-

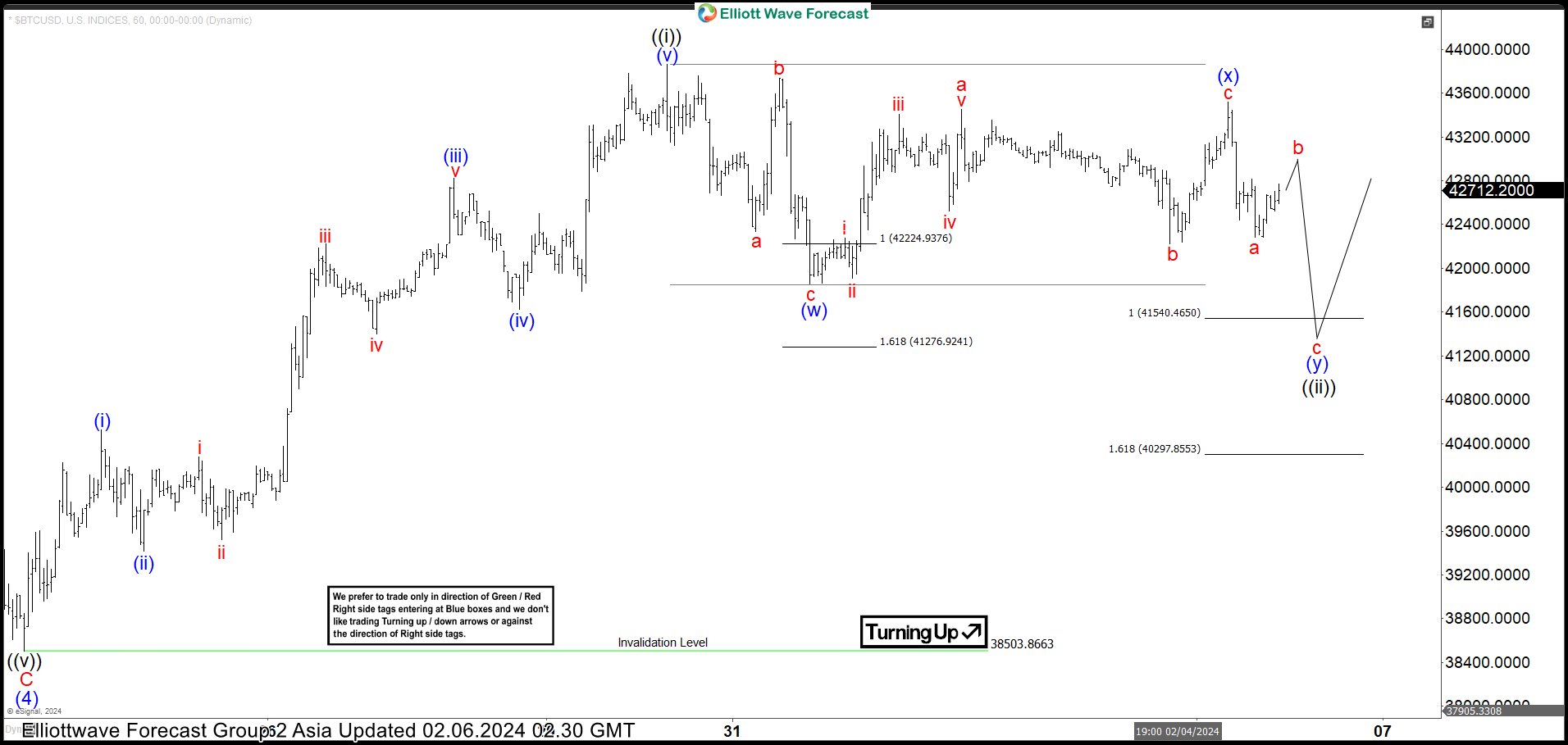

Bitcoin (BTCUSD) Looking to Extend Higher

Read MoreBitcoin ended a zigzag pullback and ready to extend higher. This article and video look at the Elliott Wave pat of the crypto currency.

