-

Invesco Nasdaq ETF ($QQQ) Reacted Higher After a Corrective Pull Back.

Read MoreHello everyone. In today’s article, we will look at the past performance of the 4H Hour Elliott Wave chart of Invesco Nasdaq ETF ($QQQ). The rally from 10.13.2022 low unfolded as a 5 wave impulse. So, we expected the pullback to unfold in 7 swings and find buyers again. We will explain the structure & […]

-

VanEck Gold Miners ETF ($GDX) Reacted Higher After a Corrective Pull Back.

Read MoreHello everyone. In today’s article, we will look at the past performance of the 1H Hour Elliott Wave chart of VanEck Gold Miners ETF ($GDX). The rally from 10.04.2023 low unfolded as a 5 wave impulse. So, we expected the pullback to unfold in 3 swings and find buyers again. We will explain the structure […]

-

Alphabet Inc. ($GOOGL) Reacting Higher From Blue Box Area.

Read MoreHello everyone. In today’s article, we will look at the past performance of the 1 Hour Elliott Wave chart of Alphabet Inc. ($GOOGL). The rally from 9.26.2022 low unfolded as a 5 wave impulse. So, we expected the pullback to unfold in 7 swings and find buyers again at the blue box area. We will […]

-

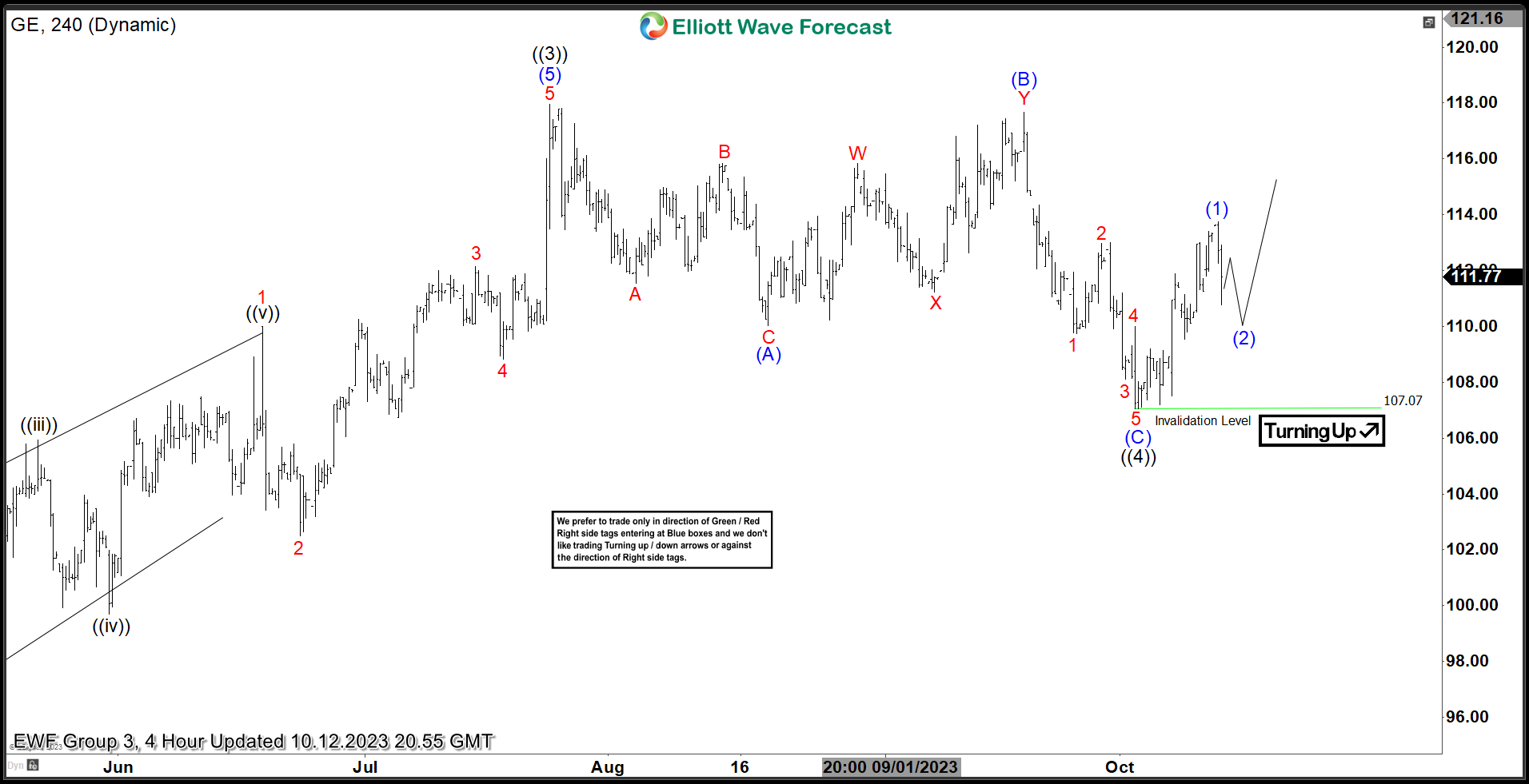

General Electric Co. ($GE) Reacted Higher After a Corrective Pull Back.

