-

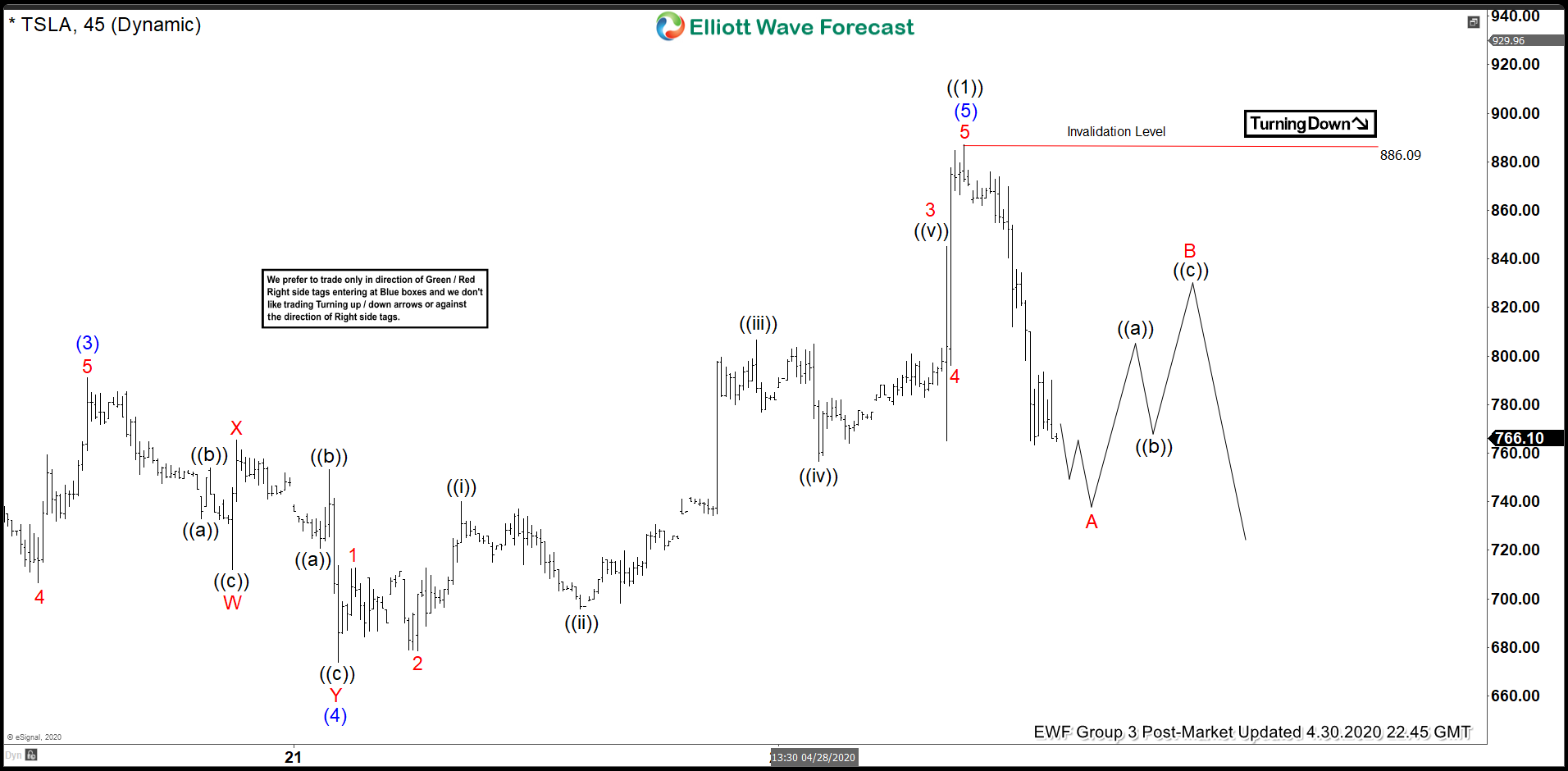

Elliott Wave View: Tesla (TSLA) Correcting Cycle from March Low

Read MoreTesla ended an impulsive rally from 3.19.2020 low and now correcting that cycle in 3, 7, 11 swing.This video and article look at the Elliott Wave path.

-

Elliott Wave View: Google (GOOGL) Ending 5 waves Impulse

Read MoreGoogle rallies impulsively from March 23, 2020 low favoring more upside. This article and video look at the Elliottwave path.

-

Elliott Wave View: Impulsive Rally in DAX From March Low

Read MoreDAX Rally from March 16, 2020 low is unfolding as an impulse which favors more upside. This video looks at the Elliott Wave path.