-

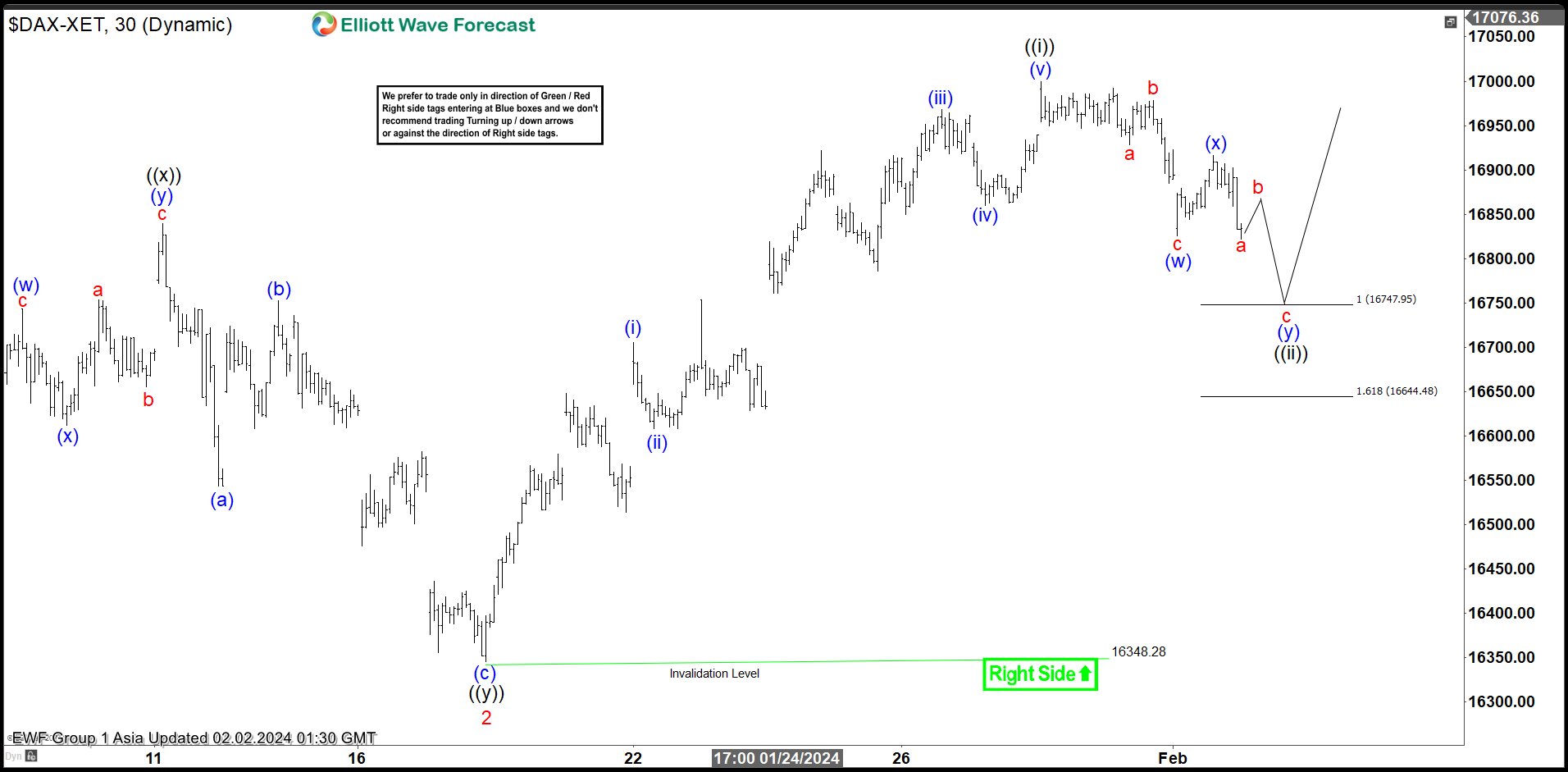

DAX Near Term Support Area

Read MoreShort Term Elliott Wave view in DAX suggests the rally from 10.23.2023 low is unfolding as a 5 waves impulse. Up from 10.23.2023 low, wave 1 ended at 17003.28. Wave 2 pullback subdivided into a double three Elliott Wave structure. Down from wave 1, wave ((w)) ended at 16448.71 and wave ((x)) rally ended at […]

