In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

NZDCAD Medium Term Elliottwave Analysis 8.23.2015

Read MoreThis is a medium term Elliott Wave Analysis video update on $NZD/CAD. We currently cover 42 instrument ranging from forex, indices, and commodities in 4 different time frames. Welcome to check our service and see if we can add value to your trading experience. Click here to start your 14 days FREE trial. Thank you for visiting our site and watching […]

-

AUDNZD Medium Term Elliottwave Analysis 8.20.2015

Read MoreThis is a medium term Elliott Wave Analysis video update on $AUD/NZD. We currently cover 42 instrument ranging from forex, indices, and commodities in 4 different time frames. Welcome to check our service and see if we can add value to your trading experience. Click here to start your 14 days FREE trial. Thank you for visiting our site and watching […]

-

$USDJPY: Elliott Wave Expanded Flat Structure

Read MoreElliott Wave FLAT structure is the corrective pattern which is often seen in the real market. There are 3 types of Flats: – Regular flat. – Expanded flat – Running flat. In this technical blog we’re going to run through Expanded flat example. Expanded Flat is a 3 wave corrective pattern which inner subdivision is […]

-

EURCAD Elliottwave Analysis 8.14.2015

Read MoreThis is an Elliott Wave Analysis video update on $EUR/CAD. The pair is approaching a very interesting area at 1.47 – 1.497 and we explain why. If you are interested to learn more about Elliott Wave or how we can help you, click to join FREE 14 days trial.

