-

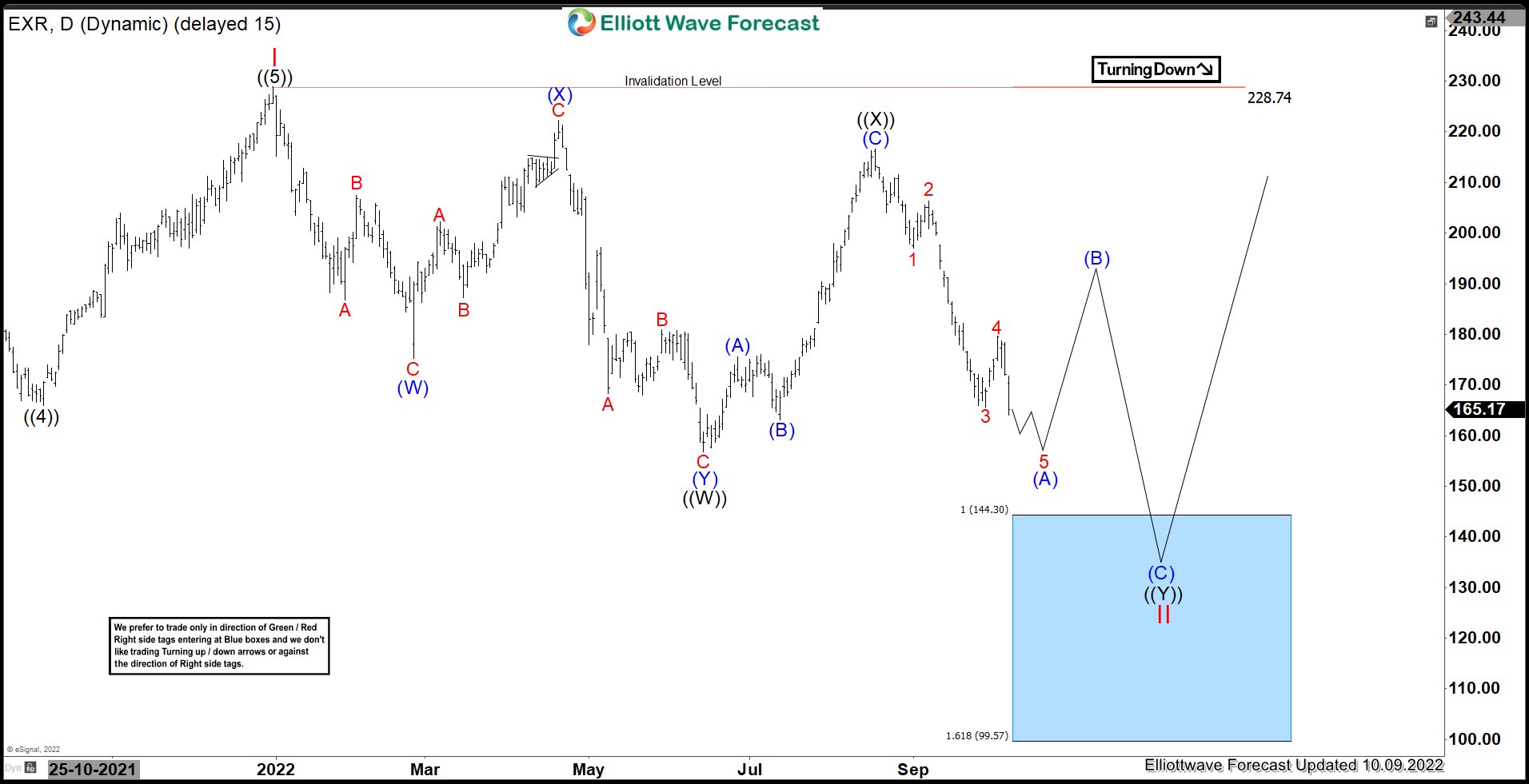

EXR : Expect Further Correction Before Rally Resumes

Read MoreExtra Space Storage Inc (EXR) is a self-administered & self-managed REIT. The company owned &/or operated 1,906 self-storage stores in 40 states. The company offers customers a wide selection of conveniently located & secure storage units across the country, including boat storage, RV storage & business storage. It is based in Salt Lake City, Utah, […]

-

AIZ : Expect Double Correction Lower Before Upside Resumes

Read MoreAssurant Inc., (AIZ) together with its subsidiaries, provides lifestyle & housing solutions that support, protect & connect consumer purchases in North America, Latin America, Europe & Asia Pacific. The company operates through two segments: Global lifestyle & Global housing. It is based in New York, Comes under Financial services sector & trades under “AIZ” ticker […]