-

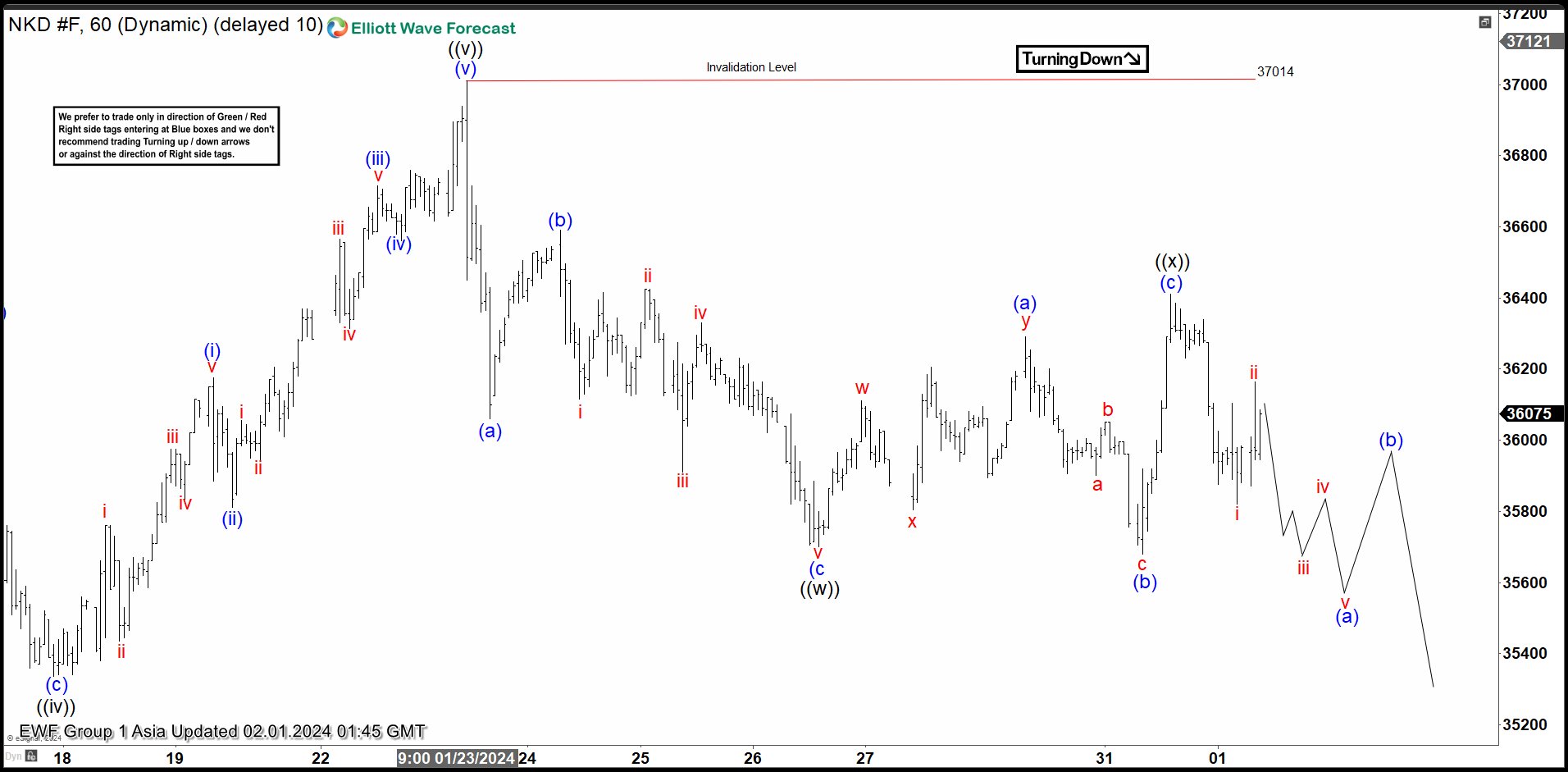

Nikkei (NKD_F) Looking for Further Downside Correction

Read MoreNikkei (NKD_F) is looking to do larger degree correction as a double three Elliott Wave structure. This article and video look at the path.

