Hello traders. As our members know, we have had many profitable trading setups recently. In this technical article, we are going to talk about another Elliott Wave trading setup we got in Silver (XAGUSD). The commodity has completed its correction exactly at the Equal Legs zone, also known as the Blue Box Area. In this […]

-

Silver (XAGUSD) Ended Correction and Turned Higher

Read MoreSilver (XAGUSD) has ended cycle from 10.20.2023 high and turns higher. This article and video look at the Elliott Wave path.

-

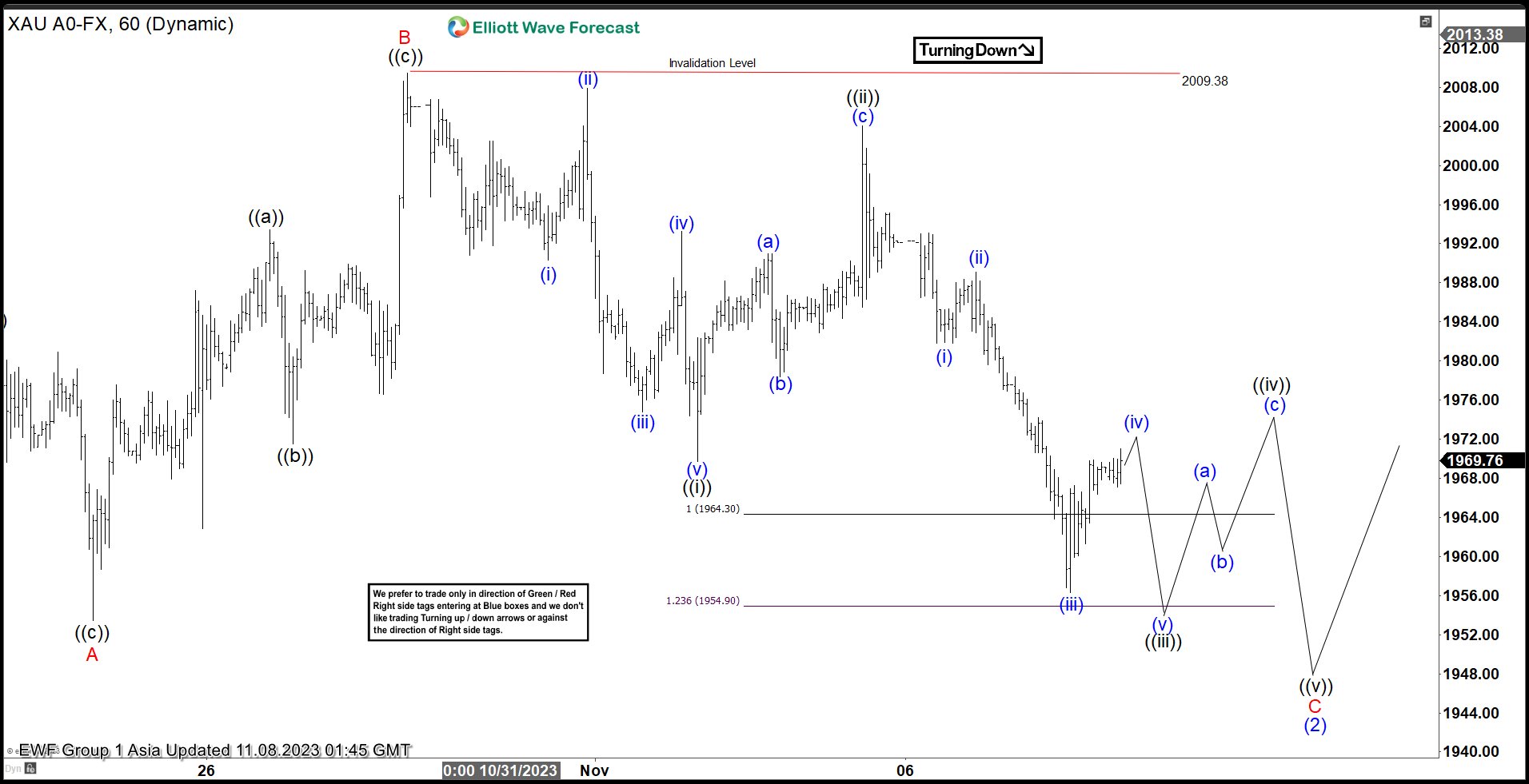

Gold (XAUUSD) Pullback Looking for Support to the Upside

Read MoreGold (XAUUSD) is correcting cycle from 10.6.2023 low before it turns higher. This article and video look at the Elliott Wave path.