-

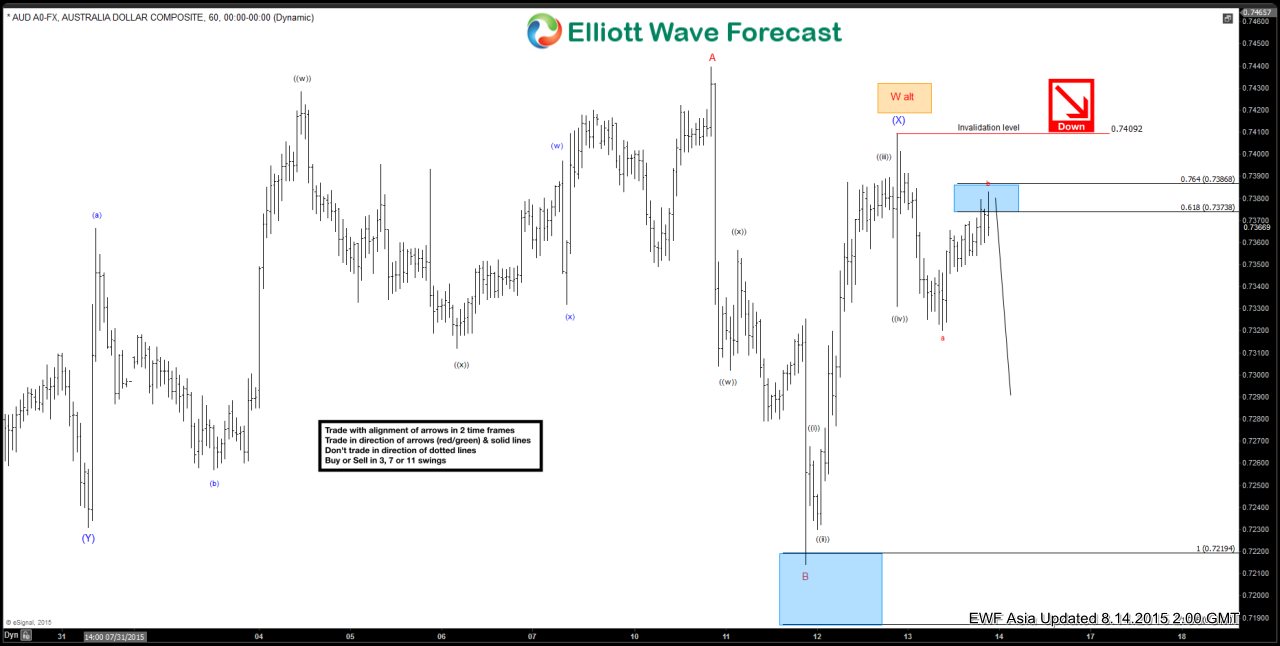

AUDUSD Short Term Elliott Wave Analysis 8.14.2015

Read MoreShort term Elliottwave view suggests that decline to 0.723 ended wave (Y). Wave (X) bounce from this level is unfolding as a FLAT structure where wave A ended at 0.7439, wave B ended at 0.7214, and wave C of (X) is proposed complete at 0.7409. The pair is currently expected to resume decline to new low or at […]

-

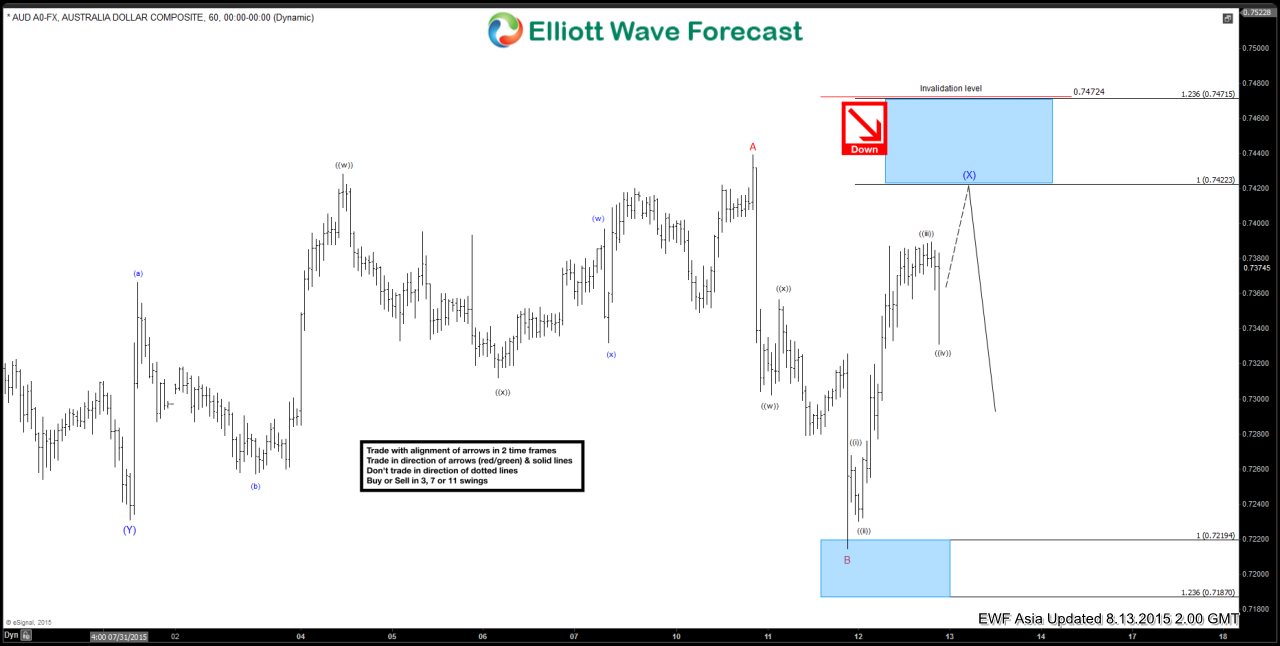

$AUD/USD Short Term Elliott Wave Analysis 8.13.2015

Read MoreRevised short term Elliottwave view suggests that decline to 0.723 ended wave (Y). Wave (X) bounce from this level is unfolding as a FLAT structure where wave A ended at 0.7439, wave B ended at 0.7214, and wave C is in progress as 5 waves towards 0.742 – 0.747 to complete wave (X). Once wave […]