-

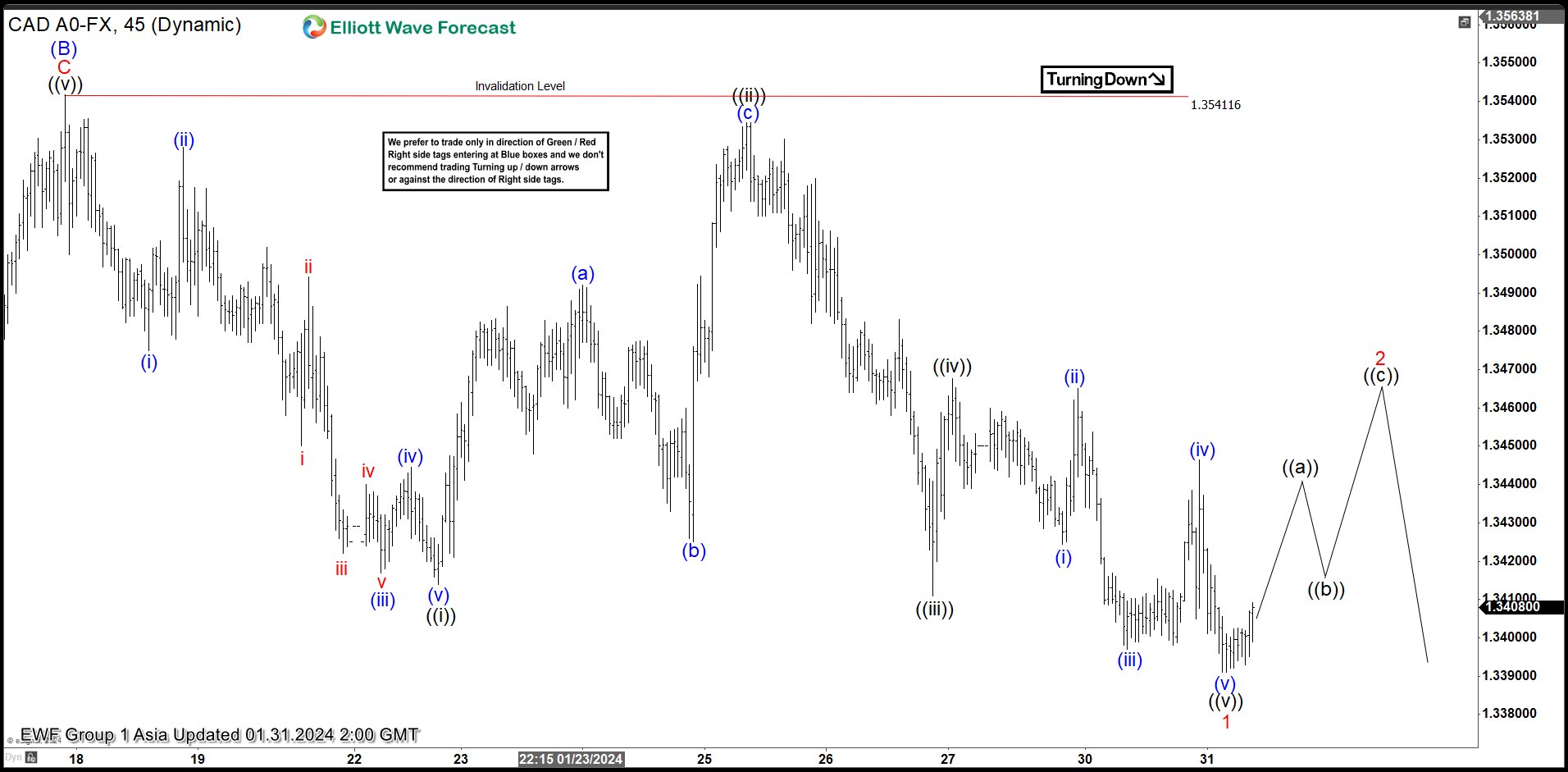

USDCAD Rally Likely Fail in 3, 7, 11 Swing

Read MoreUSDCAD decline from 1.17.2024 high looks to be in 5 swing. Near term rally is expected to fail in 3, 7, 11 swing for further downside

