In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

Live Trading Room Recap 4.24.2015

Read MoreHere is a quick recap from our Live Trading Room on 4.24.2015 where we presented many short term trade and swing opportunities to our members. Take a look at how to manage your risk by using inflection zones and Elliot Wave to your advantage. The Live Trading Room is held daily from 12:30 PM EST (5:30 PM BST), join us there for […]

-

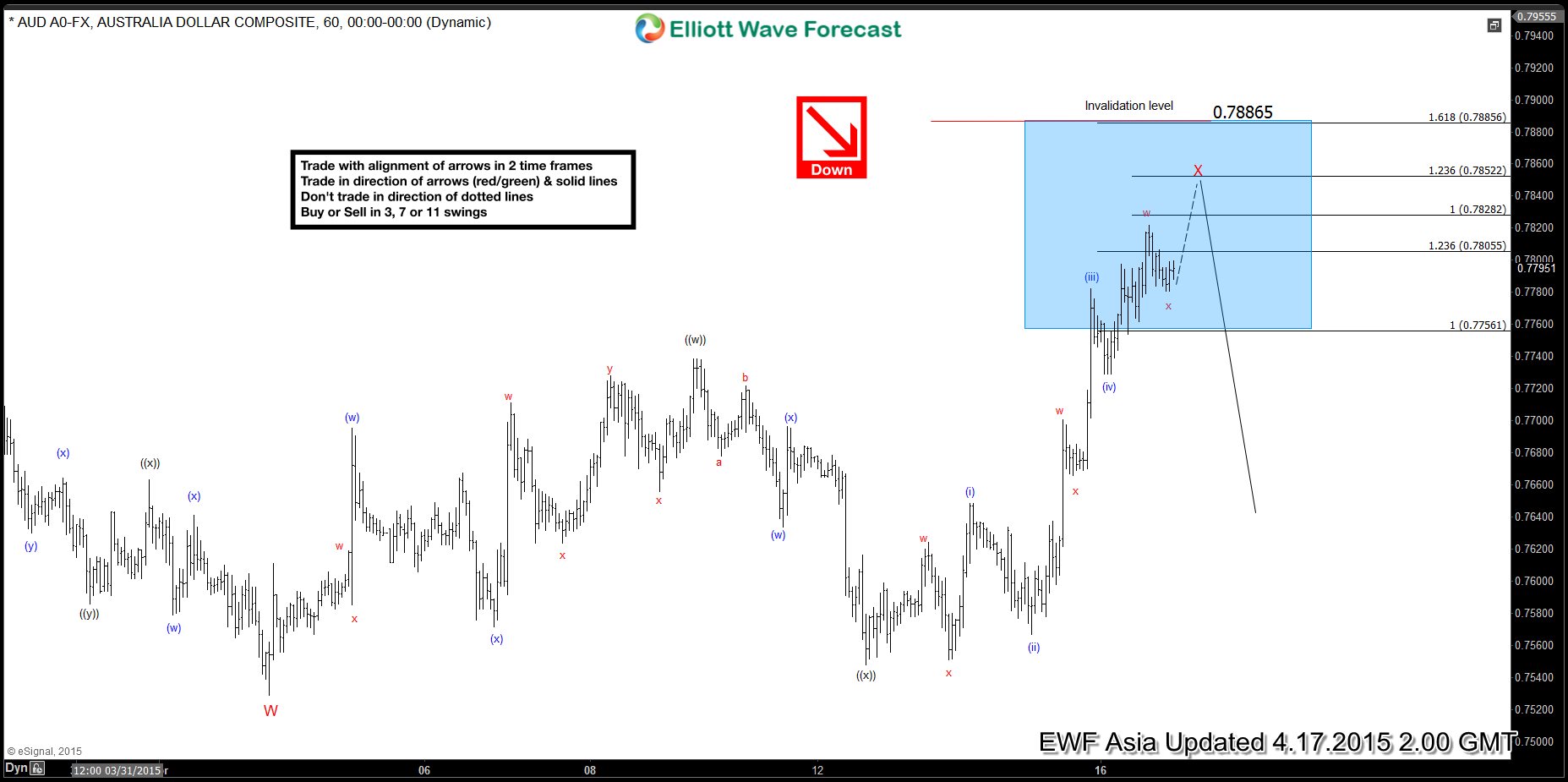

AUDUSD Short-term Elliott Wave Analysis 4.16.2015

Read MoreOur preferred Elliott wave suggest AUDUSD downtrend is mature in the higher time frames