Hello traders. As our members know, we have had many profitable trading setups recently. In this technical article, we are going to talk about another Elliott Wave trading setup we got in Silver (XAGUSD). The commodity has completed its correction exactly at the Equal Legs zone, also known as the Blue Box Area. In this […]

-

Sugar – Forecasting Elliott Wave Path and Calling The Decline

Read MoreIn this technical blog we’re going to take a quick look at the Elliott Wave charts of Sugar (SB_F) published in members area of the website. SB_F ended a cycle from 04.13.2022 peak as a Zigzag Elliott wave structure. and bounced. Based in correlation with other commodities and US Dollar Index calling for more upside, we called […]

-

Elliott Wave View: Silver Has Reached Daily Extreme Area

Read MoreSilver has reached the minimum 100% target in daily time frame from 2.1.2021 at $18.37. However, short term, the metal can still see further downside. Near term Elliott Wave view in Silver (XAGUSD) suggests the decline from 6/6/2022 high is in progress as a 5 waves impulse Elliott Wave structure. Down from 6/6/2022 high, wave […]

-

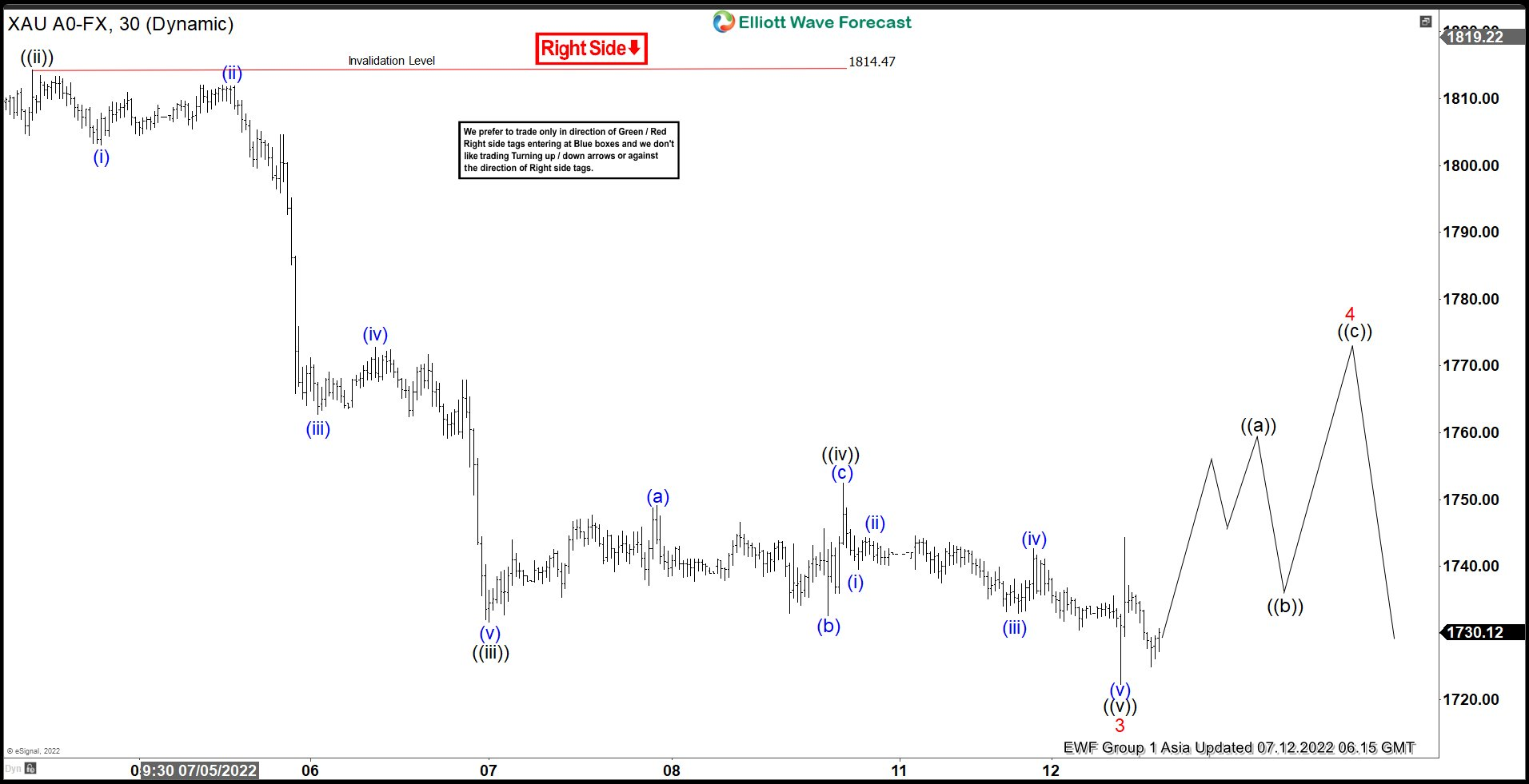

Elliott Wave View: Gold (XAUUSD) Remains Bearish Near Term

Read MoreGold (XAUUSD) shows bearish sequence from 3/8/2022 high favoring more downside. This article and video look at the Elliott Wave path