-

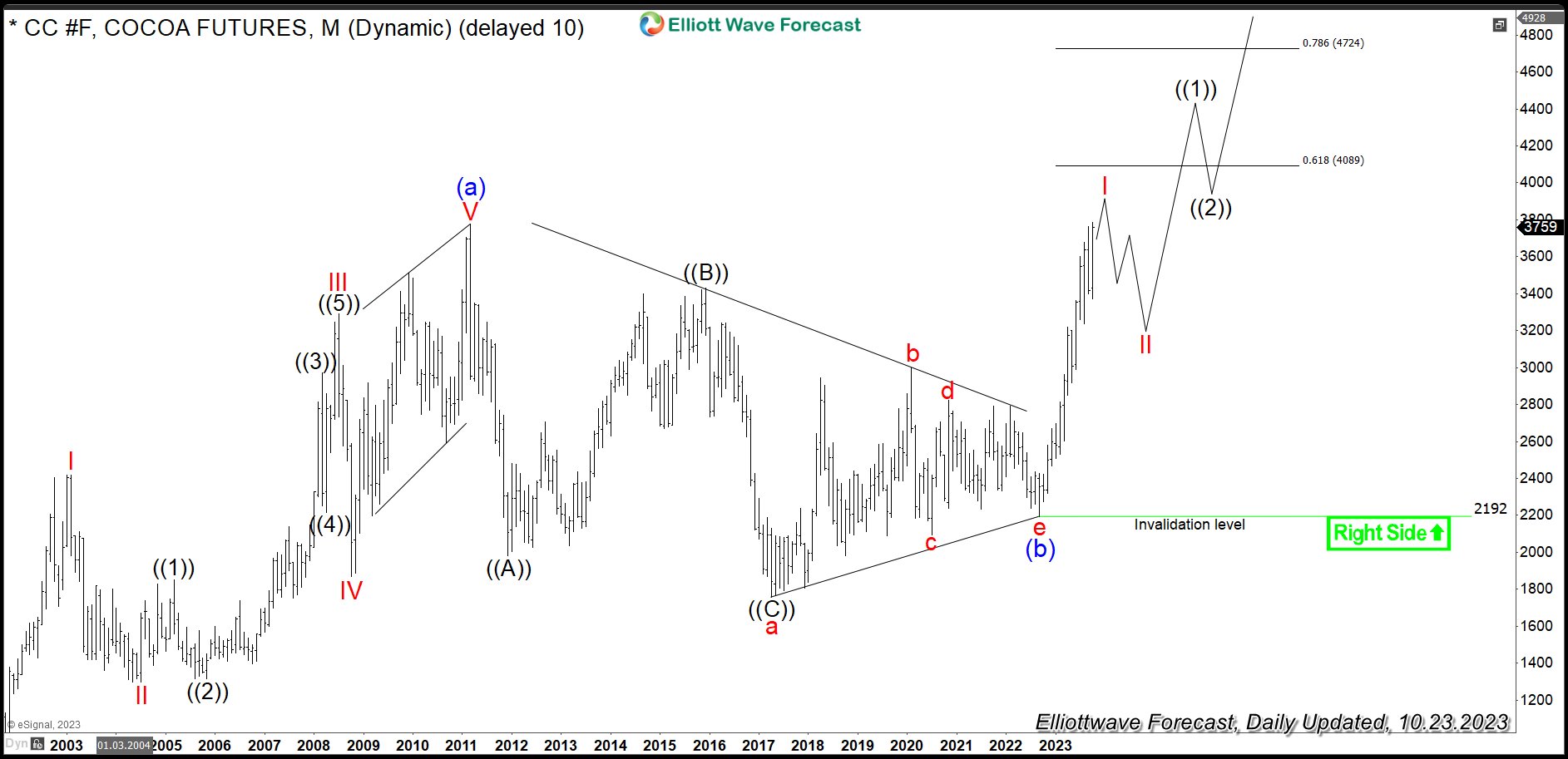

$CC #F: Cocoa Prices Trade in a Bullish Sequence

Read MoreCocoa (or cocoa bean) is one of soft commodities, along with sugar, coffee, orange juice and cotton. The bean is the fully dried and fermented seed, wherefrom cocoa solids and cocoa butter can be extracted. Cocoa beans are the basis of the chocolate. One can trade Cocoa futures at ICE owned New York Board of […]