-

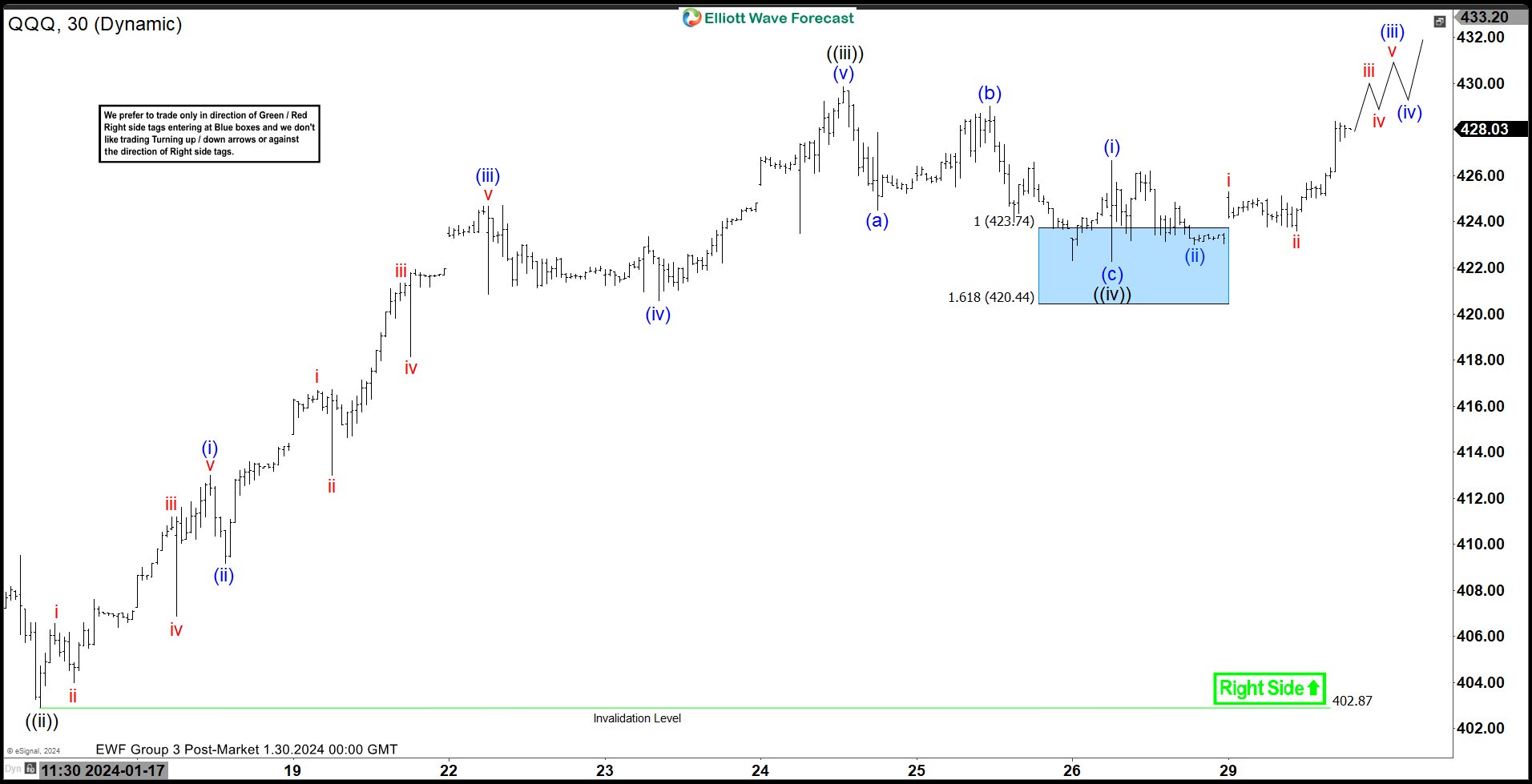

QQQ Looking to Complete 5 Waves Rally

Read MoreNasdaq 100 (QQQ) is looking to extend higher to complete 5 waves impulsive rally from 1.5.2024 low. This article and video look at the Elliott Wave path.

