-

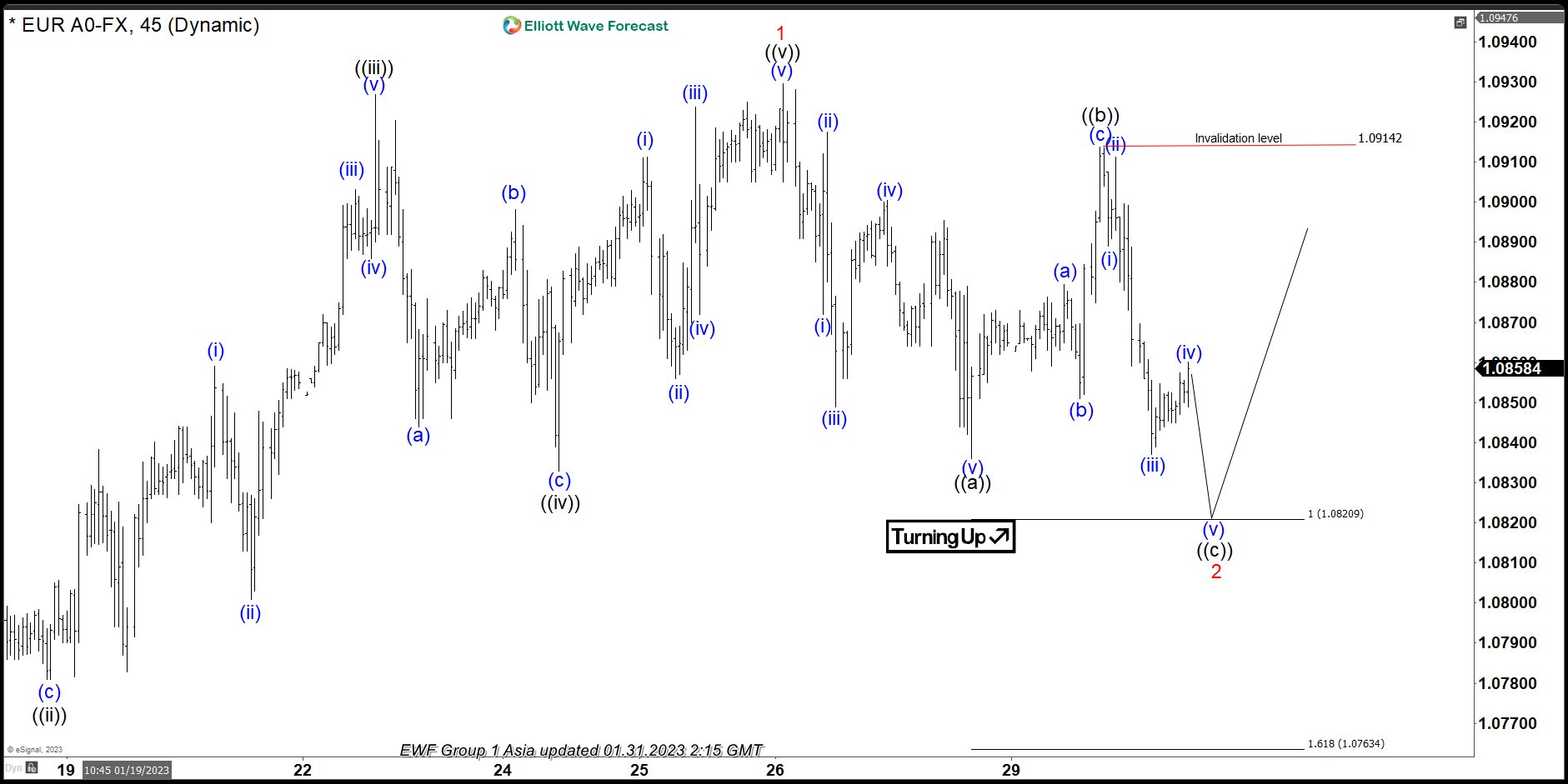

EURUSD: Pullback Likely To Find Support In Elliott Wave Correction

Read MoreIn short term Elliott wave sequence, EURUSD favors pullback in wave 2 started from 1/26/2023 high before upside resumes in wave 3. It is correcting in wave 2 in 3, 7 or 11 swings against the bullish sequence from 1/06/2023 low and expect to find support at extreme areas before turning higher. Since 1/06/2023 low, […]

-

ASML : Should It Be Ready For Next Rally ?