-

Platinum (PL) Correction Remains In Progress

Read MorePlatinum (PL) is still correcting cycle from 9.1.2022 low before the rally resumes. We also present an alternate view if the pivot at September 2022 low (796.8) fails. If it breaks below 796.8, it suggests a bigger correction against March 2020 low. In the higher time frame, the metal is in a bullish grand super […]

-

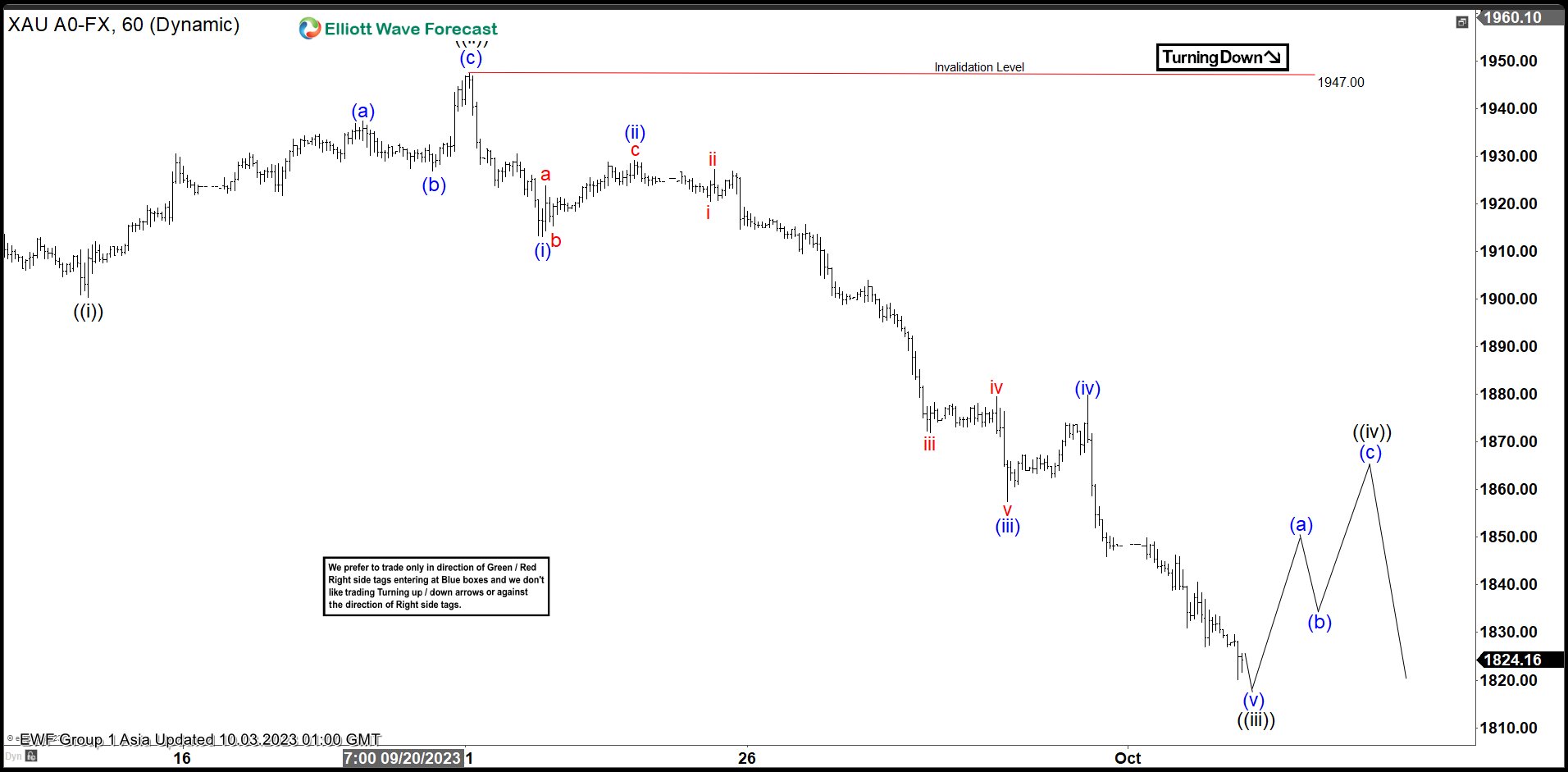

Gold (XAUUSD) Bearish Sequence Favors More Downside

Read MoreGold (XAUUSD) shows bearish sequence from 5.4.2023 high expecting further downside. This article and video look at the Elliott Wave path.

