-

AMX: Should It Be Ready For Next Rally ?

Read MoreAmerica Movil, S.A.B. de C.V. (AMX) provides telecommunication services in Latic America & internationally. The company offers wireless & fixed voice services, including local, domestic & international long-distance services & network interconnection services along with data services. It is based in Mexico, comes under Communication services sector & trades as “AMX” ticket at NYSE. As […]

-

Elliott Wave View: S&P 500 (SPX) Expect Short Term Weakness To Continue

Read MoreShort term, Elliott wave view in S&P 500 (SPX) showing 5 swing sequence lower from 12.01.2022 peak of 4087.3 as the part of correction lower in (2) against 10.13.2022 low. Ideally, (2) expects to unfold in 3, 7 or 11 swings and should hold above 10.13.2022 low to turning higher. Below 4087.3 high, it starts […]

-

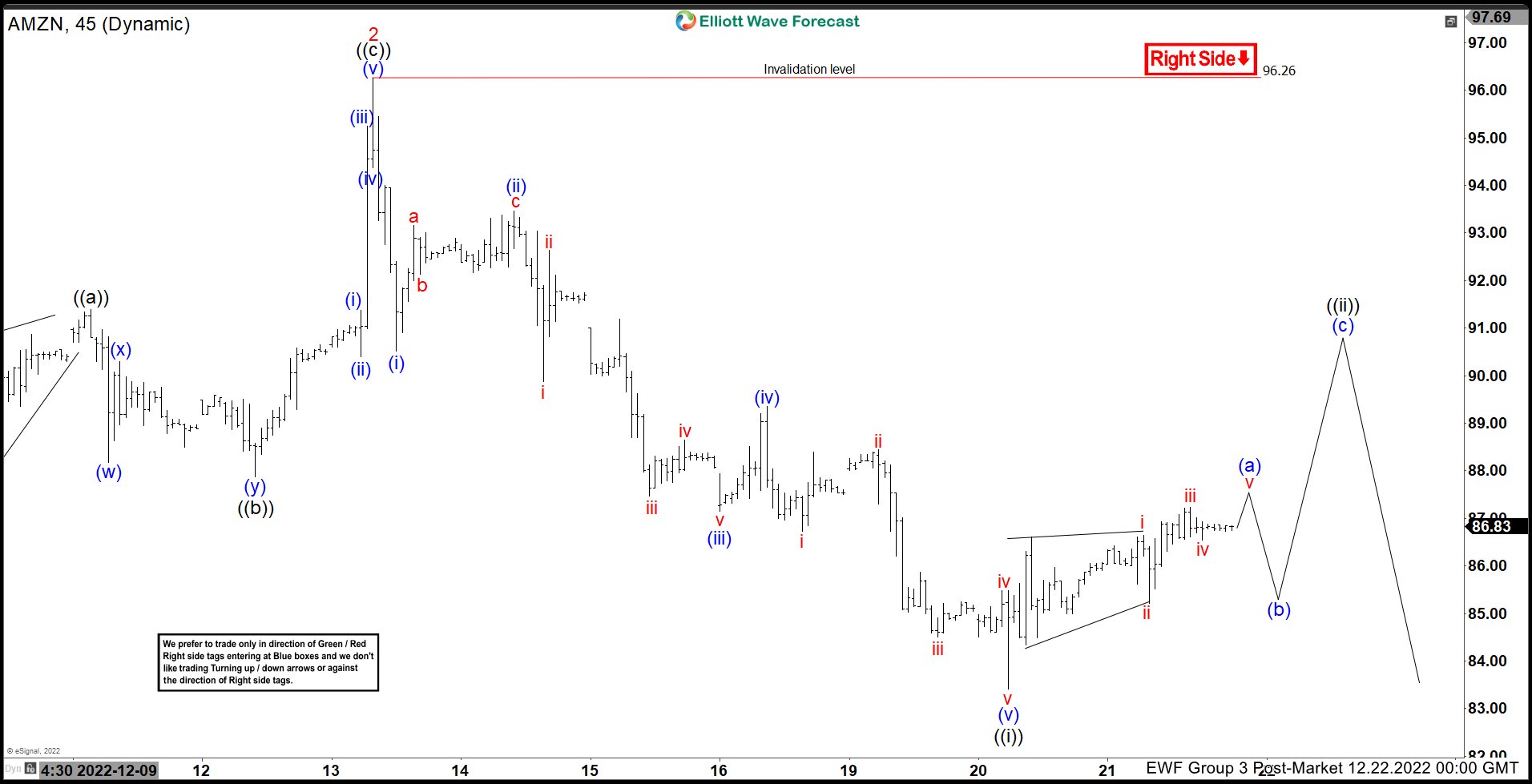

Elliott Wave View: Amazon (AMZN) Should Bounce Before Downside Resumes

Read MoreShort term Elliott wave View in Amazon (ticker; AMZN) suggests the decline from 12.13.2022 peak in 45 min chart, was clear 5 swings impulse lower, which ended ((i)) as the part of wave 3. The current sequence lower is the part of (3) of ((A)) in higher degree started from 11.15.2022 peak. It already confirms lower […]

