-

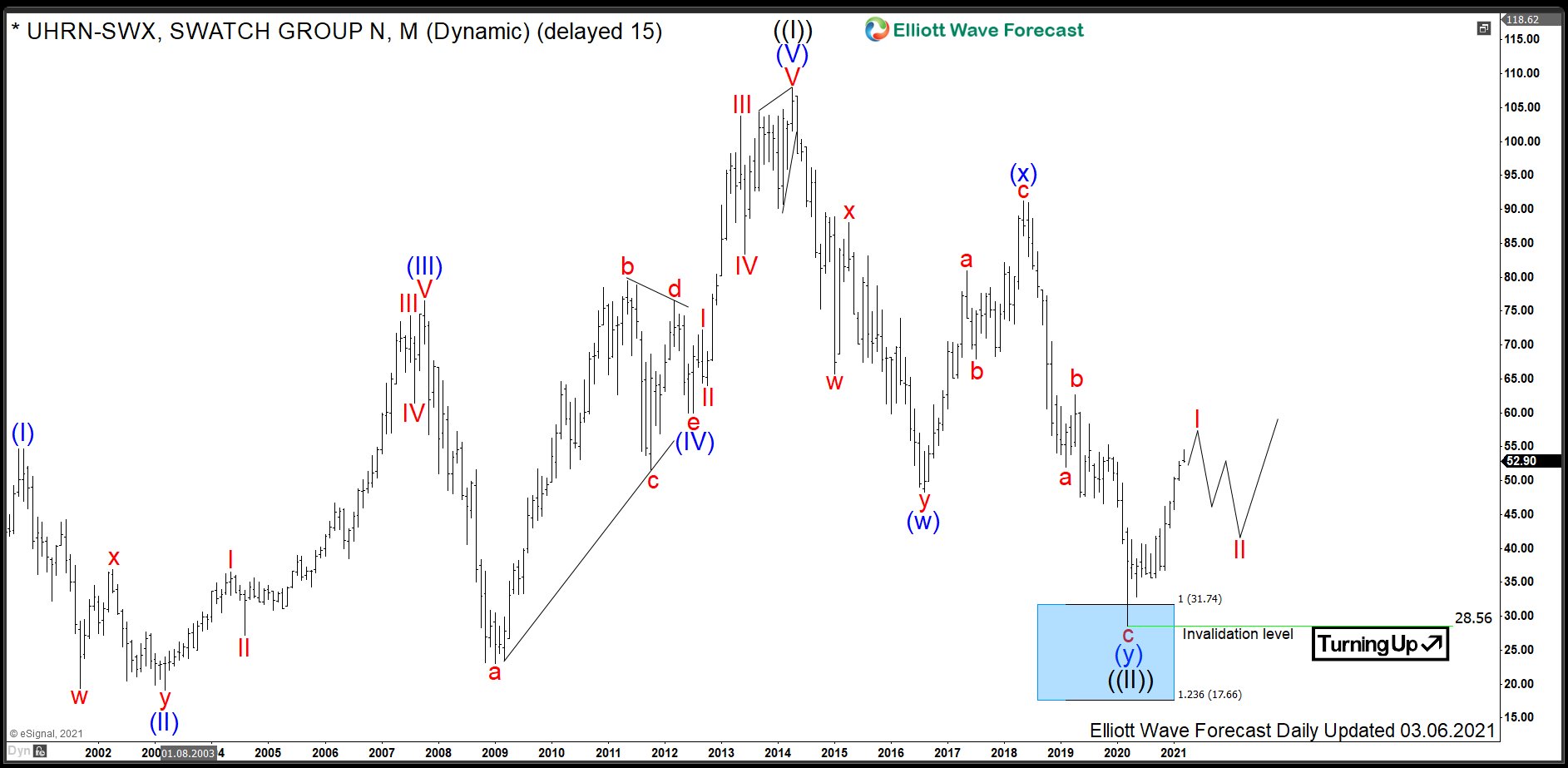

$UHRN : Swatch Group Started a New Larger Cycle Higher

Read MoreSwatch Group is a Swiss manufacturer of watches and jewellery. Besides the product line Swatch, the group owns brands including Blancpain, Breguet, ETA, Glashütte, Omega, Longines, Tissot, Hamilton, Certina, Rado and Harry Winston. As a matter of fact, the Swatch company employs about 36000 people in over 50 countries. Founded 1983 and headquartered in Biel/Bienne, […]

