-

Microsoft Corp. ($MSFT) Reacts Higher From The Blue Box Area.

Read MoreGood Day Traders and Investors. In today’s article, we will look at the past performance of the 1 Hour Elliott Wave chart of Microsoft Corp. ($MSFT) The rally from 5.24.2023 low unfolded as a 5 wave impulse with an incomplete bullish sequence from 4.25.2023 low. So, we advised members to buy the pullback in 3 […]

-

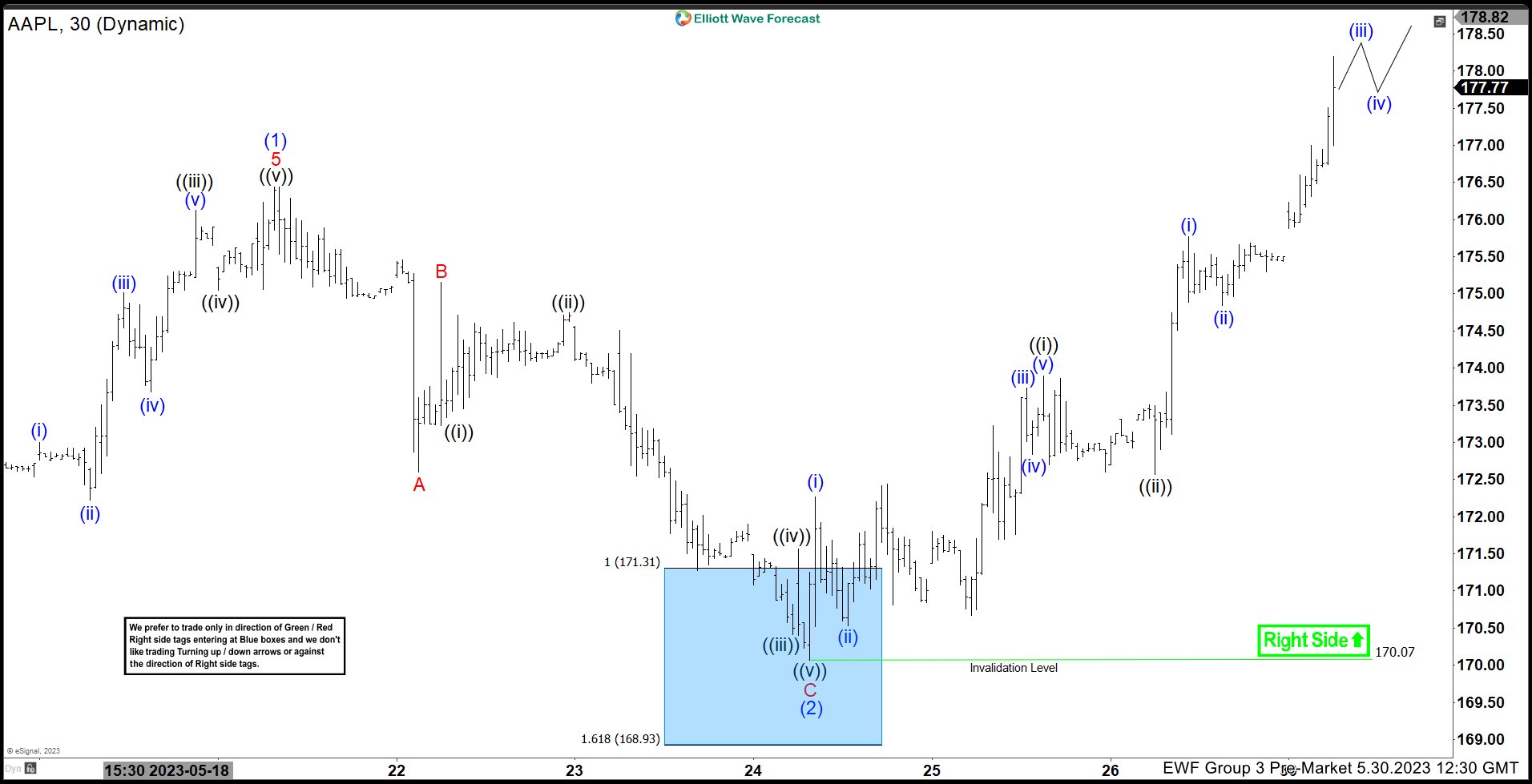

Apple, Inc. ($AAPL) Reacts Higher From The Blue Box Area.

