In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

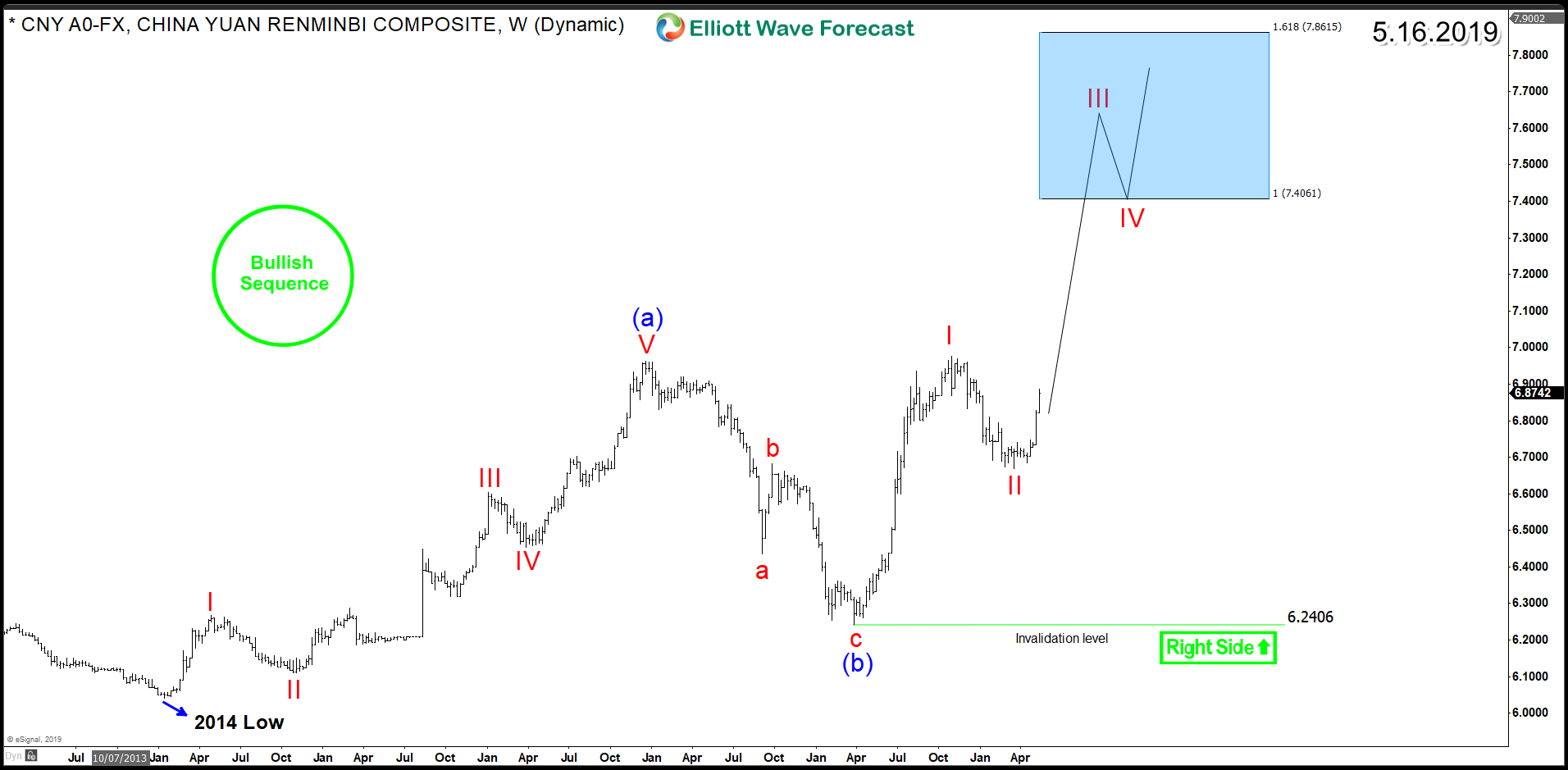

Chinese Yuan Looking For Further Weakness Against US Dollar

Read MoreThe Yuan (CNY) is the basic unit of the Renminbi which represents the official currency of the People’s Republic of China. The ongoing trade war between China and United States is affecting the economy for both country and the recent tension caused by U.S. Tariffs could be the trigger of more weakness in Yuan. China’s currency had appreciated 30% against the U.S. […]

-

AUDJPY Elliott Wave View: Forecasting The Decline

Read MoreAUDJPY Elliott wave view suggests that the cycle from 4/17/2019 peak showed lower low sequences & right side tags called for more downside. Therefore, our strategy remained selling the blue boxes in 3, 7 or 11 swings.

