In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

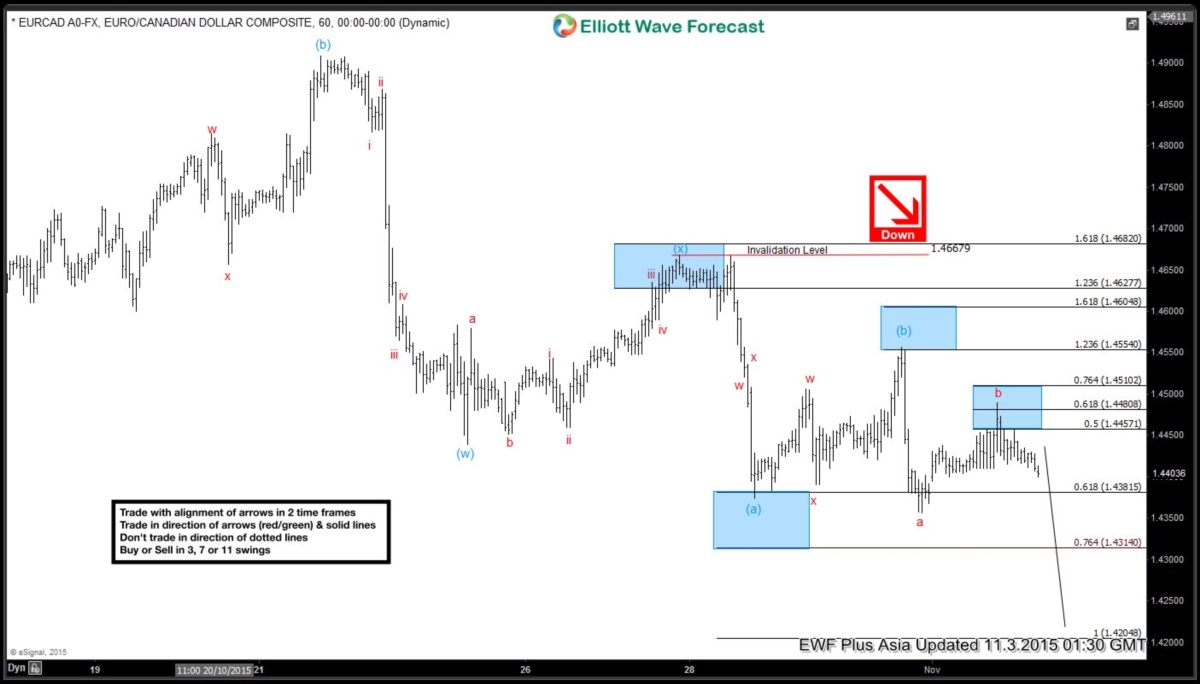

EURCAD Short Term Elliott Wave Analysis 11.04.2015

Read MoreShort term Elliott Wave view suggests decline to 1.4439 ended wave (w) and bounce to 1.4668 ended wave (x) as a FLAT. Pair has since resumed in wave (y) lower with the internals unfolding as a double correction. The first leg of the decline wave (a) ended at 1.4374, wave (b) bounce ended at 1.455, […]

-

EURCAD Short Term Elliott Wave Analysis 11.03.2015

Read MoreShort term Elliott Wave view suggests decline to 1.4439 ended wave (w) and bounce to 1.4668 ended wave (x) as a FLAT. Pair has since resumed in wave (y) lower with the internals unfolding as a double correction. The first leg of the decline wave (a) ended at 1.4374, wave (b) bounce ended at 1.455, […]

-

EURCAD Short Term Elliott Wave Analysis 10.29.2015

Read MoreShort term Elliott Wave view suggests decline to 1.4439 ended wave (w) and bounce to 1.4668 ended wave (x) as a FLAT. Pair has since resumed in wave (y) lower with the internals unfolding as a zigzag. The first leg of the decline wave (a) is in progress as 5 waves. From 1.4668 high, the […]

