-

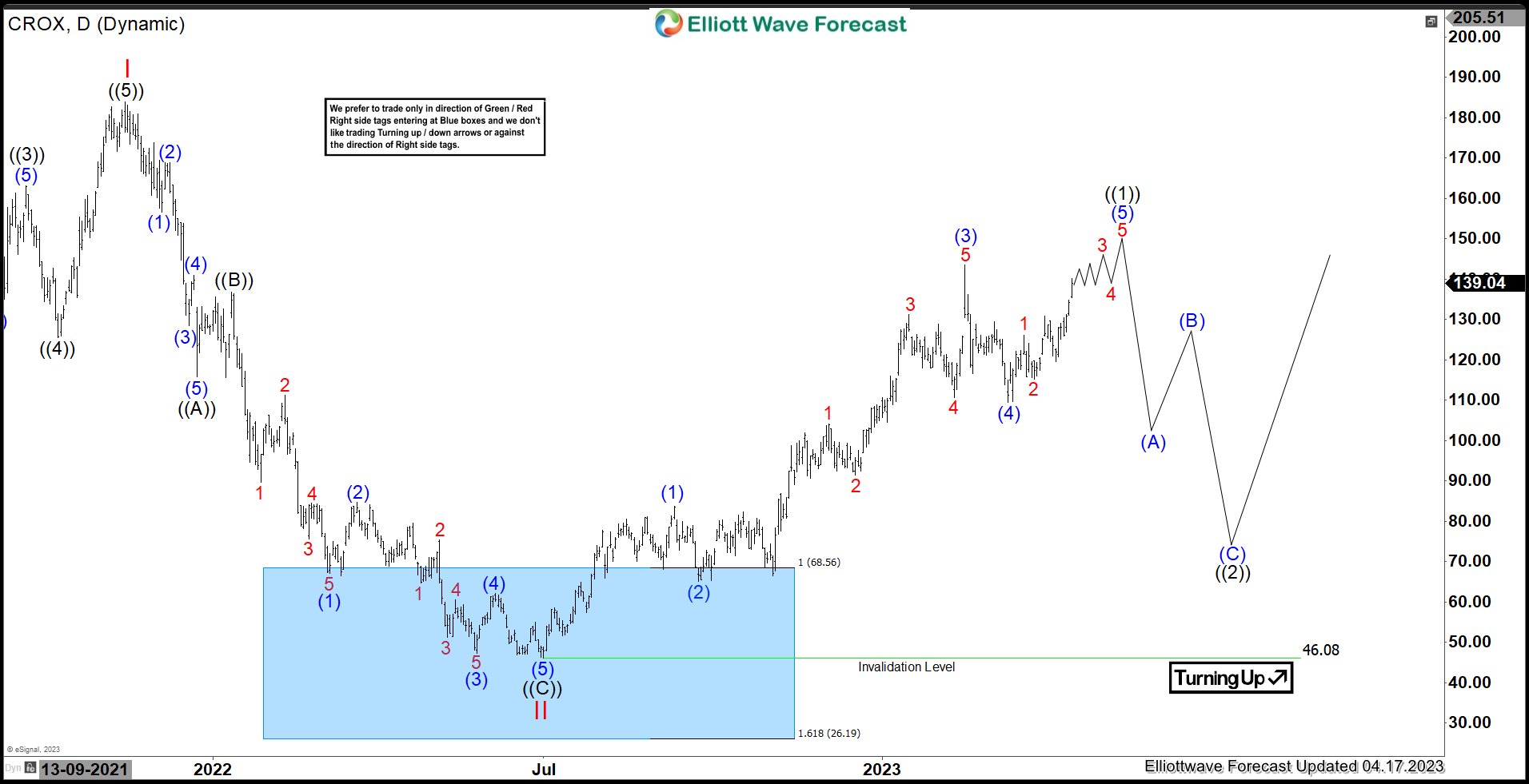

CROX Reacted Higher From Blue Box Area & Favors Upside

Read MoreCrocs Inc., (CROX) designs, manufactures, markets & distributes casual lifestyle footwear & accessories for men, women & children worldwide. The company sells its products in approximately 85 countries through wholesalers, retail stores, e-commerce sites & third-party marketplaces. It is based in Colorado, US, comes under Consumer Cyclical sector & trades as “CROX” ticker at Nasdaq. […]

-

Elliott Wave Sequence Suggests GBPUSD Favors Higher & Remain Supported

Read MoreGBPUSD ended 5 wave impulse Elliott Wave sequence as wave 1 of (C) at 1.2525 high on 4/04/2023 started from 3/08/2023 low. It already confirmed higher high sequence against September-2022 low, calling for further upside to continue in wave (C). It placed ((i)) of 1 at 1.2204 high & ((ii)) at 1.2009 low. ((ii)) was […]

-

CL_F (Crude Oil) Looking To Complete Impulse Elliott Wave Sequence Before Pullback Starts

Read MoreCL_F (Crude Oil) favors higher in 5 wave Impulse Elliott Wave sequence as wave 1 before pullback starts. It placed (B) at $64.12 low on 3/20/2023. Above (B) low, it placed ((i)) at $71.67 high & ((ii)) at $66.82 low. ((ii)) was 0.618 Fibonacci retracement of ((i)). It favored ended ((iii)) at $81.81 high on […]

-

TSLA (TESLA) Favors Further Downside

Read MoreTSLA Showing impulse Elliott Wave sequence as ((1)) higher started from 1/06/2023 low, which ended at $217.82 high on 2/16/2023. Below $217.82 high, it favors pullback in 7 or 11 swings correction in ((2)) against January low before upside resumes. It placed (W) of ((2)) at $163.91 low & (X) connector at $208 high on […]

-

DXY (US Dollar) Elliott Wave Sequence Favors Lower

Read MoreDXY (US Dollar) Showing 5 swings impulse Elliott wave sequence lower from the 3/08/2023 high, which ended at $101.415 low on 4/05/2023. Above there, it favors a corrective bounce in 3, 7 or 11 swings before downside resumes. DXY proposed ended (B) at $105.883 high on 3/08/2023. Below there, it placed ((i)) at $103.484 low […]

-

Bank of Montreal (BMO) Favors Correcting Lower

Read MoreBank of Montreal (BMO) provides diversified financial services primarily in North America. The company’s personal banking products & services include checking & savings accounts, credit cards, mortgages, financial & investment advice services & commercial banking products & services. It is based in Montreal, Canada, comes under Financial services sector & trades as “BMO” at NYSE. […]