-

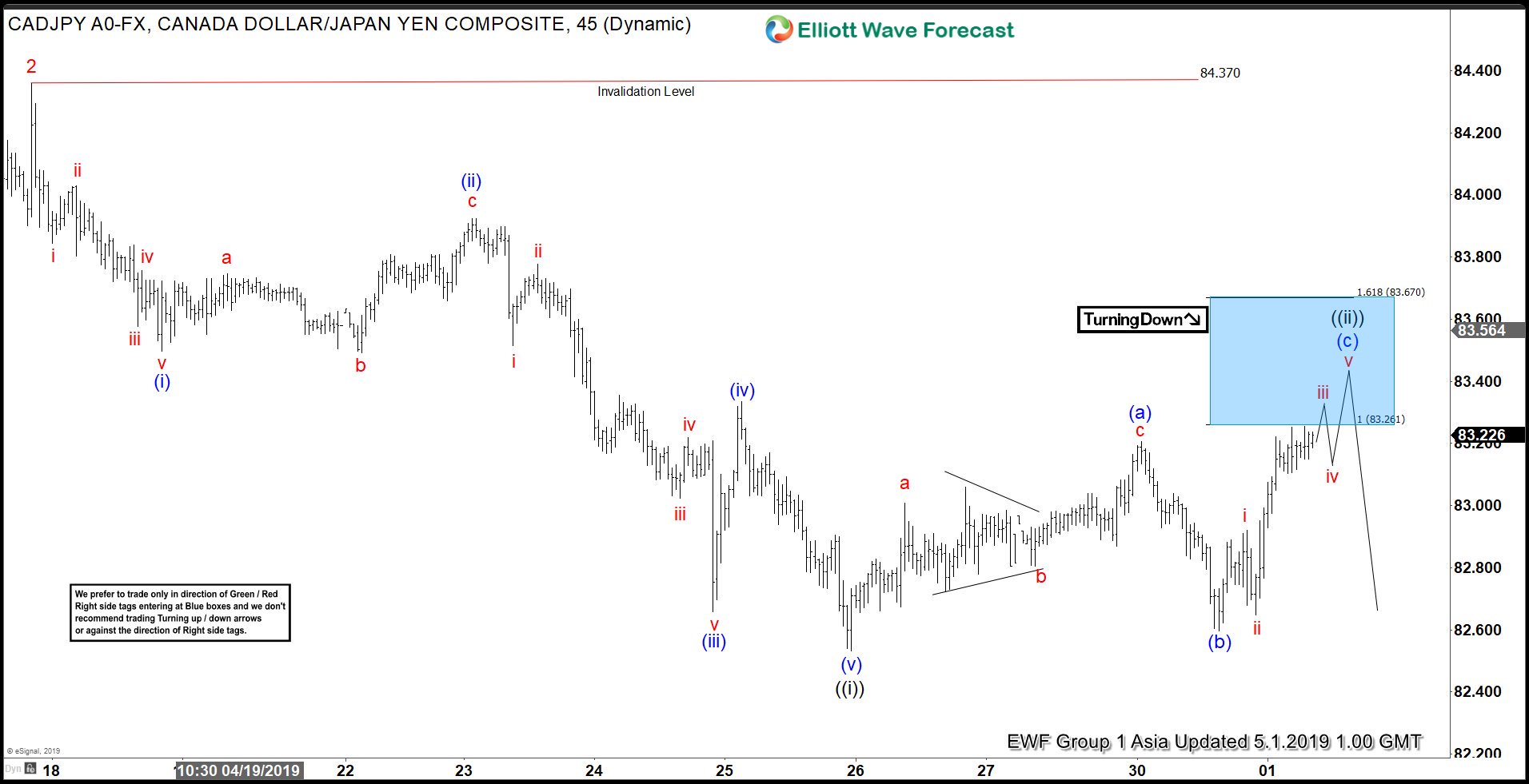

CADJPY Found Sellers In Blue Box And Declined

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the charts of CADJPY published in members area of the website. As our members know, CADJPY ended cycle from the January low at 85.23 peak, and as far as pivot at that high holds, we can be running new bearish […]

-

Elliott Wave View: Downside Pressure in USDJPY

Read MoreUSDJPY shows an impulsive decline from April 25 high. This article and video shows the short term Elliott Wave path for the pair.

-

Elliott Wave Analysis: Trading GBPAUD with Right Side System

Read MoreIn this blog, I want to share with you some Elliott Wave charts of GBPAUD which we presented to our members. In the chart below You see the 4-hour updated chart presented to our clients on the 04/17/19. The higher degree trend of the pair is to the upside because of Bullish Sequence stamp. So our members know […]

-

Elliott Wave View: Further Weakness in GBPJPY

Read MoreGBPJPY shows incomplete sequence from 3.14.2019 high favoring more downside. This video explains the short term Elliott Wave path for the pair.