but mid-term cycles still remain bearish against 3/24 (0.7937) high. Decline from 0.7937 – 0.7529 took the form of triple three structure and completed wave “W”. Wave “X” bounce is in progress and has already reached 1.236 ext of ((w))-((x)) at […]

-

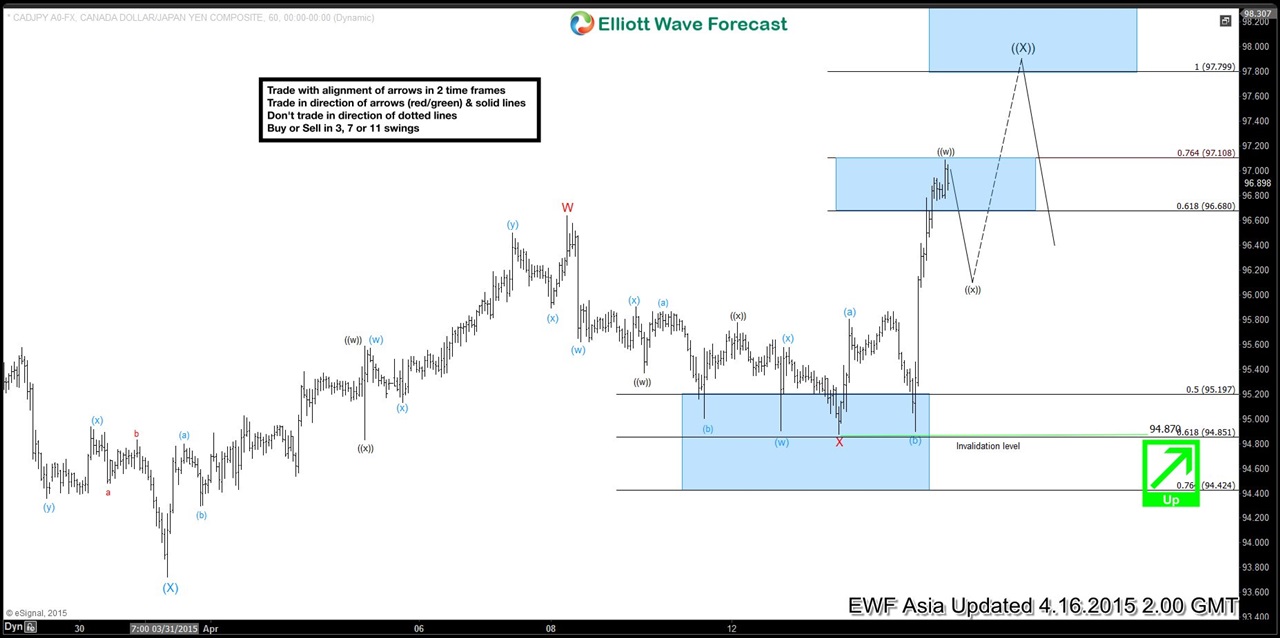

CADJPY Short-term Elliott Wave Analysis 4.15.2015

Read MoreWe can see 3 swings rally from wave (X) low at 3/31 with the first leg red wave W, the second leg red wave X, and the pair is currently finishing the third leg towards equal leg 97.79 – 98.5. Short term, the pair can see a pullback in wave ((x)). The pullback can reach as […]