-

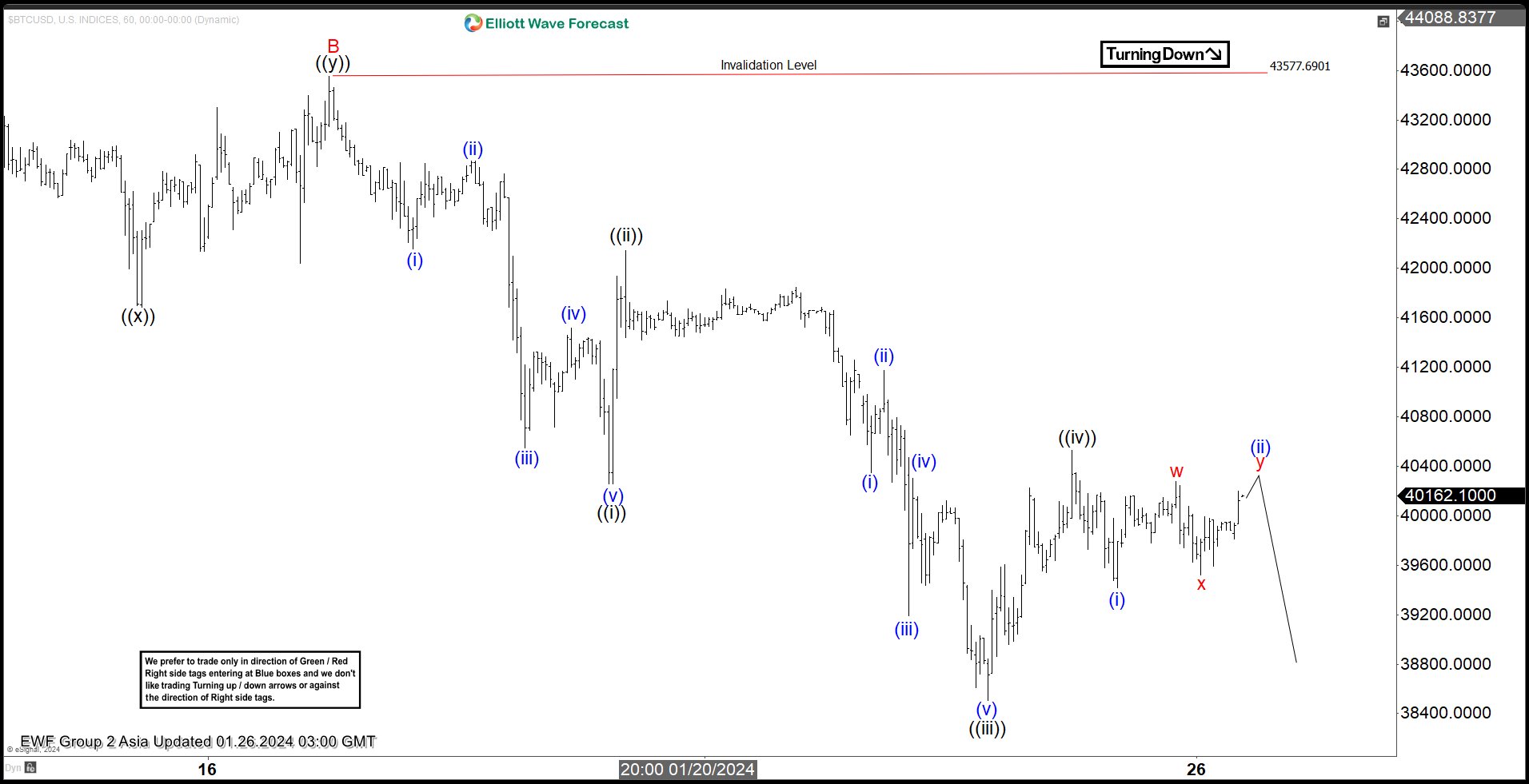

Bitcoin (BTCUSD) Looking for Support Soon

Read MoreBitcoin (BTCUSD) is doing a zigzag correction from 1.11.2024 high before it resumes higher. This article and video look at the Elliott Wave path.