-

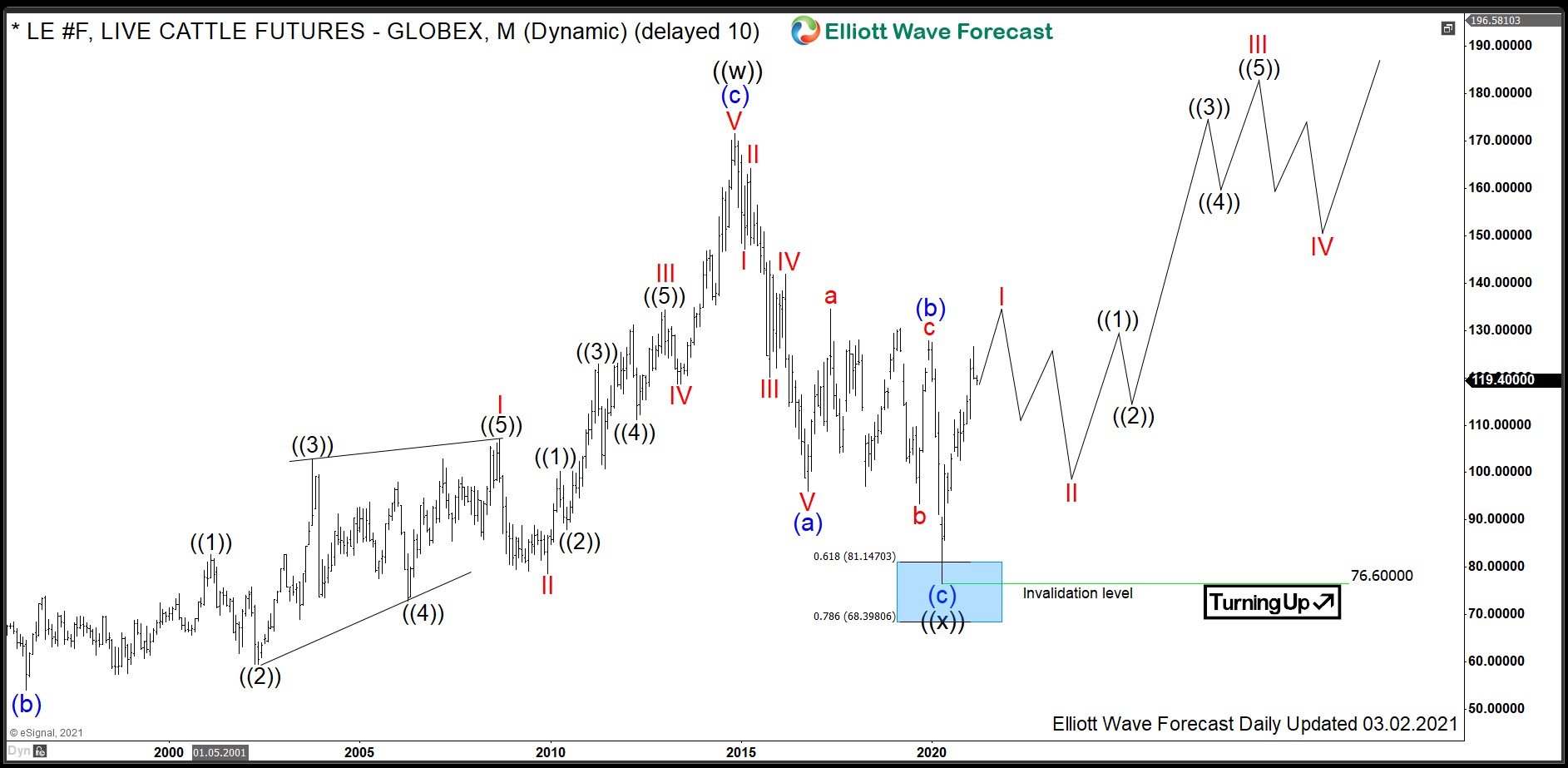

LE #F: Meat Prices to Double as Live Cattle Prices Rally

Read MoreLive Cattle is a livestock commodity within the agriculture asset class, along with lean hogs, feeder cattle and porc cutouts. Once the feeder cattle have reached the target weigh of 1050-1500 pounds, they can be referred to as fed or live cattle. One can trade Live Cattle futures at Chicago Board of Trade in contracts […]

-

$CSGN : Credit Suisse Turning Higher after Two Decades

Read MoreCredit Suisse is a global wealth manager, invetsment bank and financial services provider. It is one of the nine bulge bracket banks. Founded 1856 and headquartered in Zurich, it can be traded under tickers $CSGN at Six Swiss Exchange and $CS at New York Exchange. After printing the all-time highs in August 2000 at 89.38, […]

