In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

USDJPY Elliott Wave view: Calling For Bounces To Fail Ahead of NFP?

Read MoreUSDJPY Short-term Elliott Wave view suggests that the rally to 111.40 on May 21 ended intermediate wave (A) as a Diagonal structure coming from March 26 low (104.52) cycle. Pair is currently correcting cycle from 3/26 low within Intermediate wave (B). The pullback shows overlapping price structure suggesting that it is taking the form of a […]

-

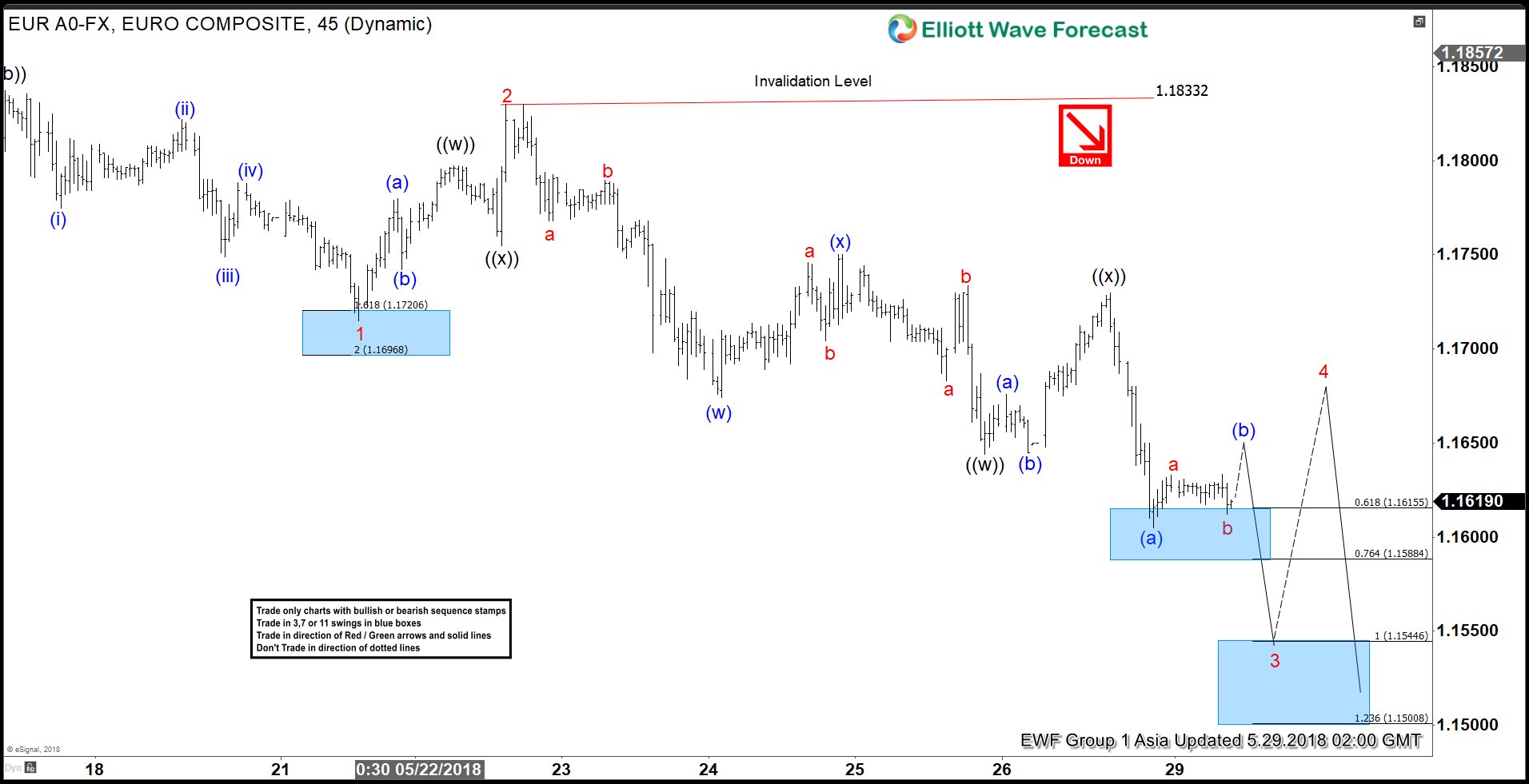

EURUSD Elliott Wave View: Bounces Are Expected To Fail

Read MoreEURUSD short-term Elliott wave view suggests that the decline from ( 1.1996 ) 5/14/2018 peak is unfolding as ending diagonal structure in Intermediate wave (5) lower as mentioned in the previous post here. The internals of each of leg in ending diagonal structure is the combination of a 3 waves corrective structure i.e the internal of wave […]

