In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

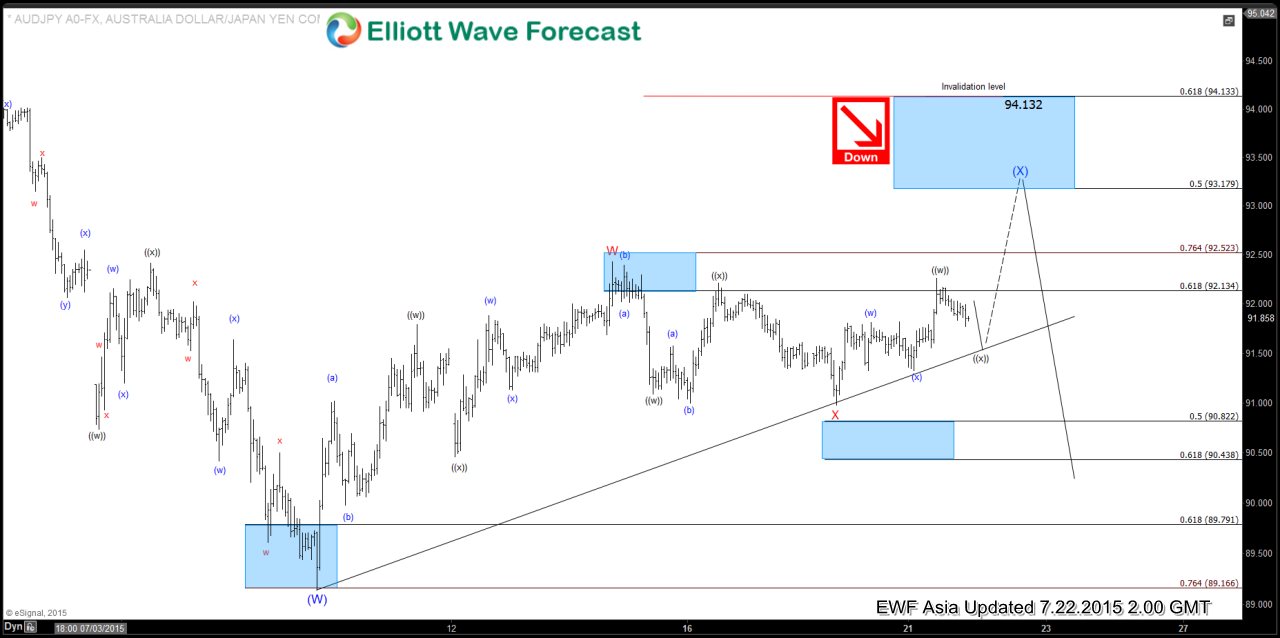

$AUD/JPY Short Term Elliott Wave Update 7.22.2015

Read MoreDecline to 89.14 completed wave (W), and pair has since bounced in wave (X) from this level. Short term Elliott Wave view suggests wave (X) bounce is unfolding in a double corrective structure W-X-Y where wave W ended at 92.43 and wave X ended at 90.98. As far as 90.98 holds, pair has a scope towards 93.18 – 94.13 area to […]

-

Elliottwave Analysis on FTSE China A50 7.21.2015

Read MoreThis video is a technical analysis for FTSE China A50 using Elliott Wave Principle. This index is not part of the 42 instrument we cover. If you are interested to learn more about Elliott Wave or how we can help you, click to join the 14 days trial.

