-

$KER: Luxury Goods Stock Kering Provides a Buying Opportunity

Read MoreKering is a French multinational luxury goods company. Headquartered in Paris, Kering was founded 1963 as Pinault S.A. The company controls and manages 3 prestigious brands: Gucci, Yves Saint Laurent and Bottega Veneta. Kering is a part of CAC40 index. Investors can trade it under the ticker $KER at Euronext Paris. Kering Monthly Elliott Wave […]

-

$EDF: French Electric Utility Stock EDF in Buying Area

Read MoreÉlectricité de France S.A. (literally, Electricity of France), commonly known as EDF, is a French multinational electric utility company. The operations include electricity generation and distribution, power plant design, construction and dismantling, energy trading and transport. Founded in 1946 and headquartered in Paris, France, the company is largely owned by the French state. EDF is a part […]

-

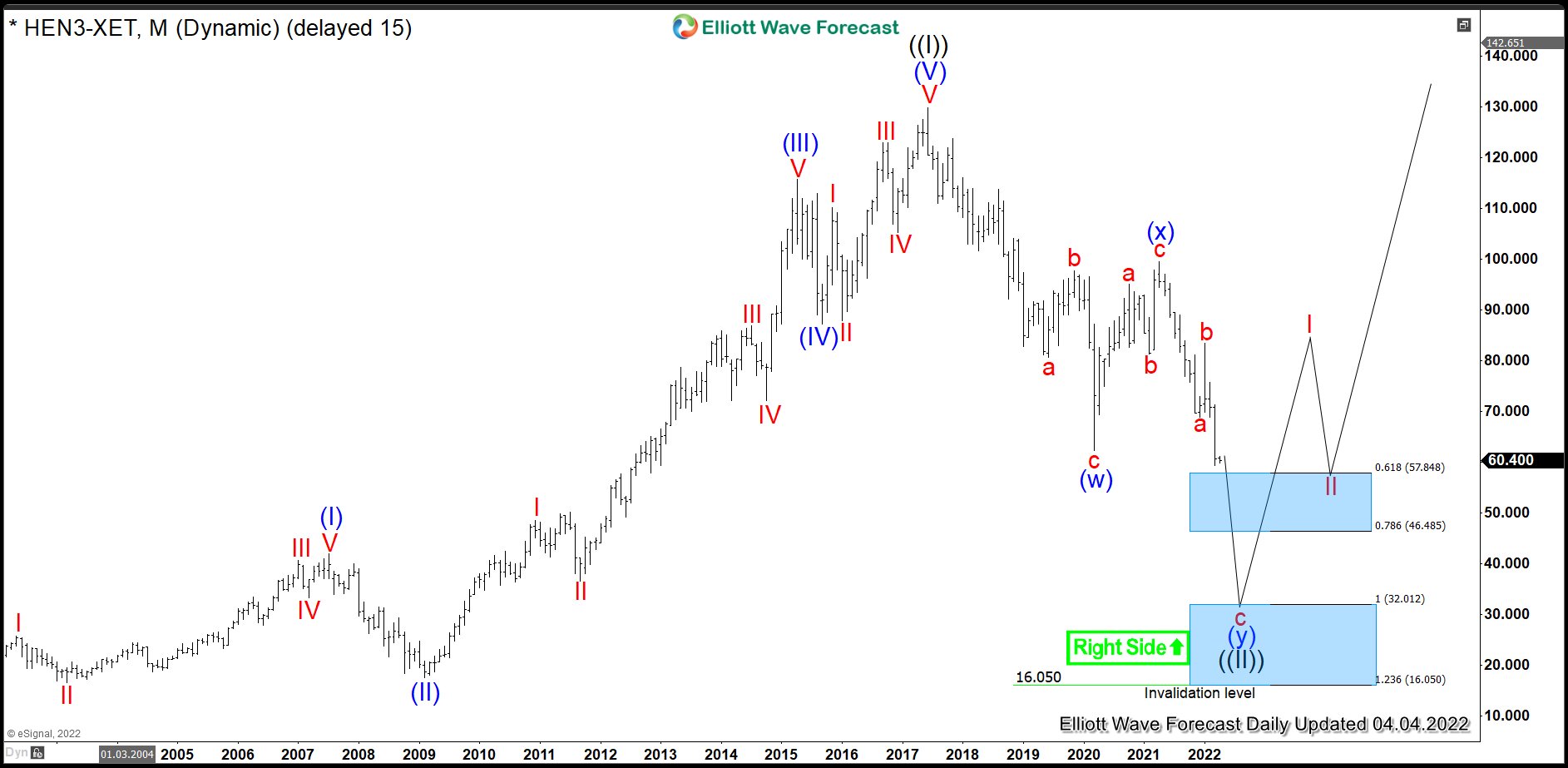

$HEN3: Bearish Sequence in Henkel Provides an Opportunity

Read MoreHenkel AG & Co. KGaA is a German chemical and consumer goods manufacturer known for such brands like Persil, Fa, Pritt, Dial, Purex and Loctite. Founded 1876 and headquartered in Düsseldorf, Germany, the company has three globally operating business units: Laundry & Home Care, Beauty Care, Adhesive Technologies. Investors can trade it under the tickers $HEN […]