-

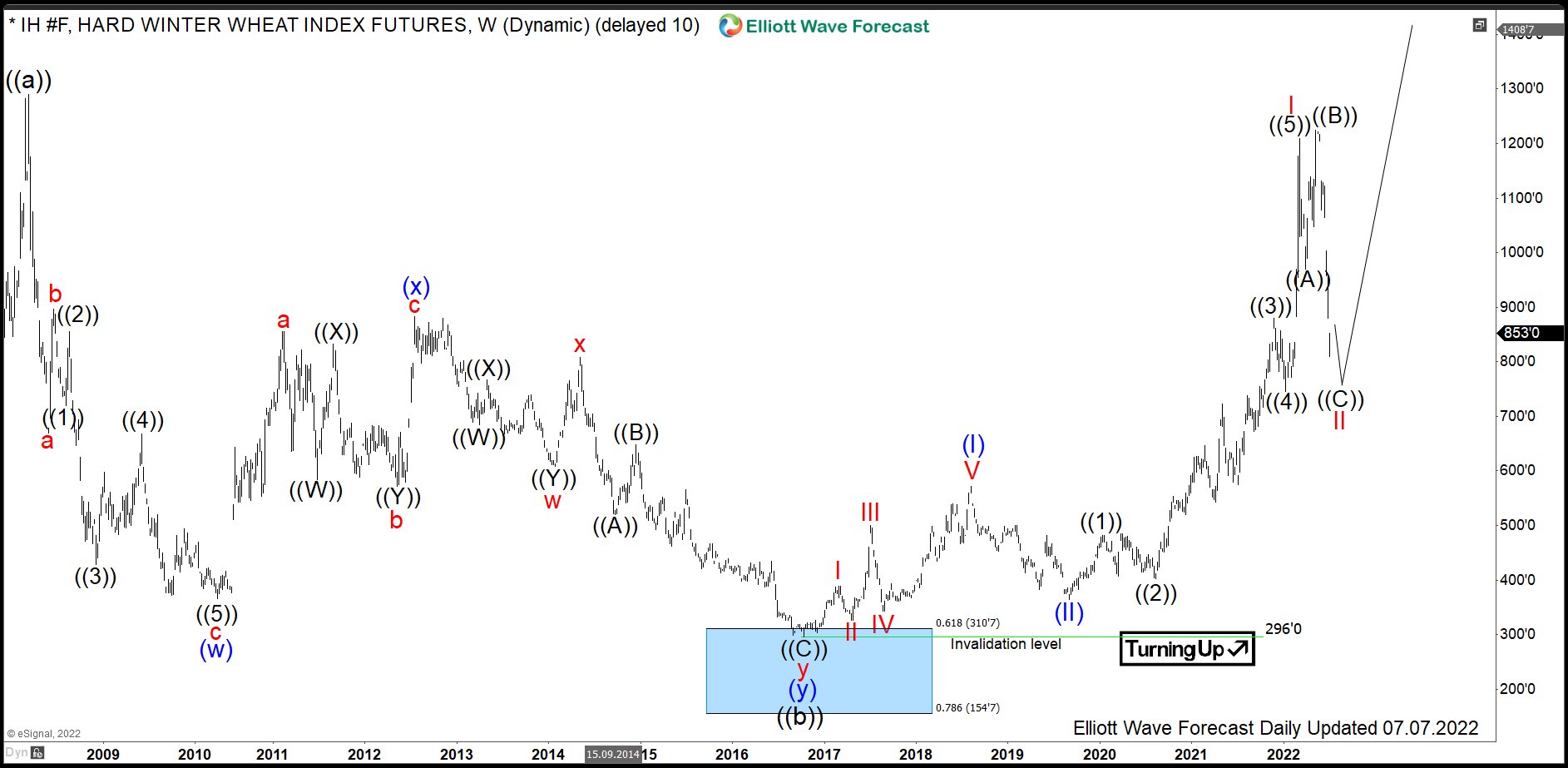

Hard Red Winter Wheat: Towards Bread Shortages in 2023?