-

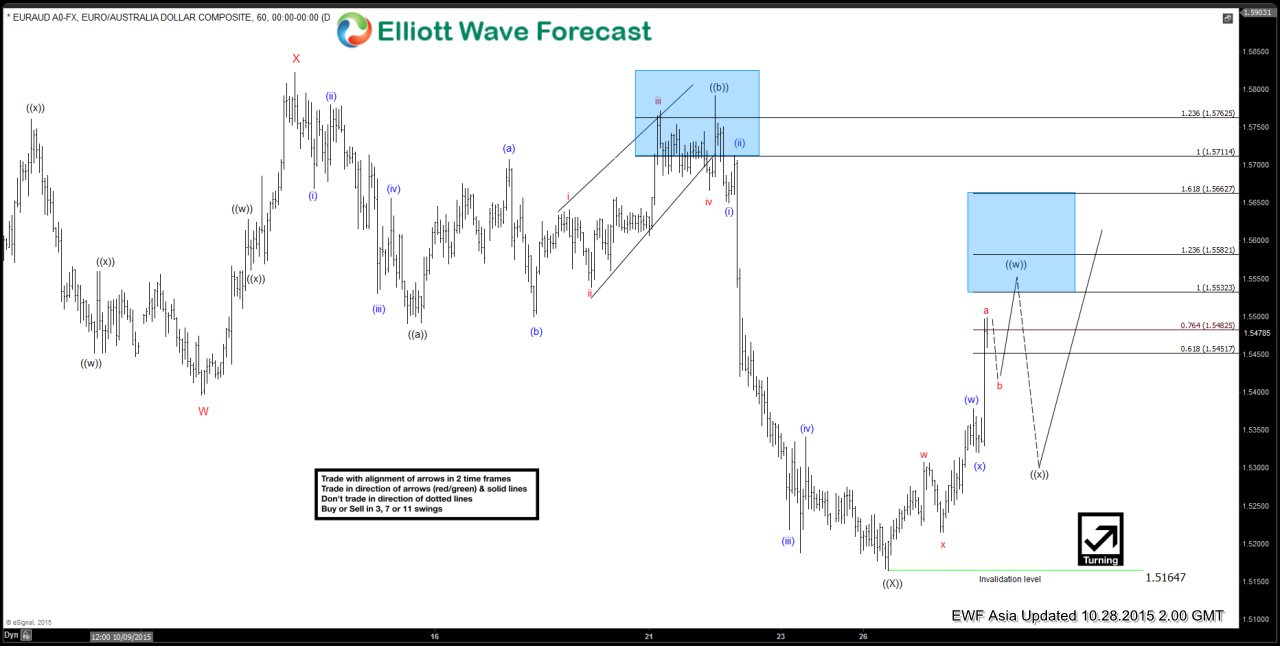

EURAUD Short Term Elliott Wave Update 10.28.2015

Read MoreRevised short term Elliott wave view suggests decline to 1.515 ended wave (X)) and pair has resumed the rally. Wave ((w)) is unfolding in a double three structure where wave (w) ended at 1.5378, wave (x) ended at 1.532, and wave (y) is in progress towards 1.5532 – 1.5582 before a 3 waves pullback. Near term, pair […]

-

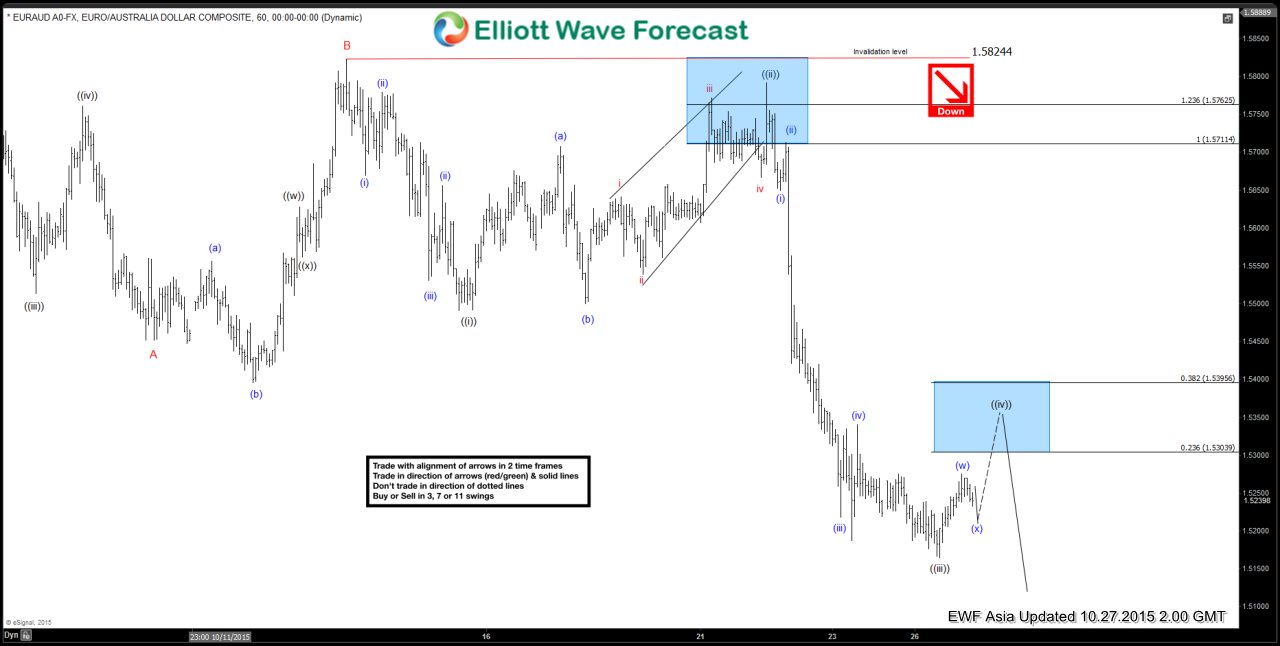

EURAUD Short Term Elliott Wave Analysis 10.27.2015

Read MoreBest reading of Elliott wave cycle suggests decline to 1.545 ended wave “A” and bounce to 1.582 ended wave “B”. Wave “C” is in progress as 5 waves where wave ((i)) ended at 1.549, wave ((ii)) ended at 1.579, wave ((iii)) ended at 1.516, and wave ((iv)) is in progress towards 1.53 – 1.539 area before turning […]

-

NZDCAD Medium Term Elliottwave Analysis 10.26.2015

Read MoreThis is a medium term Elliottwave Analysis video on $NZDCAD. Pair is in the area where wave (x) FLAT can complete, and at least 3 waves pullback can happen. EWF currently covers 50 instrument ranging from forex, indices, and commodities in 4 different time frames. Try our service 14 days FREE to get access to Elliottwave charts […]