-

Elliott Wave View: SPX Looking for New All-Time High

Read MoreSPX is looking to extend into all time high. Dips should continue to find support in 3, 7, or 11 swing. This article & video look at the Elliott Wave path.

-

Elliott Wave View: GBPJPY Ended Correction

Read MoreRally from September 21, 2020 low in $GBPJPY is unfolding as a 5 waves impulse Elliott Wave structure. Up from September 21, 2020 low, wave (1) ended at 140.7 and pullback in wave (2) ended at 136.79. Pair resumed higher again and ended wave (3) at 152.55 as 1 hour chart below shows. Wave (4) […]

-

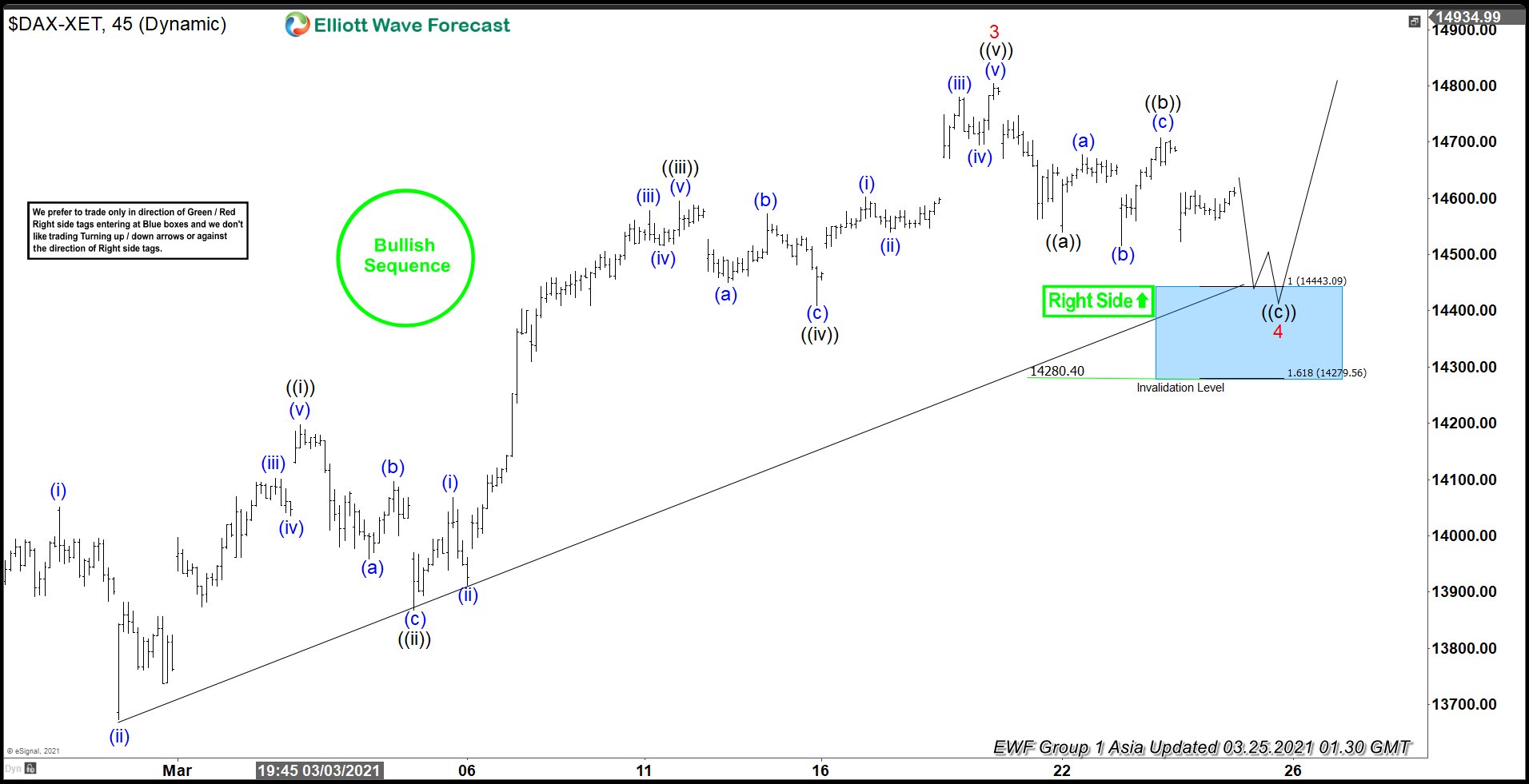

Elliott Wave View: DAX Correction Near Complete

Read MoreDAX is correcting cycle from February 23 low and can see support soon. This article and video look at the Elliott Wave path.