-

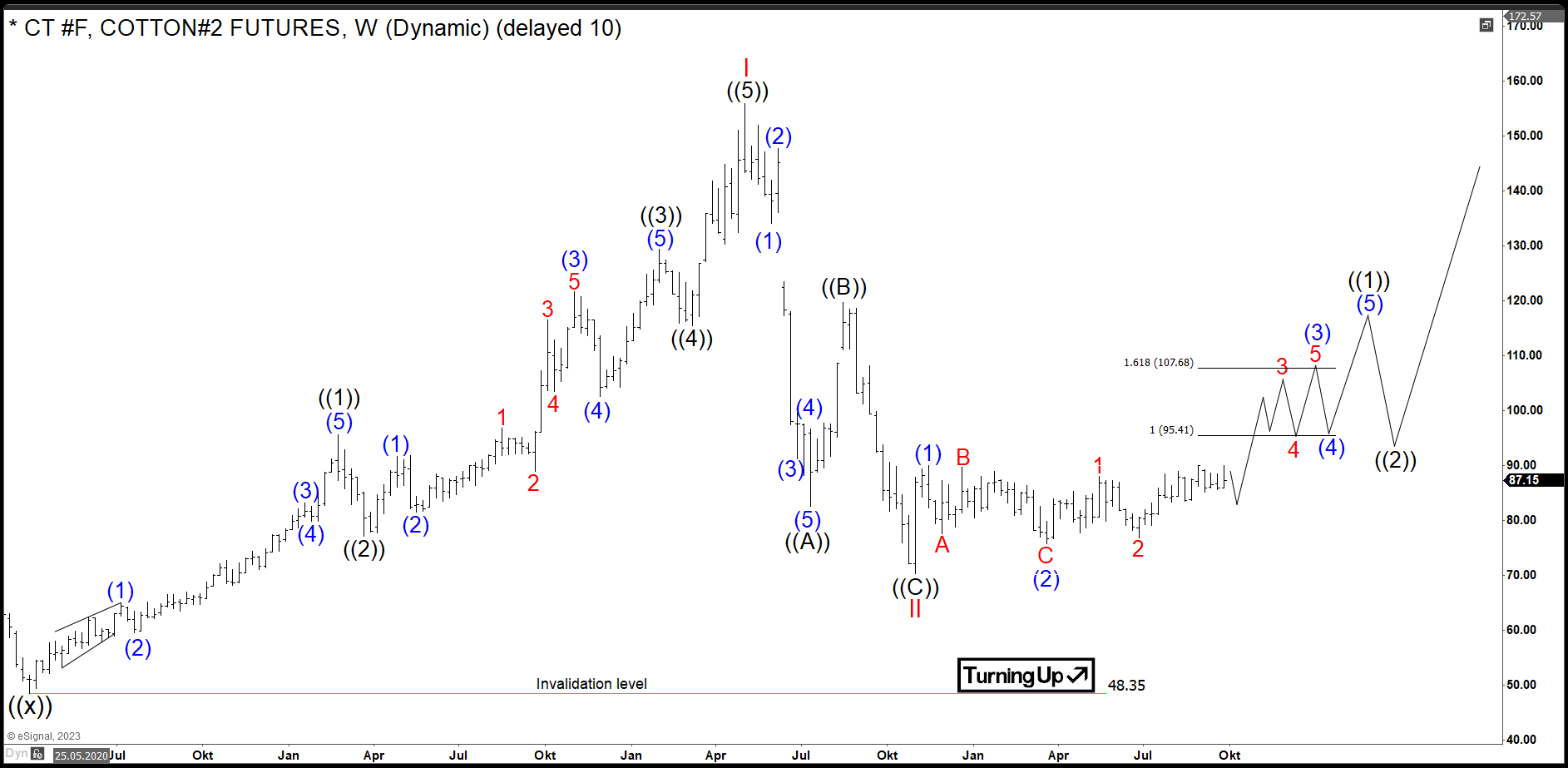

$CT #F: Nesting Price Action in Cotton Provides an Opportunity

Read MoreCotton is one of soft commodities, along with sugar, coffee, orange juice and cocoa. In early centuries, Alexander the Great has brought cotton from Pakistan to Europe. Much later and finally, it has obtained the dominance in textile manufacturing during the British industrial revolution in the 18th century. It was so critical that at times of Civil War […]