Read MoreGood Day Traders. In today’s article, we will look at the past performance of the 1 Hour Elliott Wave chart of Apple, Inc. ($AAPL) The rally from 5.03.2023 low unfolded as a 5 wave impulse and ended on 5.19.2023 at $176.43. A 7 swing corrective pullback (WXY) took place since that peak. So, we advised […]

-

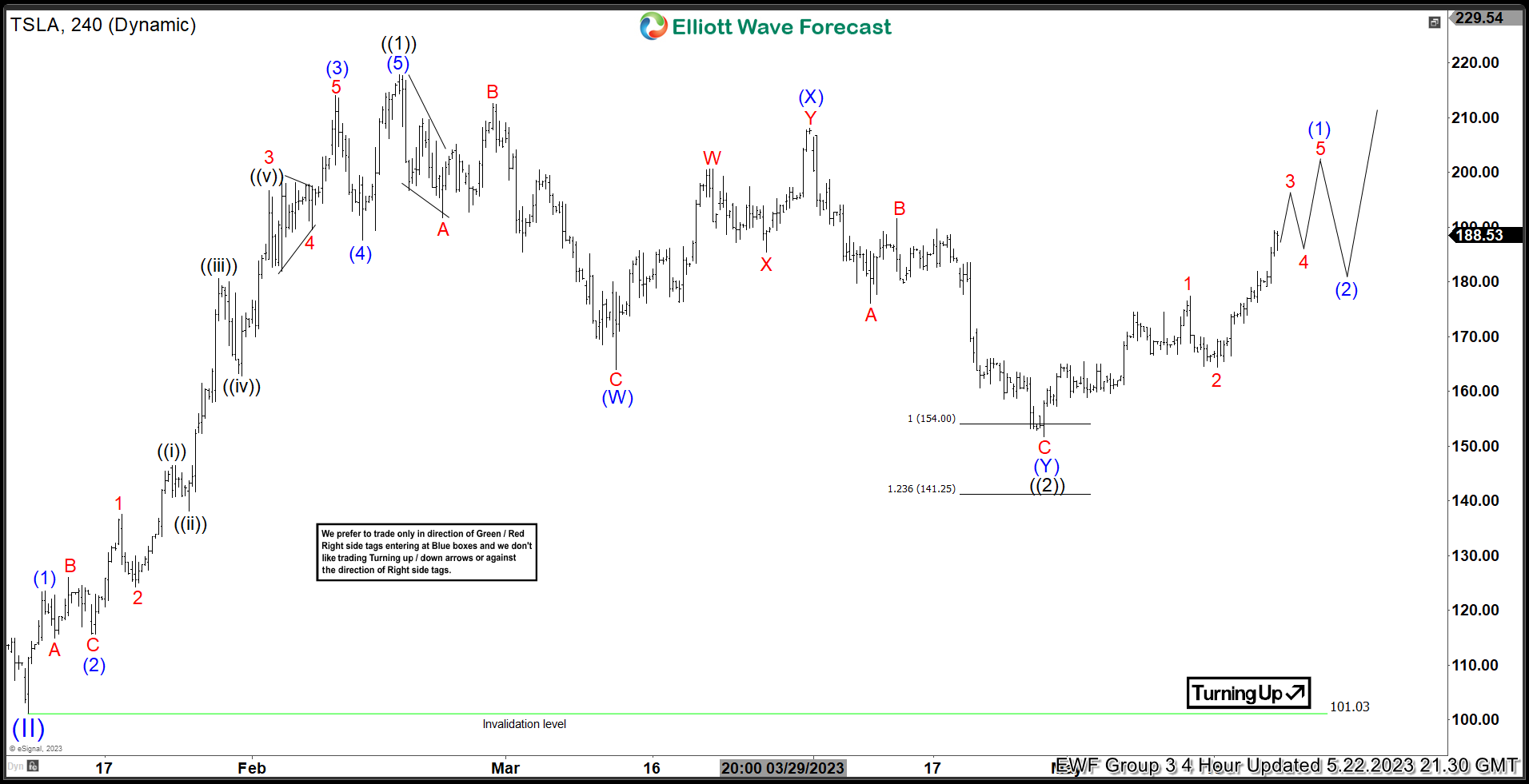

Tesla, Inc. ($TSLA) Reacts From Extreme Area After a 5 Wave Rally.