-

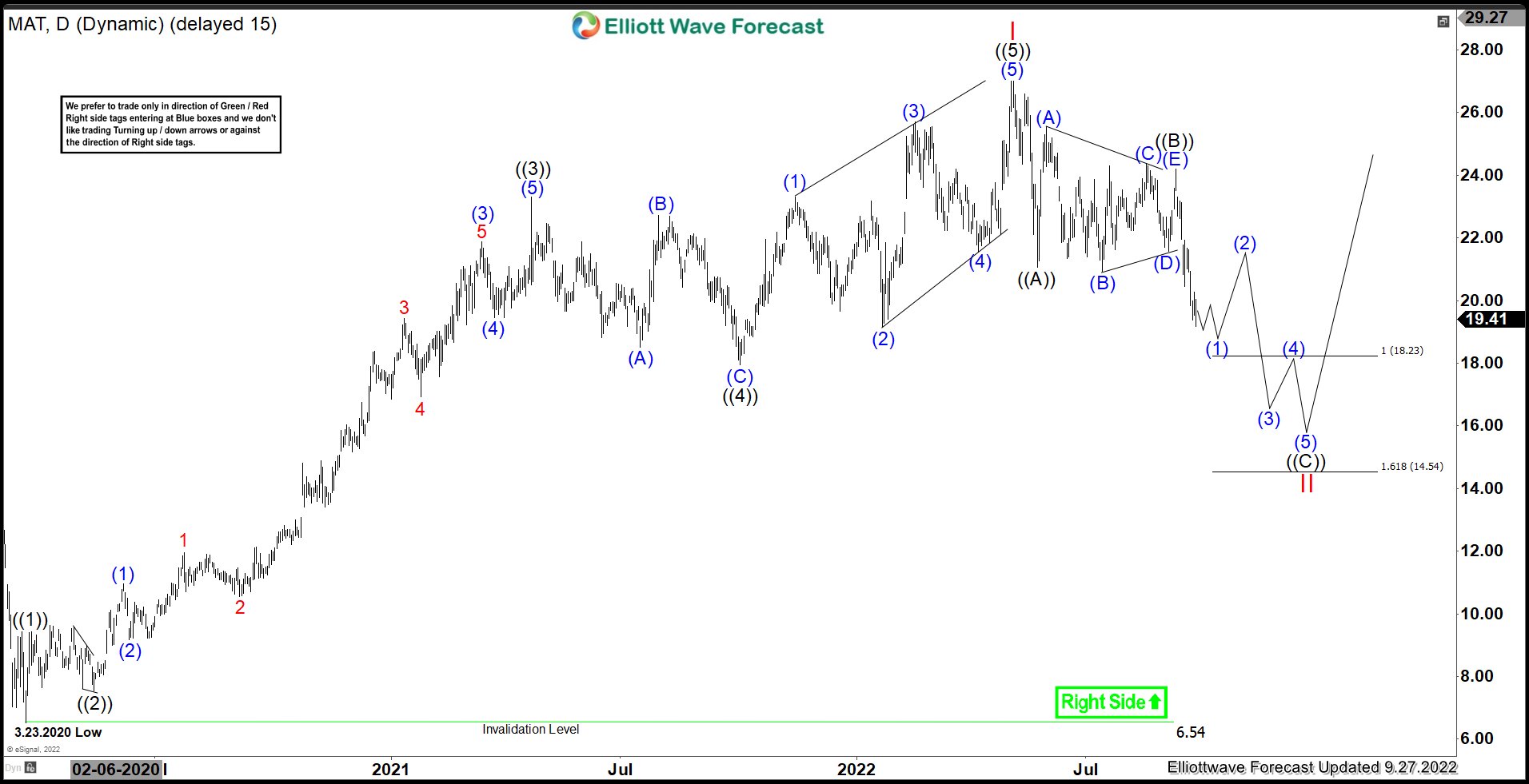

MAT : Expect Short Term Downside To Continue Before Rally Resumes

Read MoreMattel, Inc. (MAT), a children’s entertainment company, designs & produces toys & consumer products worldwide The company operates through North America, International & American Girl segments. It is based in El Segundo, CA, comes under Consumer Cyclical sector & trades as “MAT” ticket at Nasdaq. MAT made a low of $6.53 during March-2020 sell off […]

-

EWBC : Expect Larger Correction To Continue Before Rally Resumes

Read MoreEast West Bancorp Inc, (EWBC) operates as the bank holding company for East West Bank that provides a range of personal & commercial banking services to individuals & businesses. It operates through three segments, Consumer & Business banking, Commercial banking & others. It is based in Pasadena, CA, comes under Financial services sector & trades […]

-

RRR : Expecting A Larger Correction Before Rally Resumes

Read MoreRed Rock Resorts Inc., (RRR) develops & operates casino & entertainment properties in the US. It operates through two segments, Las Vegas Operations & Native American Management. It is based in Las Vegas, comes under Consumer Cyclical sector & trades as “RRR” ticker at Nasdaq. RRR made all time at $2.76 during global sell off […]

-

GMAB : Should Expect Sideways To Lower Before Upside Resumes

Read MoreGenmab A/S (GMAB) develops antibody therapeutics for the treatment of the cancer and other diseases. The company is based in Copenhagen, Denmark, comes under Healthcare – Biotechnology sector & trades as “GMAB” ticker at Nasdaq. GMAB made an all time high at $49.07 & currently favors correcting lower the sequence up since 2013 low. It […]