Read MoreHard Red Winter Wheat is one of the grain commodities, along with soft red wheat, corn, soybeans and others. Within the wheat family, first of all, there is a fundamental difference between two wheat types. Soft wheat is low in protein and is basically used in cakes in pastries. By contrast, hard wheat has a […]

-

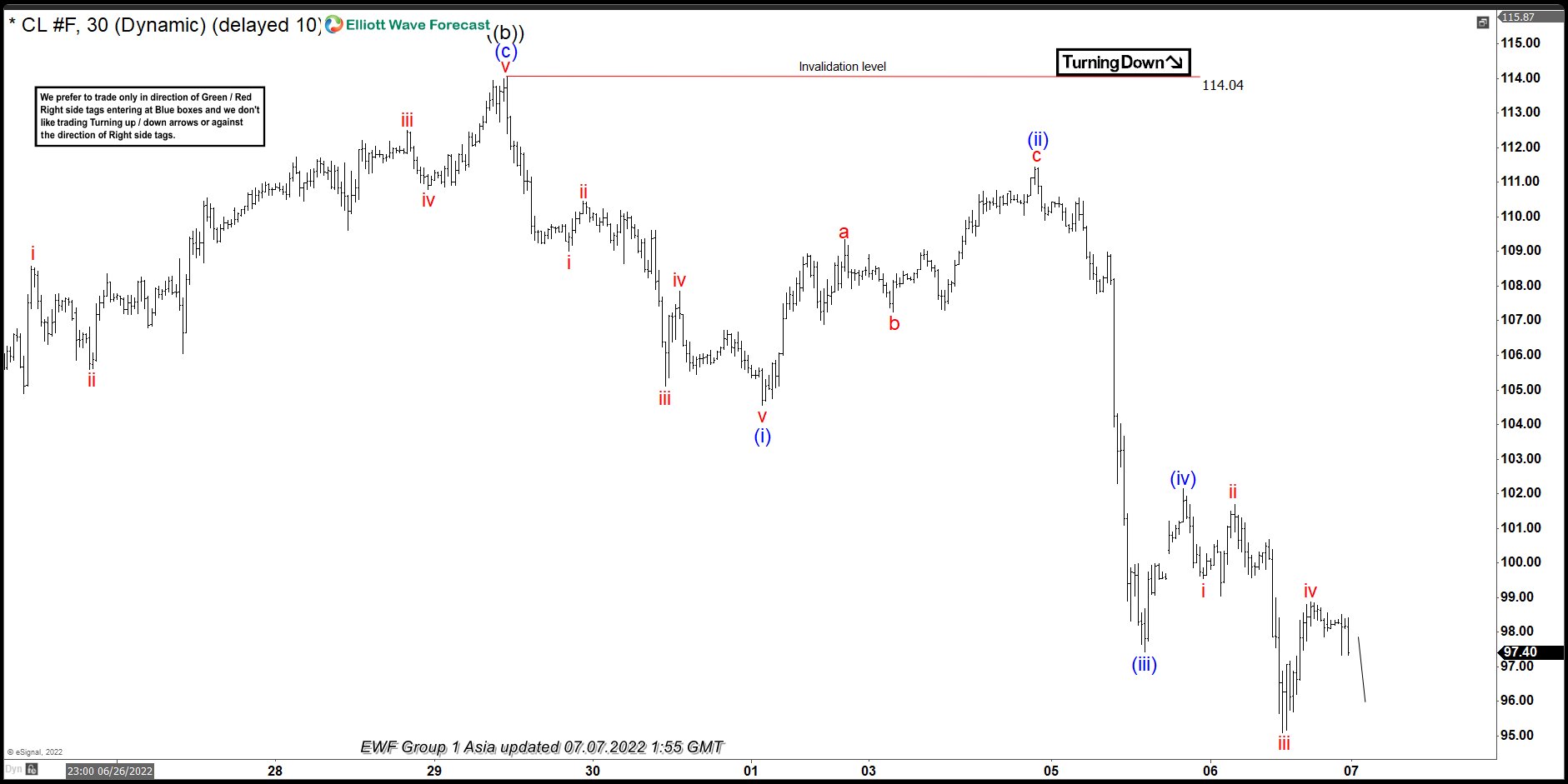

Elliott Wave View: Oil Near To Complete a Cycle Looking For A Bounce

Read MoreShort term Elliott Wave view in Oil suggests the decline from 123.77 did 5 waves down ended an impulse as wave ((a)) at 101.56. Then market bounced building a corrective structure and ended wave ((b)) at 114.04. Oil has turned lower in wave ((c)) to complete a 3 swings structure to look for a double […]

-

GCC (Wisdomtree Commodity Strategy Fund) Calling For Higher Commodities

Read MoreGCC (Wisdom Tree Commodity Strategy Fund) is a great indicator for commodities direction. This Fund is positively correlated with Oil. Previously, we have mentioned the idea that the Fund reached the blue box area back in 03.2020. Since then, it has started a rally which looks like a nest. A nest is a series of […]