-

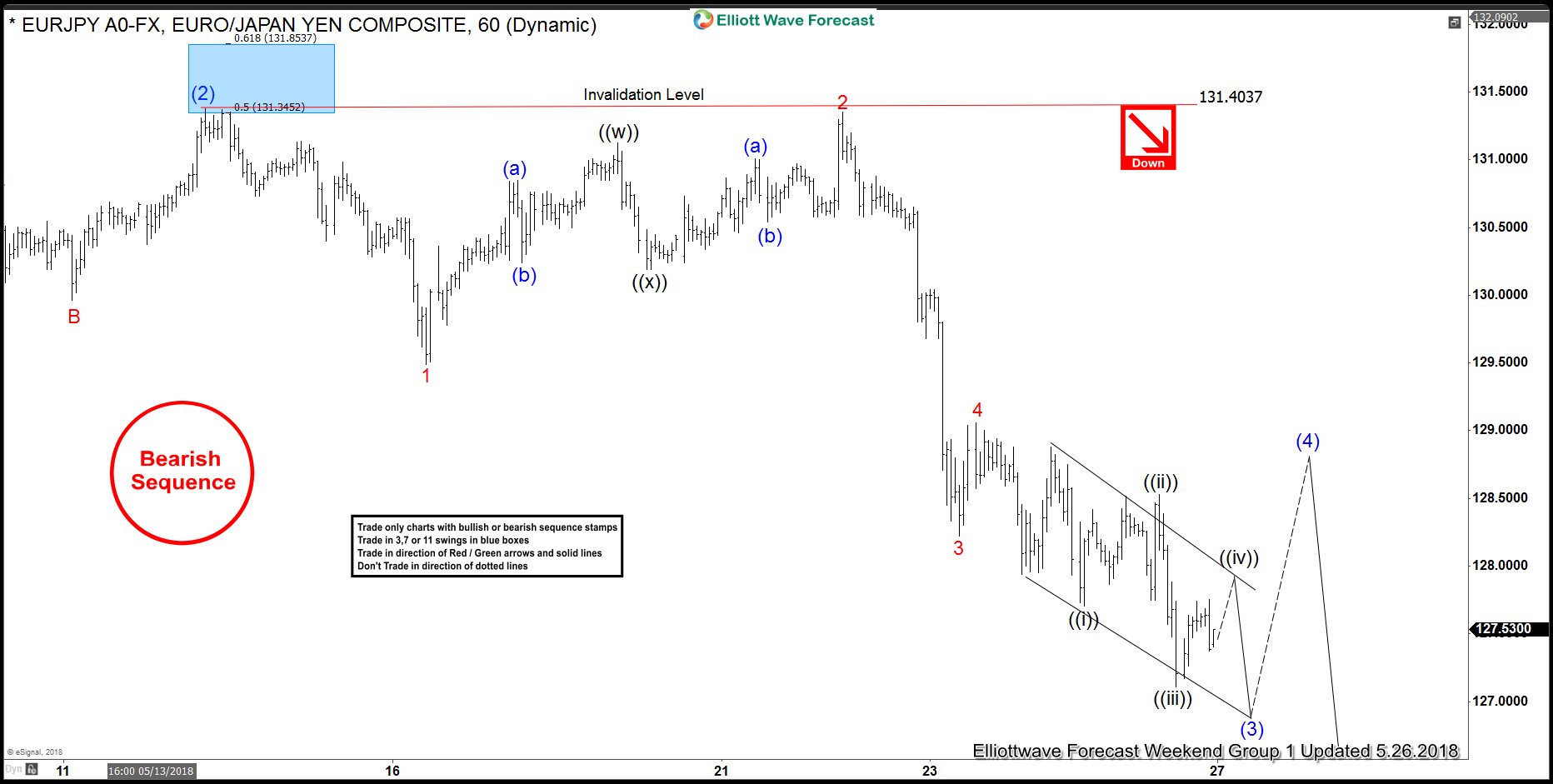

Elliott Wave Analysis: EURJPY Has a Bearish Sequence

Read MoreEURJPY short-term Elliott Wave view suggests that the bounce to 5/14 high at 131.38 ended wave (2). Down from there, the decline is unfolding as Elliott wave impulsive structure as expected and should complete wave (3). The internal sub-division of each leg lower is showing 5 waves structure in lesser degree cycles, which is characteristic of […]