Read MoreASML Holding N.V., (ASML) develops, produces, markets, sells & services advanced semiconductor equipment systems consisting of lithography, metrology & inspection related systems for memory & logic chipmakers. It operates in Japan, South Korea, Singapore, Taiwan, China, Netherlands, Europe, US & others Asian countries. It is based in Veldhoven, Netherlands, comes under Technology sector & trades […]

-

ALB – Should Expect To Continue Rally

Read MoreAlbemarle Corporation (ALB) develops, manufactures & markets engineered specialty chemicals worldwide. It operates through three segments, Lithium, Bromine & Catalysts. It is based in Charlotte, NC, comes under Basic Materials sector & trades under “ALB” ticker at NYSE. ALB showing higher high sequence from March-2020 low, expecting more upside to continue. It ended impulse wave […]

-

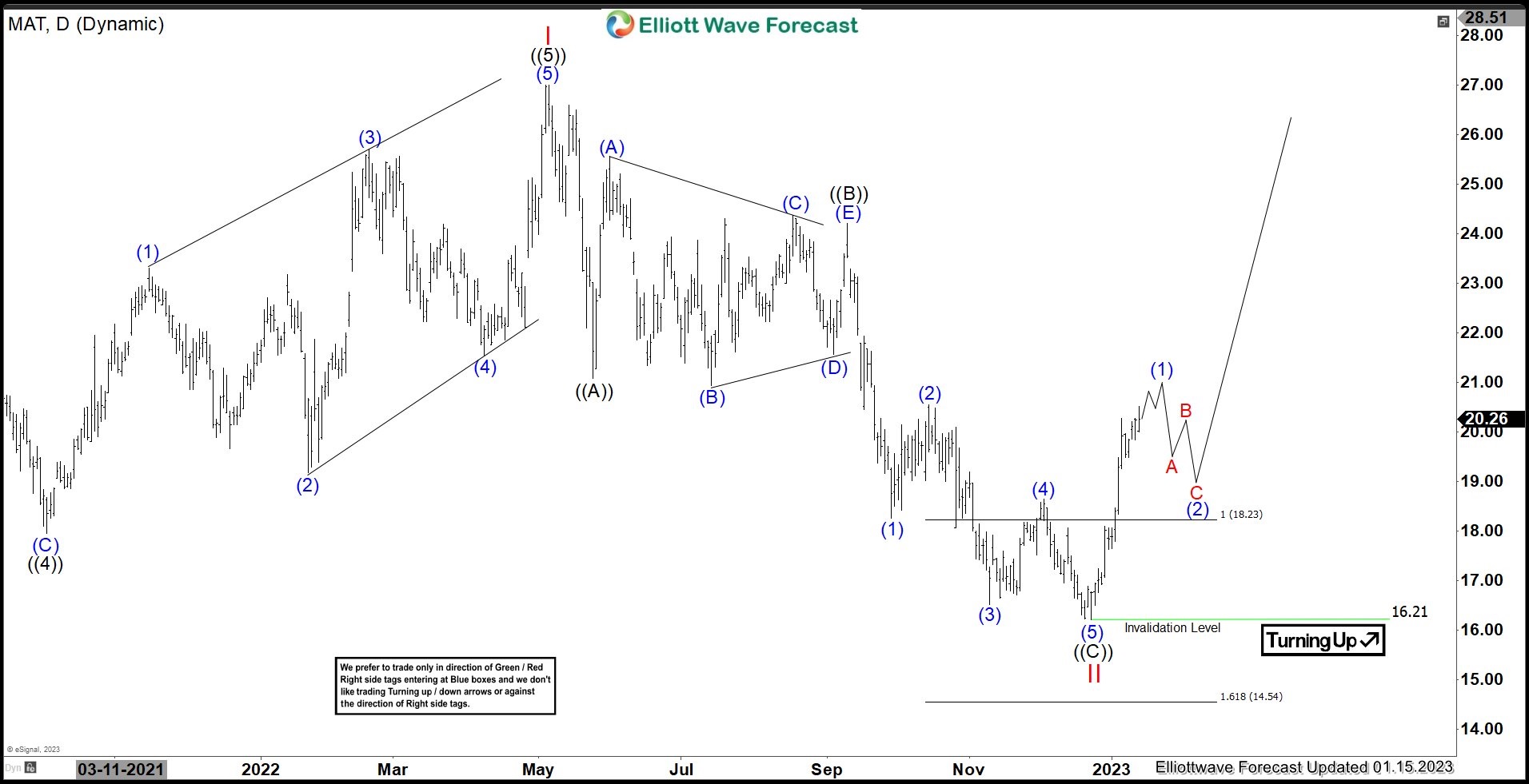

MAT : Should Expect Upside To Continue

Read MoreMattel, Inc. (MAT), a children’s entertainment company, designs & produces toys & consumer products worldwide. The company operates through North America, International & American Girl segments. It is based in El Segundo, CA, comes under Consumer Cyclical sector & trades as “MAT” ticket at Nasdaq. In the previous article, MAT ended wave I at $26.99 […]

-

Wells Fargo & Company (WFC) : Expects Sideways To Lower In Correction

Read MoreWells Fargo & Company (WFC) as diversified financial services company, provides banking, investment, mortgage, consumer & commercial finance products & services in the US & internationally. It operates through four segments, consumer banking & lending, commercial banking, corporate & investment banking & wealth & investment management. It is based in San Francisco, CA, comes under […]

-

MAT : Expect Short Term Weakness Before Turning Higher

Read MoreMattel, Inc. (MAT), a children’s entertainment company, designs & produces toys & consumer products worldwide. The company operates through North America, International & American Girl segments. It is based in El Segundo, CA, comes under Consumer Cyclical sector & trades as “MAT” ticket at Nasdaq. In the previous article, MAT expected to extend lower in […]