In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

USDCAD Short-term Elliott Wave Analysis 1.5.2015

Read MorePreferred Elliott wave view suggests pair completed wave “W” at 1.1673 and wave “X” is also proposed to be over at 1.1595. Cycle from 1.1594 is proposed to be over at 1.1843 which we think completed wave (( w )). Wave (( x )) pull back is in progress and is taking the form of a […]

-

USDCAD Elliott Wave Setup Video

Read MoreUSDCAD preferred Elliott Wave view shows decline from 1.1843 high is taking the form of a 7 swing structure and expected to test 1.1729 – 1.1710 area before pair turns higher and resumes the rally. Worst case scenario would be a 3 wave bounce from 1.1729 – 1.1710 area but ideally we would expect the […]

-

EURUSD running an Elliottwave sequence .

Read MoreThe Instrument is showing a 5 swing structure in the Monthly chart ,we are not using The Elliottwave Theory for the forecast but the sequence in which the Market moves.EURUSD is entering an area which has bounced 3 times ,the drop from 2008 peak ,bounced after 3 waves, failed and now doing 7 ,so the pair […]

-

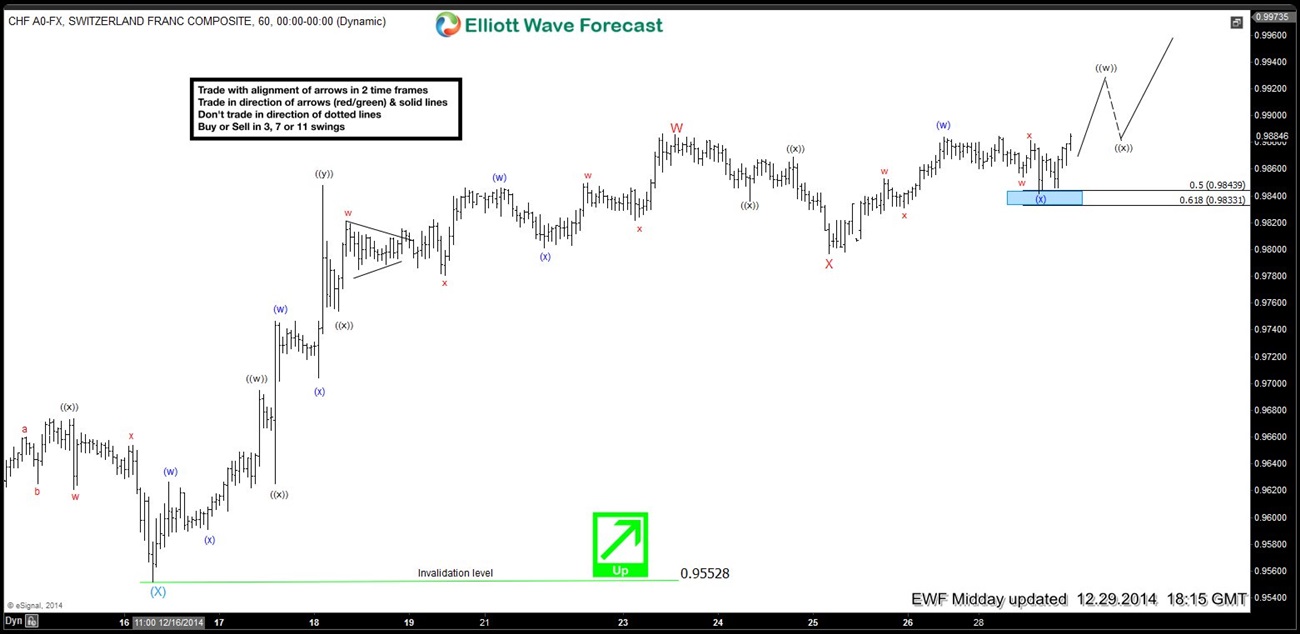

USDCHF Short-term Elliott Wave Analysis 12.29.2014

Read MoreUSDCHF preferred Elliott Wave view remains bullish and suggests wave “W” ended at 0.9887 and wave “X” is also proposed to be over at 0.9796. Pair has made a new high above 0.9887 adding more conviction to this view and near-term focus is on 0.9928 – 0.9949 area to complete wave (( w )) before […]

-

USDCAD 240m Elliot Wave Trade Plan

Read MoreHere is a quick blog from our Live Trading Room host, Dan Hussey. Take a look at how to manage your risk by using inflection zones and Elliot Wave to your advantage. The Live Trading Room is held daily from 12:30 PM EST (5:30 PM BST), join Dan there for more insight into these proven methods of trading. USDCAD 240m […]

-

EURJPY Elliott Wave Video

Read MorePreferred Elliott Wave suggests pair has ended a WXY structure from 149.77 high, we have labelled it as wave (W). Bounce from the lows is also unfolding as a WXY structure and expected to reach 147.37 – 147.87 area which is equal legs – 1.236 ext area of W-X. Market moves in a sequence of […]