-

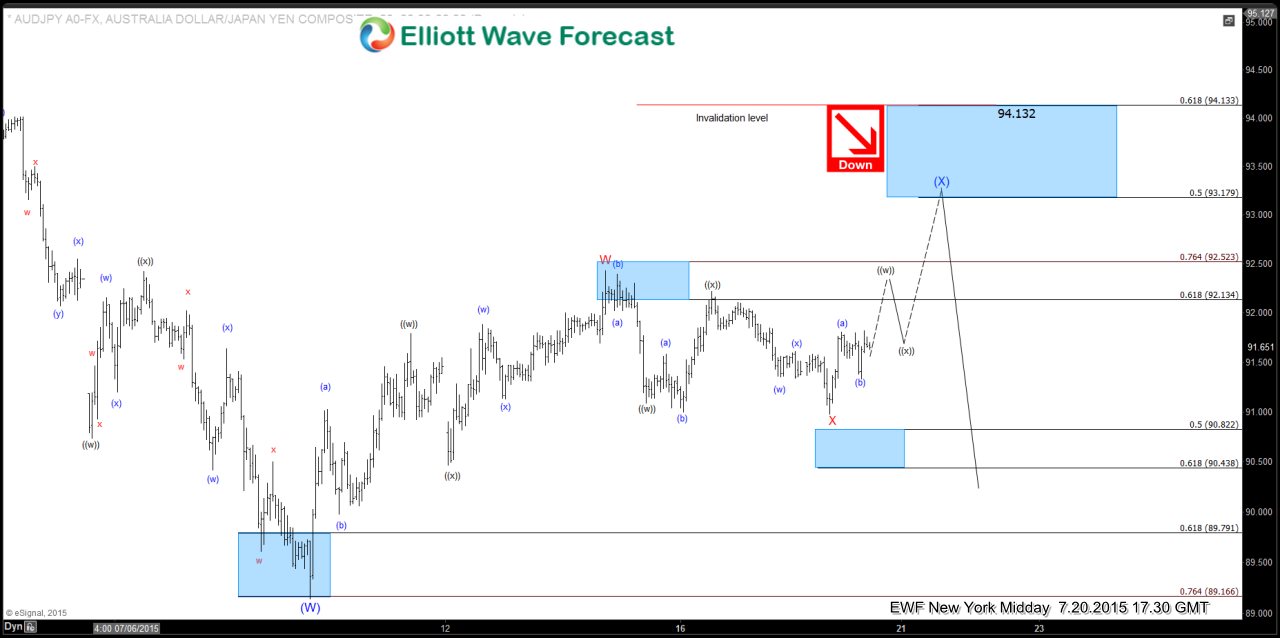

$AUD/JPY Short Term Elliott Wave Update 7.20.2015

Read MoreDecline to 89.14 completed wave (W), and pair has since bounced in wave (X) from this level. Short term Elliott Wave view suggests wave (X) bounce is unfolding in a double corrective structure W-X-Y where wave W ended at 92.43, wave X ended at 90.98, and wave Y is in progress towards 93.18 – 94.13 area to complete wave (X). We don’t […]