Read MoreHello Traders. In today’s article, we will look at the past performance of 4 Hour Elliott Wave chart of Tesla, Inc. ($TSLA) The rally from 1.06.2023 low unfolded as a 5 wave impulse and ended on 2.16.2023 at $217.55. A 7 swing corrective pullback (WXY) took place since the peak. So, we advised members to […]

-

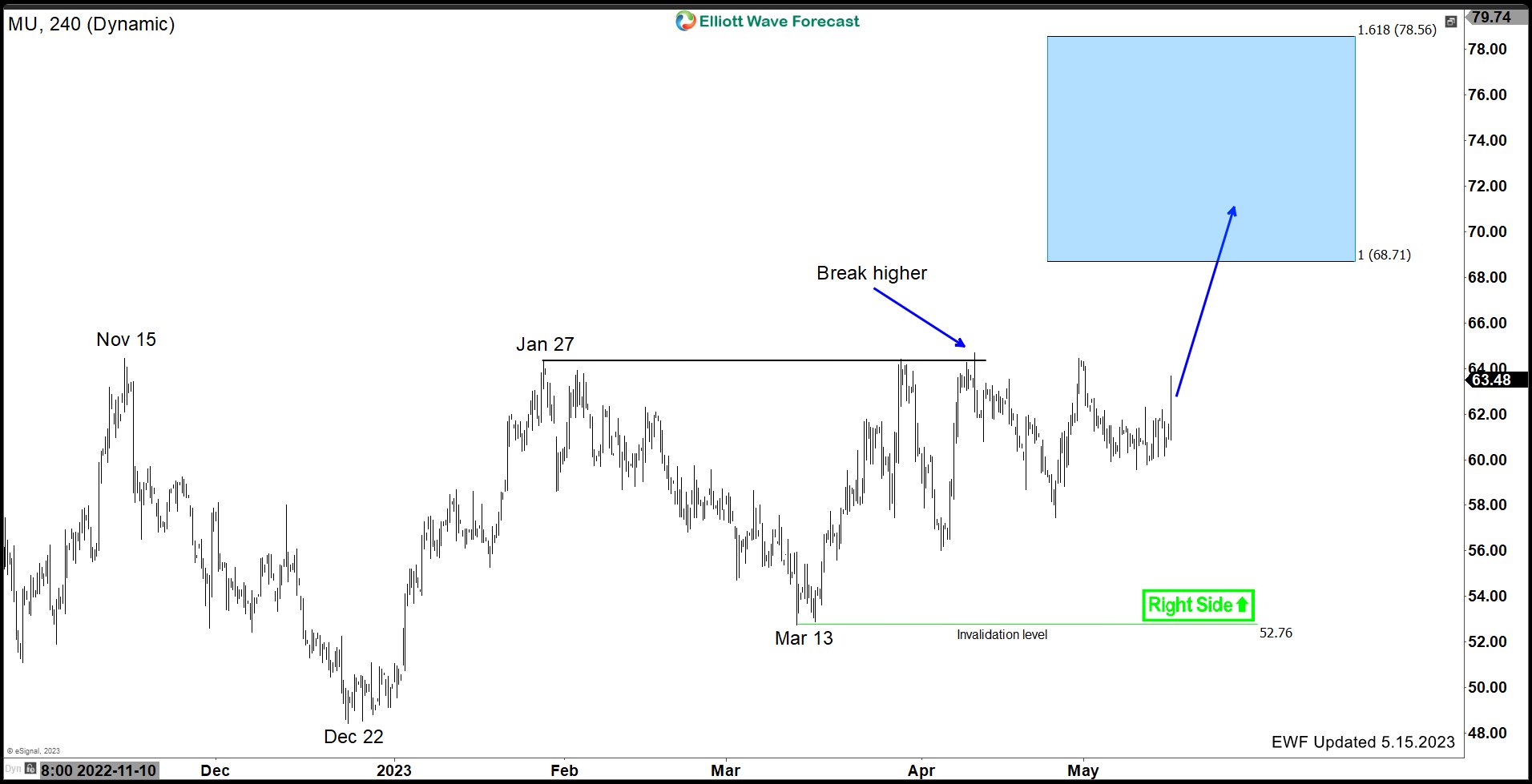

Micron Technology Inc. ($MU) is calling for more upside in the Tech Sector.

Read MoreHello Traders! Today, we will look at the shorter cycles of Micron Technology Inc ($MU) and explain why the stock should remain supported in the near term. This is how we saw it back in March 2023 expecting a bounce to take place first before lower again. $MU 4H Elliott Wave Analysis May 15th 2023: The stock has […]

-

Will TD Bank ($TD) React Lower from our Blue Box Area?

Read MoreHello Traders! Today, we will look at the shorter cycles of Toronto-Dominion Bank ($TD) and explain why the stock should soon reach a Blue Box area and react lower. First of all, This is how we saw it in March 2023 expecting a bounce to take place before lower again. $TD 4H Elliott Wave Analysis May 8th 2023: The […]

-

How Is The Real Estate Sector ($IYR) Calling For More Upside.

Read MoreHello Traders! Today, we will look at the shorter cycles of The Real Estate ETF ($IYR) and explain why the sector should remain supported for the next few weeks. This is how we saw it in March 2023 expecting a bounce to take place first before lower again. $IYR (Real Estate) 4H Elliott Wave Analysis […]