-

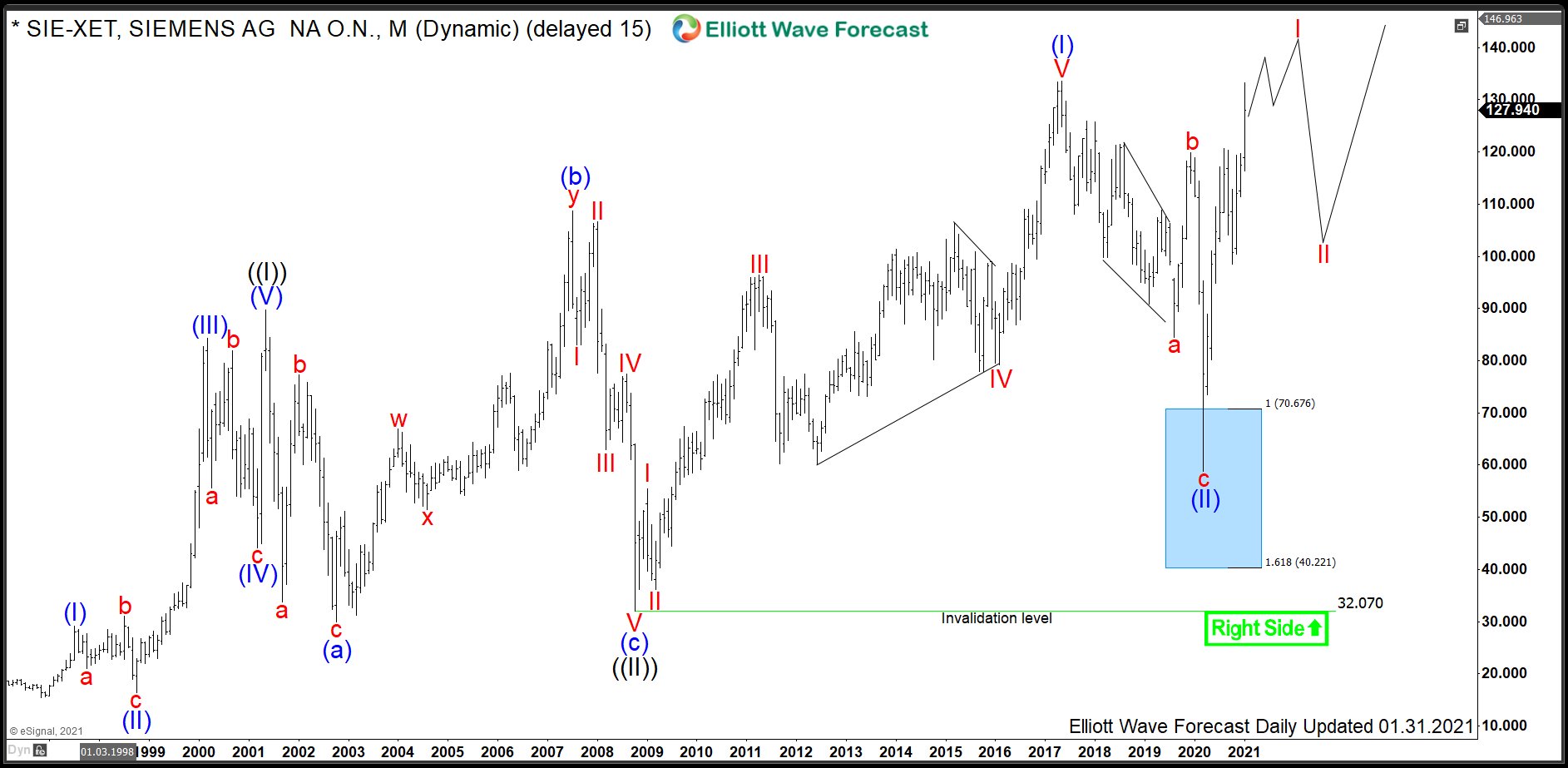

$SIE : Manufacturing Giant Siemens Should Continue Rally

Read MoreSiemens SE is a German multinational conglomerate company and by revenue the largest industrial manufacturing enterprise in Europe. Company’s principal business divisions are Industry, Energy, Healthcare, Infrastructure & Cities. Founded in 1847 and headquartered in Munich, Germany, the company employs approx. 385’ooo people worldwide. Siemens is a part of both DAX30 and of SX5E indices. […]

-

$CON : Automotive Parts Manufacturer Continental to Accelerate Higher

Read MoreContinental is a German multinational automotive parts manufacturing company. It is specializing in brake systems, interior electronics, tachographs, automotive safety, powertrain and chassis components, tires and other parts for the automotive and transportation industries. Founded in 1871 and headquartered in Hanover, Germany, Continental is a part of DAX30 index. From the all-time lows, the stock […]