-

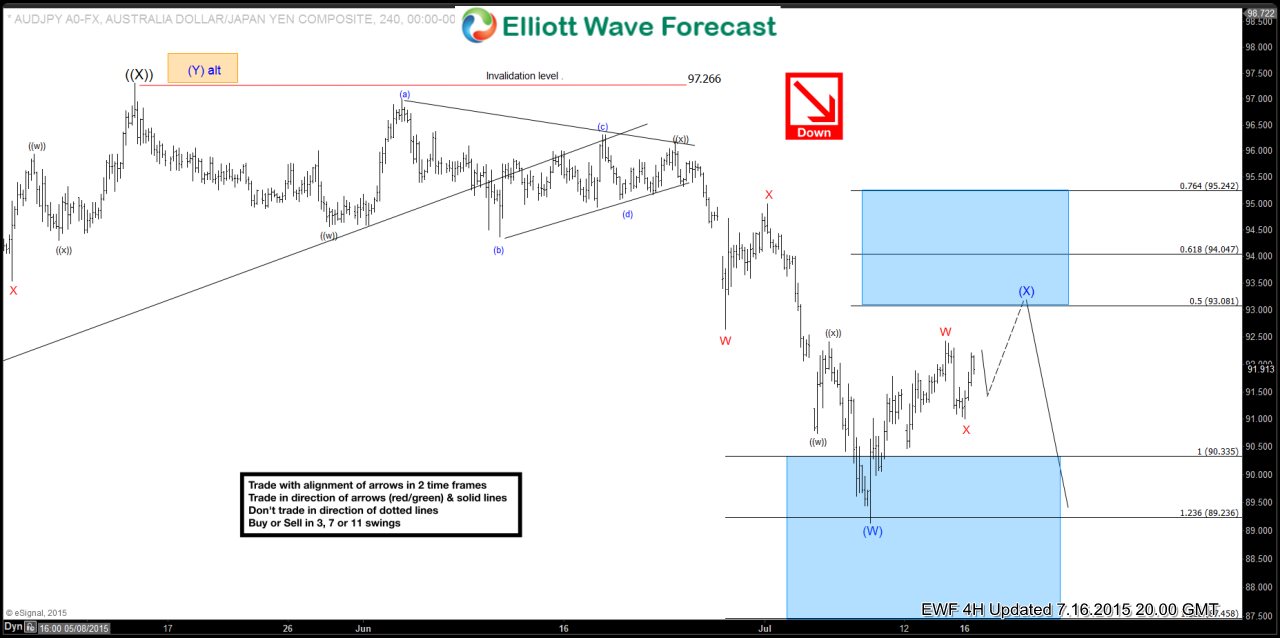

$AUD/JPY 4 Hour Elliott Wave Update 7.17.2015

Read MoreDecline to 89.15 completed wave (W), and pair has since bounced in wave (X) from this level. Updated Elliott Wave view suggests the bounce is unfolding in a double corrective structure W-X-Y where wave W ended at 92.43, wave X ended at 91, and wave Y is in progress towards 93.08 – 95.24 area to complete wave (X). We don’t like […]

-

$AUD/JPY 4 Hour Elliott Wave Update 7.16.2015

Read MoreDecline to 89.15 completed wave (W), and pair has since bounced in wave (X) from this level. Revised Elliott Wave view suggests the bounce is unfolding in a double corrective structure W-X-Y where wave W ended at 92.43, and wave X is in progress towards 90.4 – 90.78 before turning higher one more leg in wave Y towards 93.08 – 95.24 […]

-

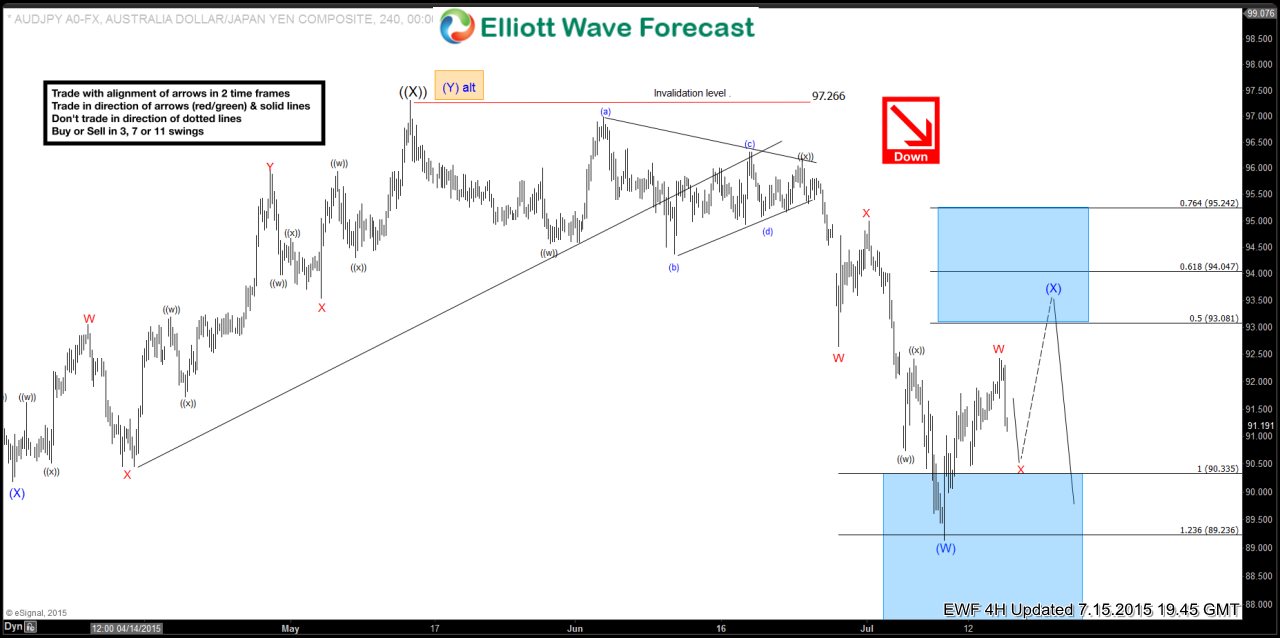

$AUD/JPY 4 Hour Elliott Wave Analysis 7.15.2015

Read MoreDecline to 89.15 completed wave (W). Pair has since bounced in wave (X) from this level, and the bounce is unfolding in a double corrective structure W-X-Y where wave W ended at 91.79, wave X ended at 90.46, and wave Y is in progress towards 93.08 – 95.24 area to complete wave (X). We don’t like buying the proposed […]