-

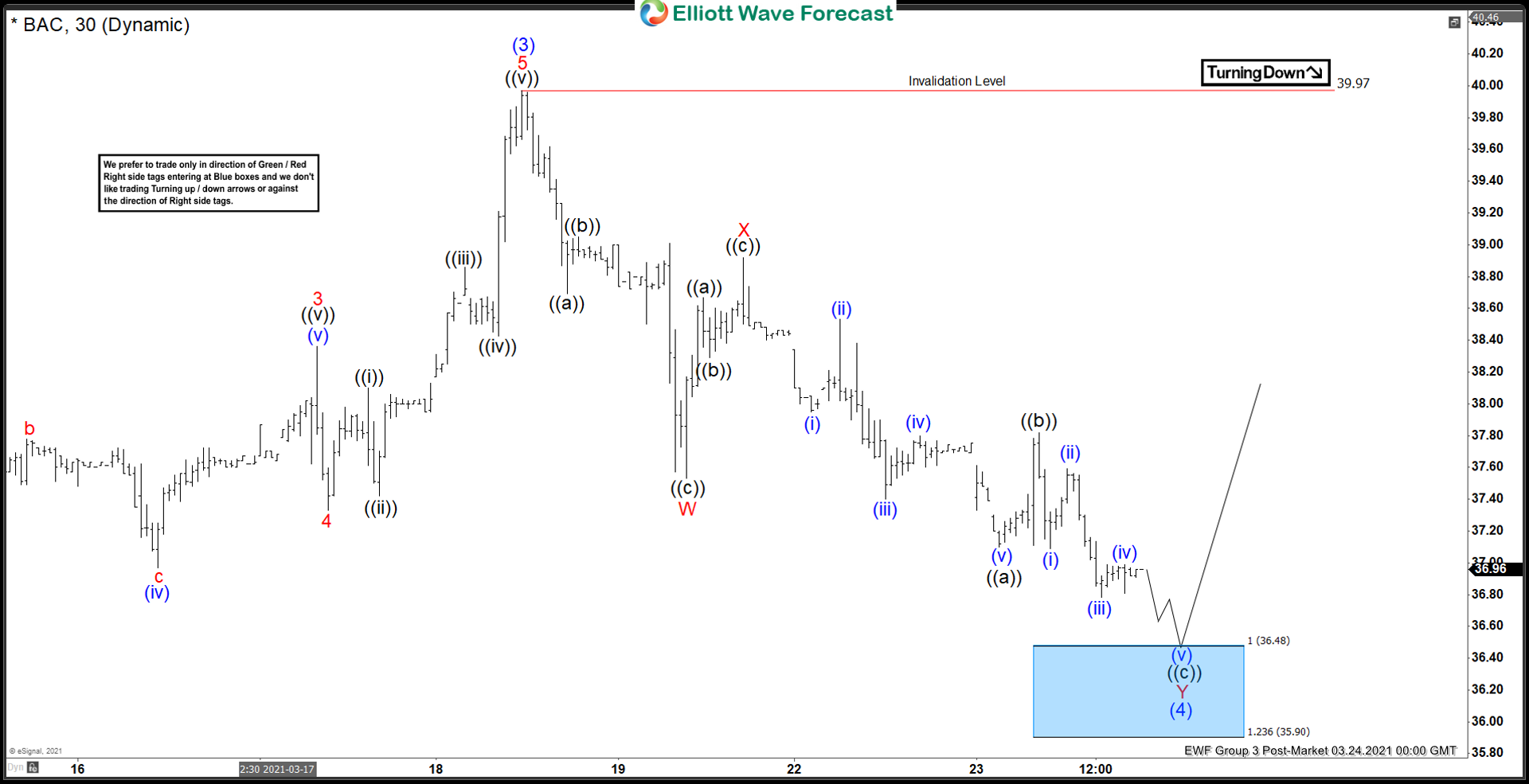

Elliott Wave View: BAC (Bank of America) Approaching Potential Support Area

Read MoreBank of America (BAC) is approaching support area where 3 waves rally at least can be seen. This article and video look at the Elliott Wave path.

-

Elliott Wave View: Microsoft (MSFT) Starts New Bullish Cycle

Read MoreMicrosoft (MSFT) has started a new bullish cycle. This article and video look at the short term Elliott Wave path of the stock.

-

Elliott Wave View: CADJPY Upside Remains Favored

Read MoreCADJPY rally in an impulsive structure and structure is likely incomplete due to lack of divergence. This article and video look at the Elliott Wave path.