-

USDX Elliott Wave View: Ending Diagonal In Progress

Read MoreUSDX short-term Elliott Wave view suggests that the rally from 5/14 low 92.24 is extending higher as Elliott Wave Ending diagonal structure within Intermediate wave (5). Keep in mind that Ending Diagonal usually appears in sub-division of wave (5) of impulse or wave C of Zigzag or Flat. In Ending Diagonal, the internal distribution of […]

-

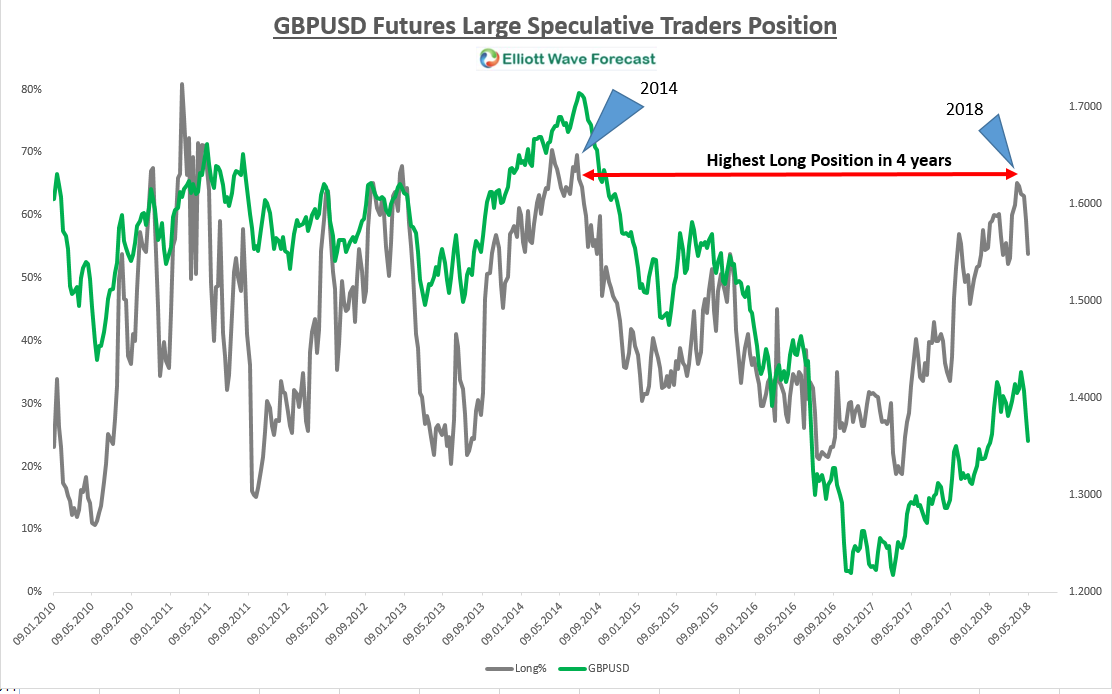

Sentiment Extreme Drags GBPUSD Lower

Read MoreIn this blog, I want to discuss the retreat in the COT Sentiment Net long position in the GBPUSD and what effects it can take. First off let me start explaining what the COT report is all about. The Commitments of Traders Report, short COT is a weekly market report which is issued by the Commodity Futures […]

-

GBPUSD Elliott Wave View: Showing Impulse Structure

Read MoreGBPUSD Elliott wave view in short-term cycle suggests that the decline from 4/17/2018 high (1.4377) is unfolding as an impulse Elliott wave structure where bounce to 1.3607 high ended Intermediate wave (4). Down from there, intermediate wave (5) remains in progress as Elliott Wave ending diagonal structure. Ending diagonal usually appears in the sub-division of wave (5) of […]