Read MoreHello everyone. In today’s article, we will look at the past performance of the 8 Hour Elliott Wave chart of General Electric Co. ($GE). The rally from 12.16.2022 low unfolded as a 5 wave impulse. So, we expected the pullback to unfold in 7 swings and find buyers again. We will explain the structure & […]

-

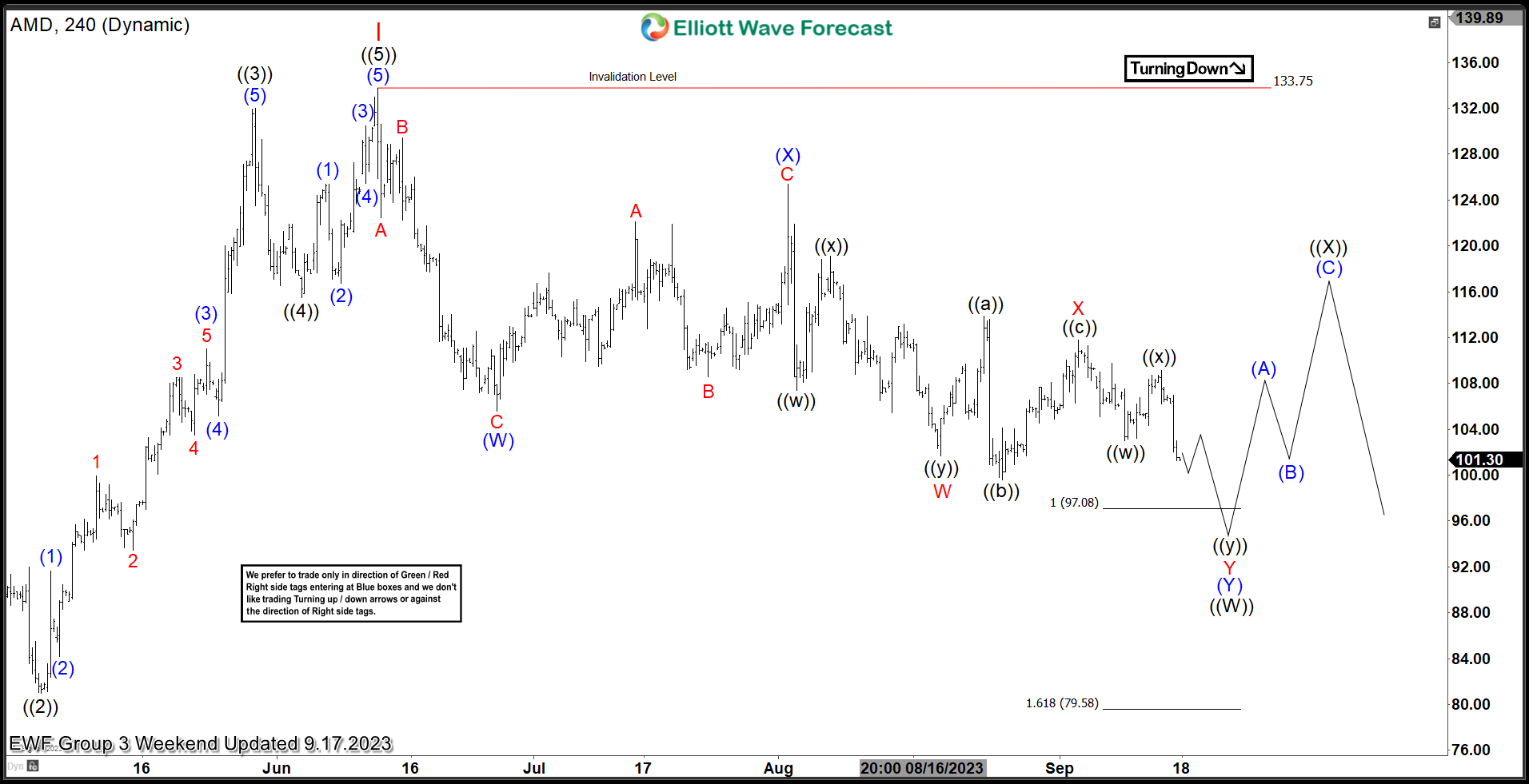

Advanced Micro Devices ($AMD) Found Buyers After a Corrective Pull Back.

Read MoreHello everyone. In today’s article, we will look at the past performance of the 4 Hour Elliott Wave chart of Advanced Micro Devices, Inc. ($AMD). The rally from 10.13.2022 low unfolded as a 5 wave impulse. So, we expected the pullback to unfold in 7 swings and find buyers again. We will explain the structure […]

-

SPDR Utilities Select Sector ($XLU) Is Poised To Rally Soon From a Blue Box Area

Read MoreHello Traders! Today, we will look at the Elliott Wave structure of SPDR Utilities Select Sector ($XLU) and explain why the stock is bound to end a cycle and bounce soon. The Utilities Select Sector SPDR® Fund seeks to provide investment results that correspond generally to the price and yield performance of the Utilities Select Sector […]