In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

EURGBP Short-term Elliott Wave Video Analysis 4.9.2015

Read MorePreferred view suggests pair is in a double three or ((w))-((x))-((y)) Elliott wave structure down from 0.7384 peak when dip to 0.7223 completed wave ((w)) and wave ((x)) ended at 0.7380 with a full test of 0.7384 peak. Wave (w) of ((y)) ended at 0.7285 and recovery to 0.7315 was wave (x). Pair is now […]

-

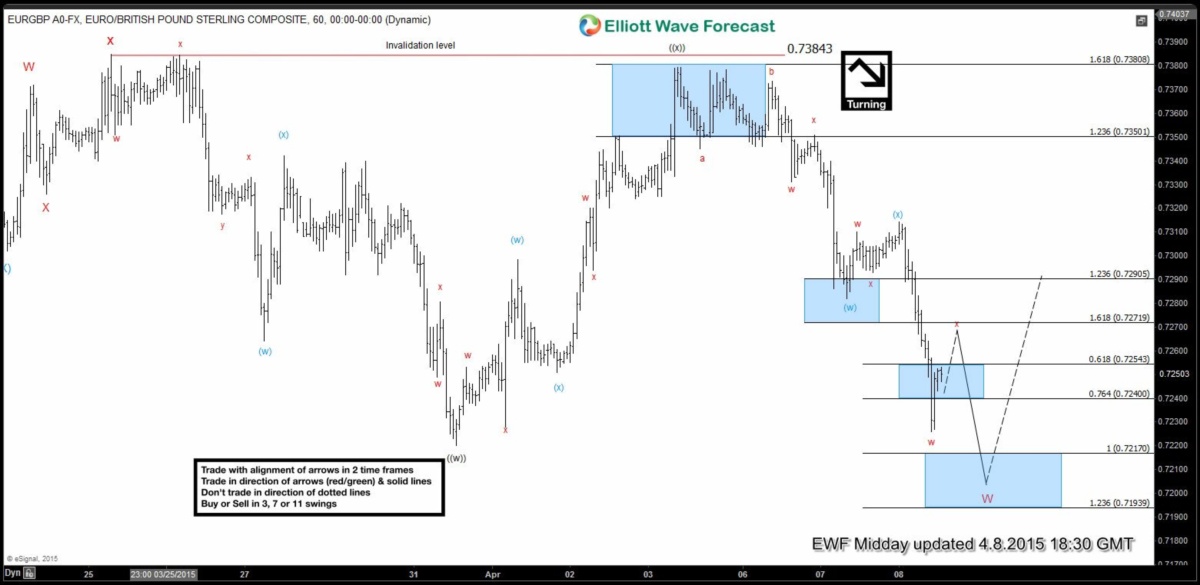

EURGBP Short-term Elliott Wave Analysis 4.8.2015

Read MorePreferred view suggests pair is in a double three or ((w))-((x))-((y)) Elliott wave structure down from 0.7384 peak when dip to 0.7223 completed wave ((w)) and wave ((x)) ended at 0.7380 with a full test of 0.7384 peak. Wave (w) of ((y)) ended at 0.7285 and recovery to 0.7315 was wave (x). Pair is now […]

-

EURGBP Elliott Wave Trading Plan Update

Read MoreHere is a quick blog from our Live Trading Room host, Dan Hussey. Take a look at how to manage your risk by using inflection zones and Elliot Wave to your advantage. The Live Trading Room is held daily from 12:30 PM EST (5:30 PM BST), join Dan there for more insight into these proven methods of trading. […]

-

USDJPY Trading Plan & Technical Update

Read MoreHere is a quick blog from our Live Trading Room host, Dan Hussey. Take a look at how to manage your risk by using inflection zones and Elliot Wave to your advantage. The Live Trading Room is held daily from 12:30 PM EST (5:30 PM BST), join Dan there for more insight into these proven methods of trading. […]

-

GBPJPY Elliott Wave Analysis 3.24.2015

https://elliottwave-forecast.com/wp-content/uploads/2015/03/COTD-GBPJPY-3.25.2015.mp4Read More -

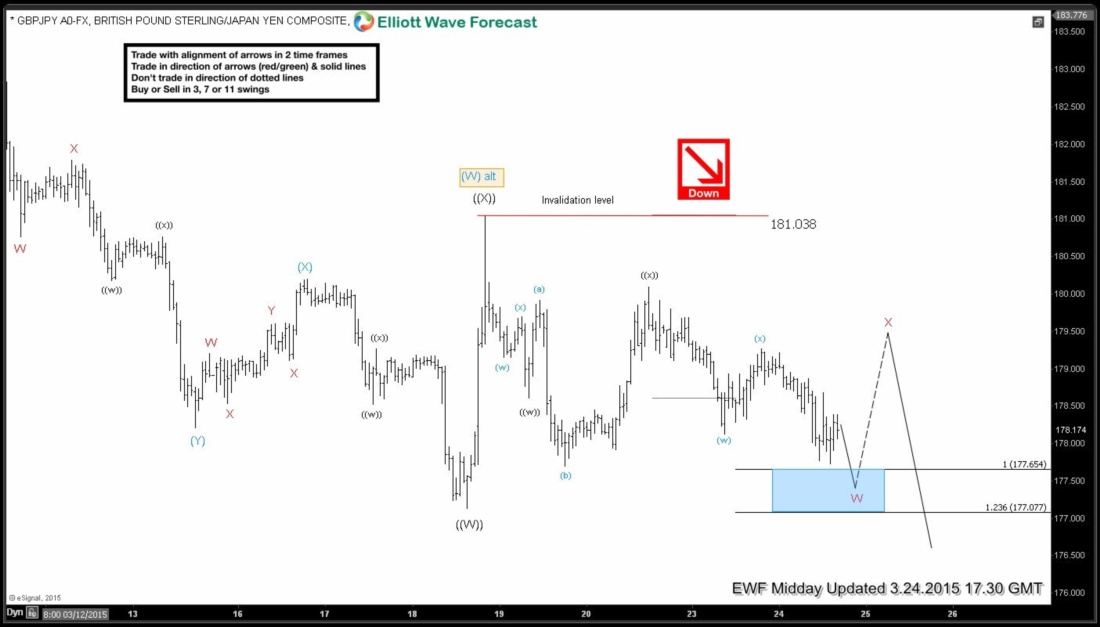

GBPJPY Short-term Elliott Wave Analysis 3.24.2015

Read MorePreferred Elliott Wave view suggests pair formed a secondary peak @ 181.03 and bounces are now expected to hold below this high for continuation lower. Decline from 181.03 peak is taking the form of a double three or ((w))-((x))-((y)) Elliott Wave structure when pair is currently in final leg of wave ((y)). Area between 177.65 […]