-

CADJPY Ending a cycle from 1.30.2015

Read MorePair has rallied in 3 swings from wave (X) low at 3/31 with the first leg red wave W, the second leg red wave X, and the pair is currently finishing the third leg towards 97.79 – 98.5 equal leg area. Short term, the pair can see a pullback in wave ((x)), and the pullback can reach […]

-

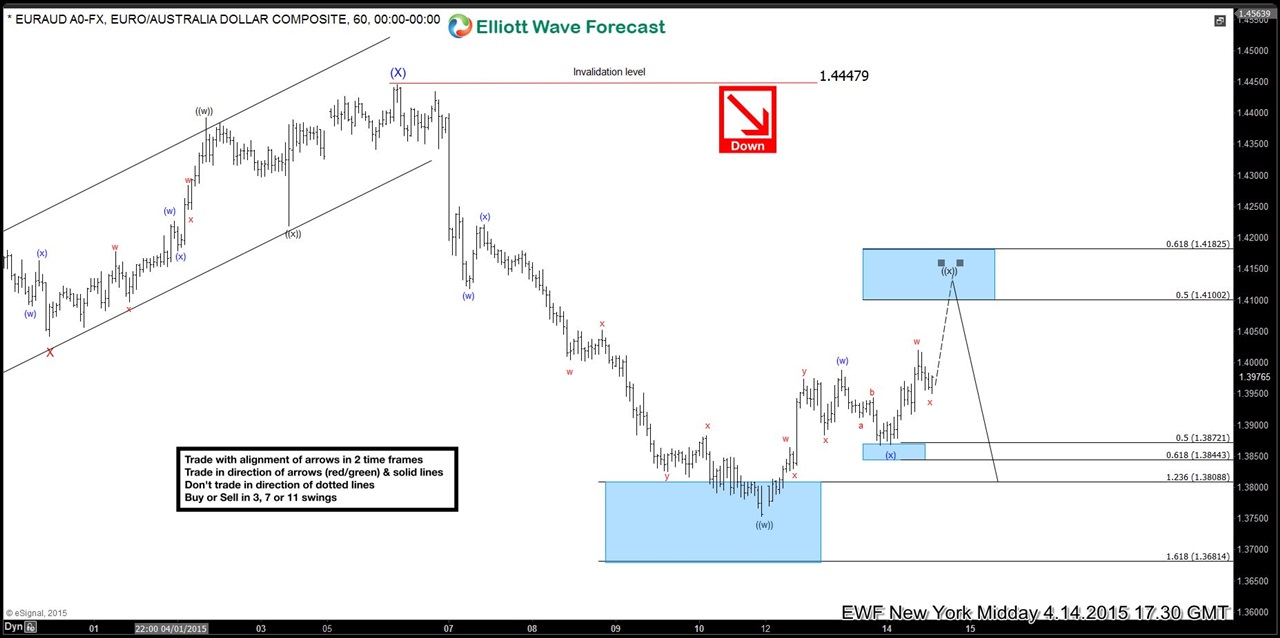

EURAUD Short-term Elliott Wave Analysis 4.15.2015

Read MorePreferred Elliott wave view suggests EURAUD cycles remain bearish against 6th April high (1.4447). Decline from 1.4447 – 1.3753 was a double three Elliott wave structure i.e. (w)-(x)-(y) when wave (w) completed at 1.4118, wave (x) completed at 1.4221 and wave (y) completed at 1.3753 making a higher degree wave ((w)). Pair is currently in […]

-

EURAUD Short-term Elliott Wave Analysis 4.14.2015

Read MorePreferred Elliott wave view suggests EURAUD cycles remain bearish against 6th April high (1.4447). Decline from 1.4447 – 1.3753 was a double three Elliott wave structure i.e. (w)-(x)-(y) when wave (w) completed at 1.4118, wave (x) completed at 1.4221 and wave (y) completed at 1.3753 making a higher degree wave ((w)). Pair is currently in […]