-

BX : Expect Short Term Weakness To Continue Before Turning Higher

Read MoreBlackstone Inc., (BX) is an alternative asses management firm specializing in real estate, private equity, hedge fund solutions, credit, secondary funds of funds, public debt & multi-asset class strategies. The firm typically invests in early stage companies. It is based in New York, comes under Financial services sector & trades as “BX” ticker at NYSE. […]

-

Elliott Wave View: Apple (AAPL) Expect Weakness Continues After A Corrective Bounce

Read MoreShort term Elliott Wave View in Apple Inc., (AAPL) suggests that cycle from 12.05.2022 high was ended at 140 low as wave 1 as 5 waves impulse Elliott Wave structure. While above there, it starts bouncing in proposed 7 swing correction, which expect to fail below 150.90 high of wave (2) to resume lower. It ended […]

-

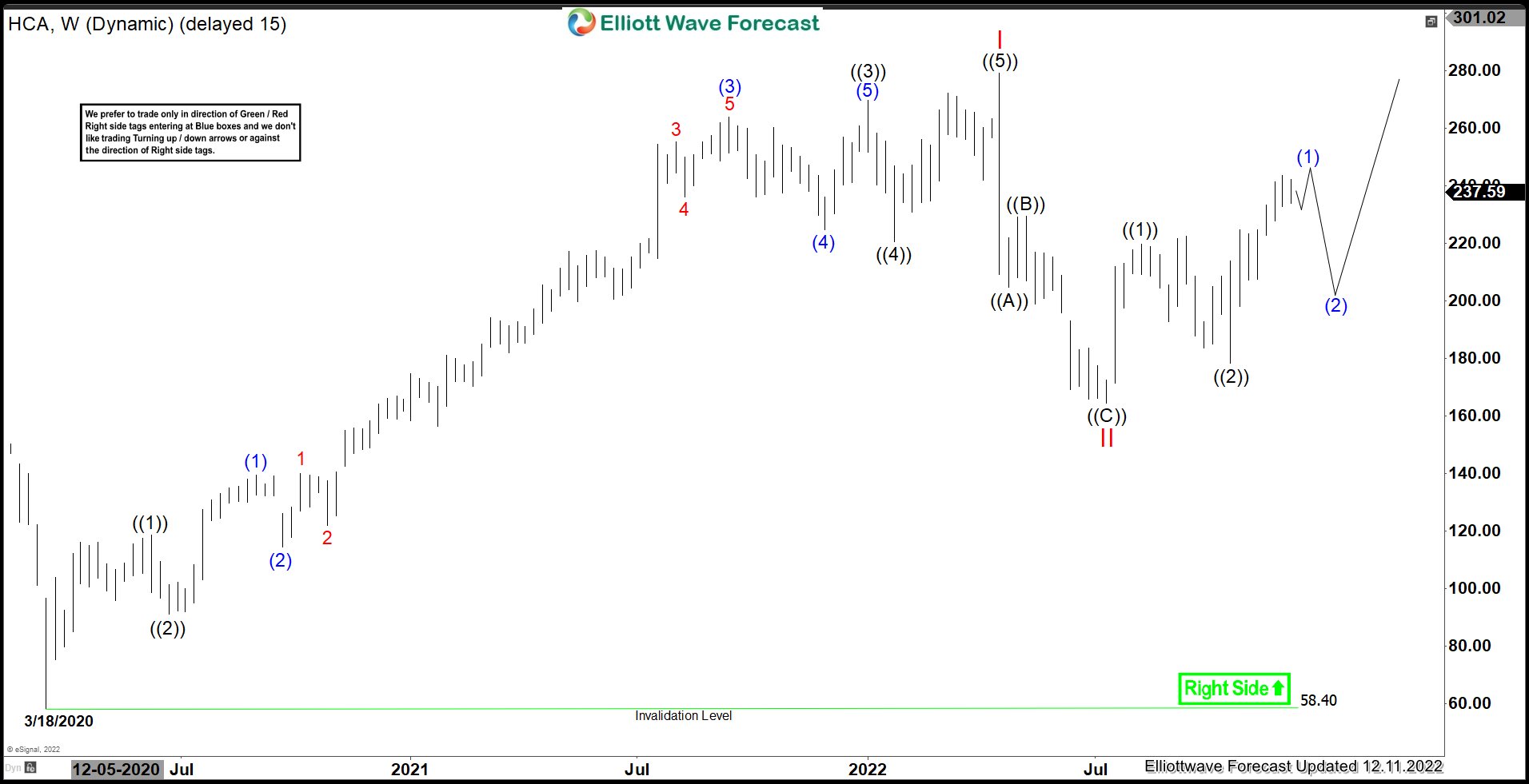

HCA : Should It Be Ready For Next Rally ?

Read MoreHCA Healthcare, Inc., (HCA) provides health care services company in the United States. The company operates general & acute care hospitals that offers medical & surgical services, including inpatient care, intensive care, cardiac care, diagnostic & emergency services & outpatient services. It is based in Nashville, Tennessee, comes under Healthcare (XLV) sector & trades as […]