii)) before buyers appear for more upside. As far as January 18 low pivot at 125.07 stays intact, expect dips to find support in 3, 7, or 11 swing for further upside.