-

Elliott Wave View: SPX Rally from March Low as an Impulse

Read MoreSPX rally from March low is unfolding as an impulse. This article and video looks at the short term Elliott Wave path of the Index.

-

Elliott Wave View: Rally in EURJPY Expected to Fail

Read MoreEURJPY broke below September 3, 2019 low (115.86) and pair now shows a lower low sequence from February 2018 high and January 2020 high as the video below explains. Near term, decline from April 7, 2020 high is unfolding as a 5 waves impulsive Elliott Wave structure. Down from April 7, wave (i) ended at […]

-

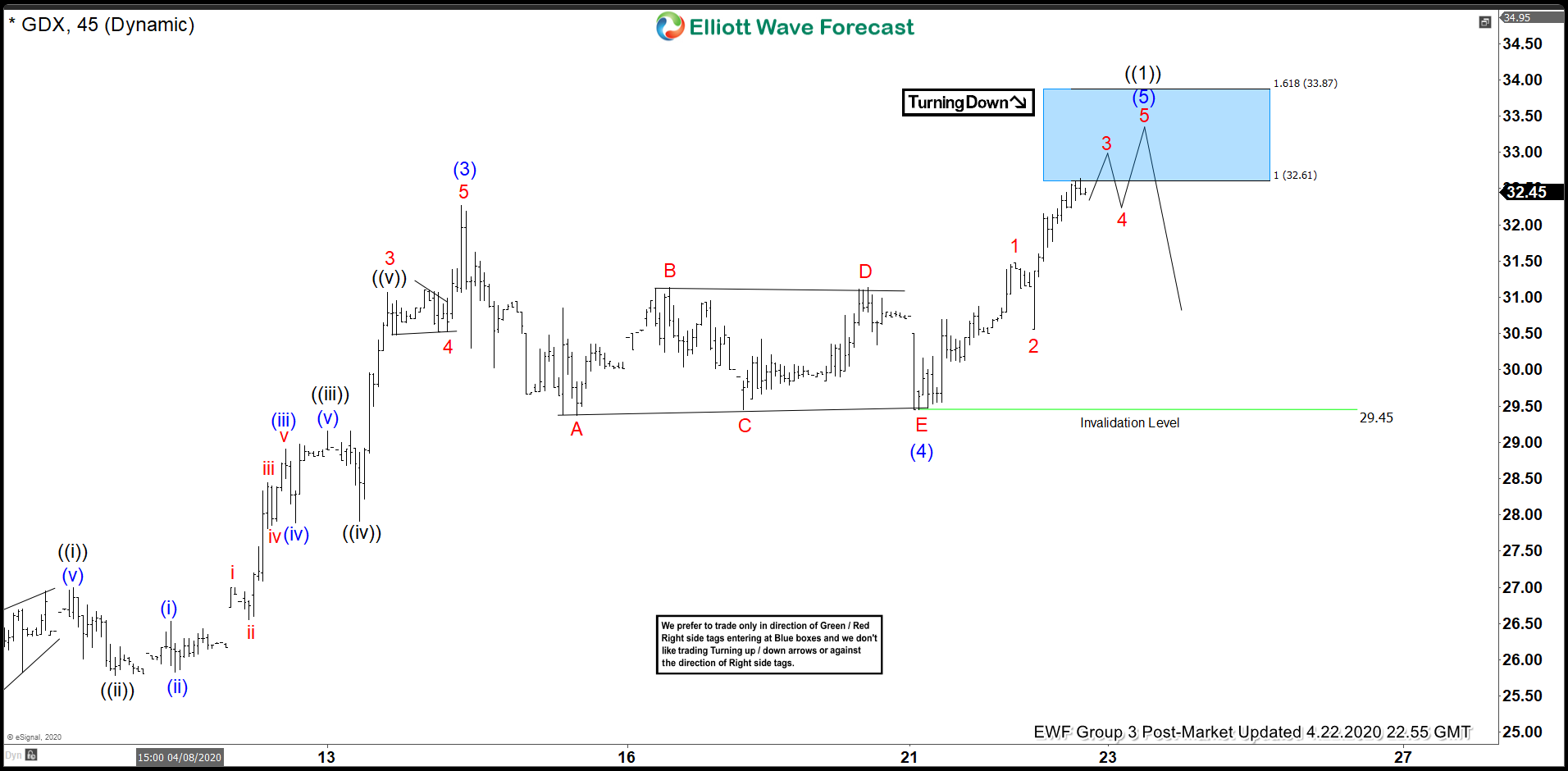

Elliott Wave View: GDX Extends Higher to 7 Year High

Read MoreGDX has made a 7 year high and still shows incomplete sequence to the upside. This article and video looks at the Elliott Wave path.