In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

Elliott Wave View: GBPAUD Looking for Further Downside

Read MoreGBPAUD is looking for more downside and rally should fail in 3, 7, 11 swing. This article and video look at the Elliott Wave path.

-

How the Right Side and Correlation Help Improve Accuracy

Read MoreElliottwave-Forecast.com (EWF) approach to forecasting is unique compared to other services / wavers. Through years of experience, we have developed tools in addition to Elliott Wave to improve the forecasting accuracy. One of the chief complains with Elliott Wave is that the theory provides at least 1 if not more alternative count. The technique is […]

-

USDRUB : Russian Rouble Shows Medium Term Strength

Read MoreRussian Rouble (or Ruble) is the currency of the Russian Federation and the 17th most traded currency in the world. Within current environment of rising commodity prices, the world market impact of Russia, which is a major commodities producer, should strengthen. Without any doubt, this fact will increase the trading volumes of the Russian national […]

-

Elliott Wave View: Further Upside in EURUSD

Read MoreEURUSD rallies as an impulse from Nov 11 looking for more upside. This article and video looks at the Elliott wave structure.

-

Elliott Wave View: EURJPY Ready for Next Bullish Leg

Read MoreEURJPY has started the next bullish leg higher and dips should find support in 3, 7, 11 swing. This article and video is looking at the Elliott Wave path.

-

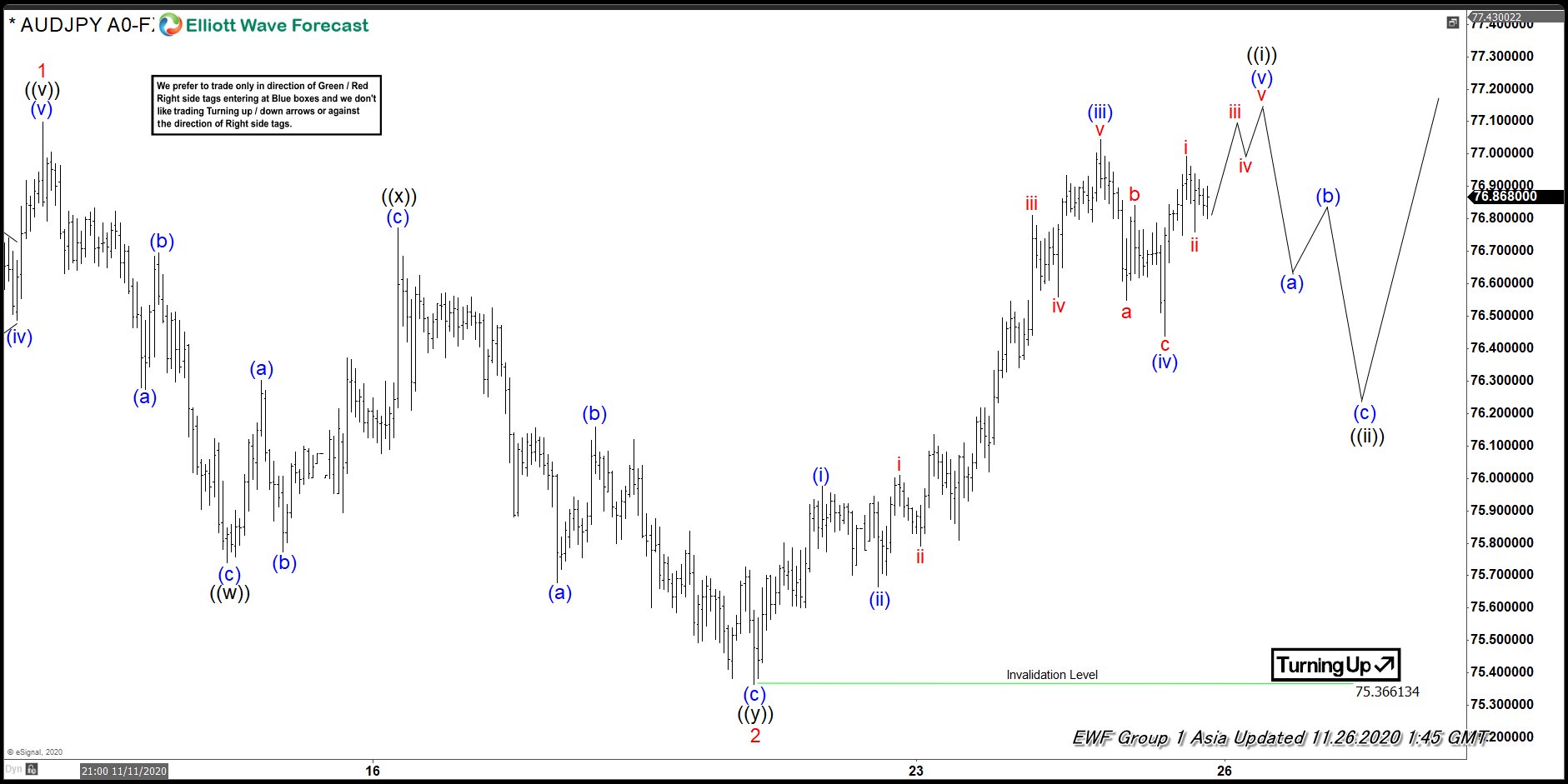

Elliott Wave View: AUDJPY Looking for Bullish Breakout

Read MoreAUDJPY will create a bullish sequence if it can break above Aug 31 peak (78.46). This video looks at the Elliott Wave path.