-

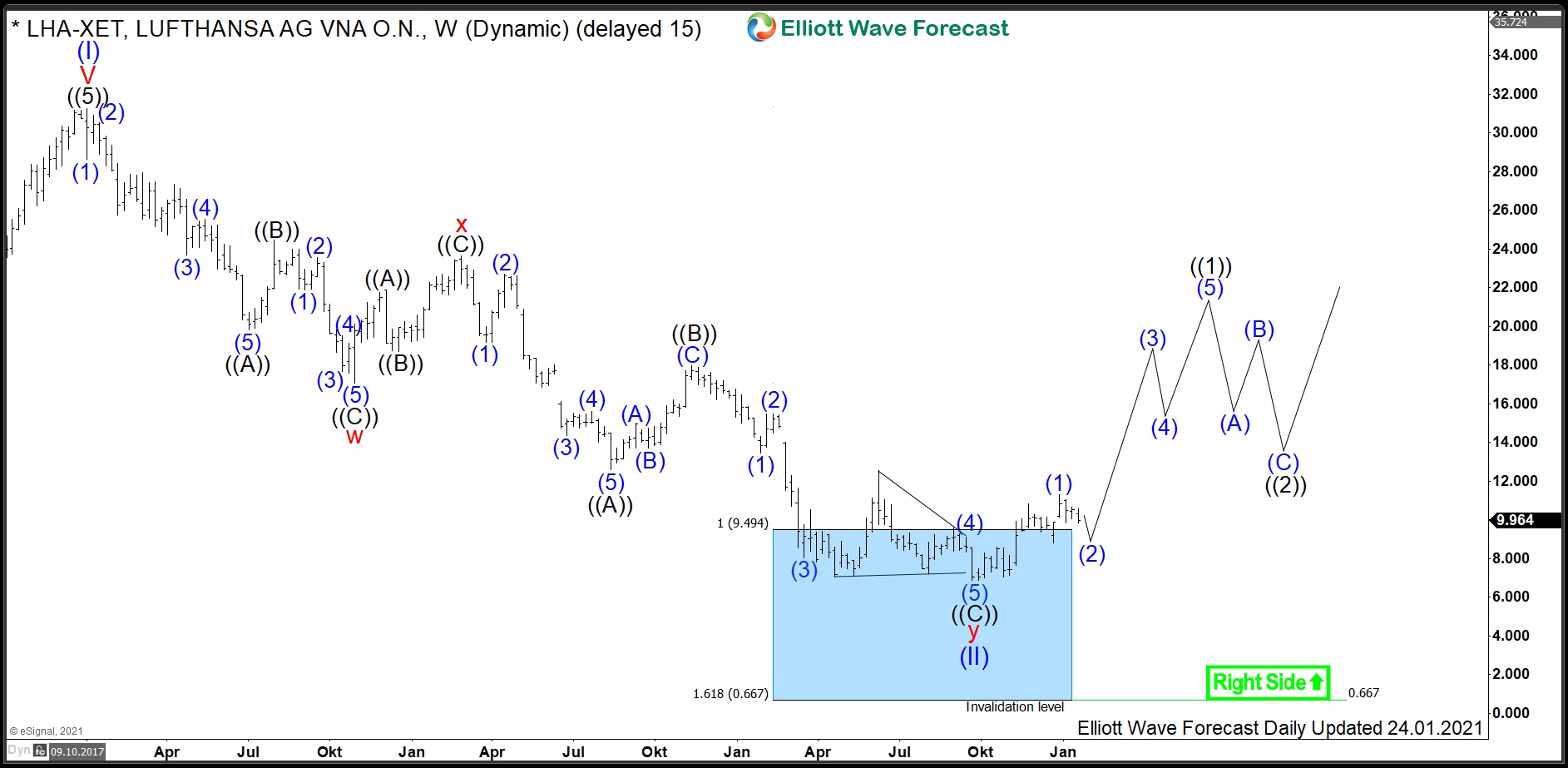

$LHA : Lufthansa Ramping Up Despite Lockdowns

Read MoreDeutsche Lufthansa AG is the largest German airline and behind Ryanair the second largest company in Europe in terms of the number of passengers. Founded in 1926 and headquartered in Cologne, Germany, it can be traded under the ticker $LHA at XETRA in Frankfurt. Besides its own services, Lufthansa owns Austrian Airlines, Swiss International Airlines, Brussels […]