-

$UFI: Textile Stock Unifi to Accelerate Higher from Buying Area

Read MoreUnifi Inc. is a global textile solutions provider based in Greensboro, North Carolina, USA. The stock being a component of the Russel3000 index can be traded under ticker $UFI at NYSE. Unifi is one of the world’s leading innovators in manufacturing synthetic and recycled performance fibers. The company is in a possession of proprietary technologies and […]

-

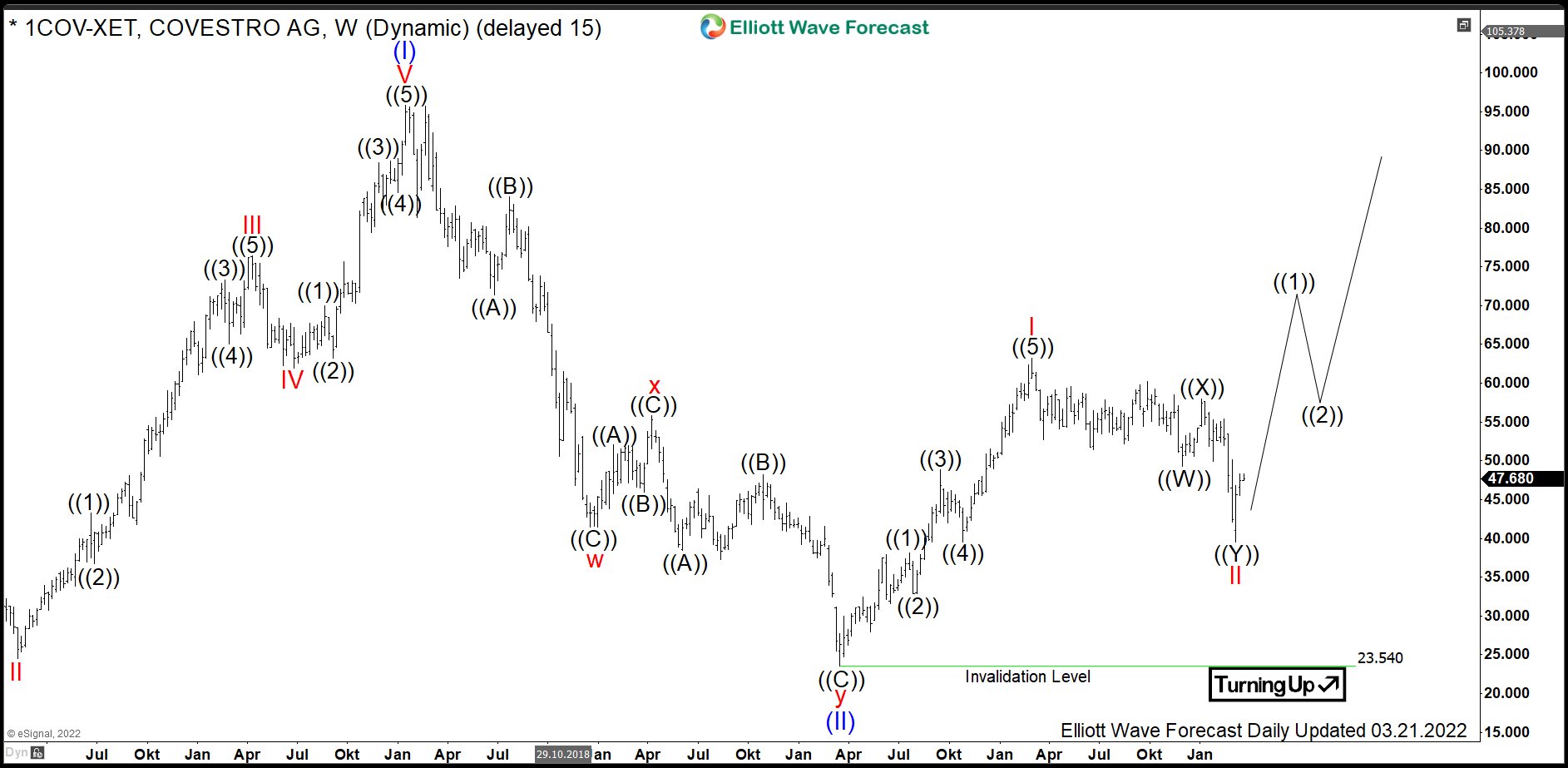

$1COV: Buying Material Science Stock Covestro in Pullback

Read MoreCovestro AG (formerly, Bayer MaterialScience) is a German company which produces a variety of polycarbonate and polyurethane based raw materials. The products include coatings and adhesives, polyurethanes for thermal insulation and electrical housings, polycarbonate based highly impact-resistant plastics (Makrolon) and more. Formed in 2015 as a spin off from Bayer, Covestro is headquartered in Leverkusen, […]

-

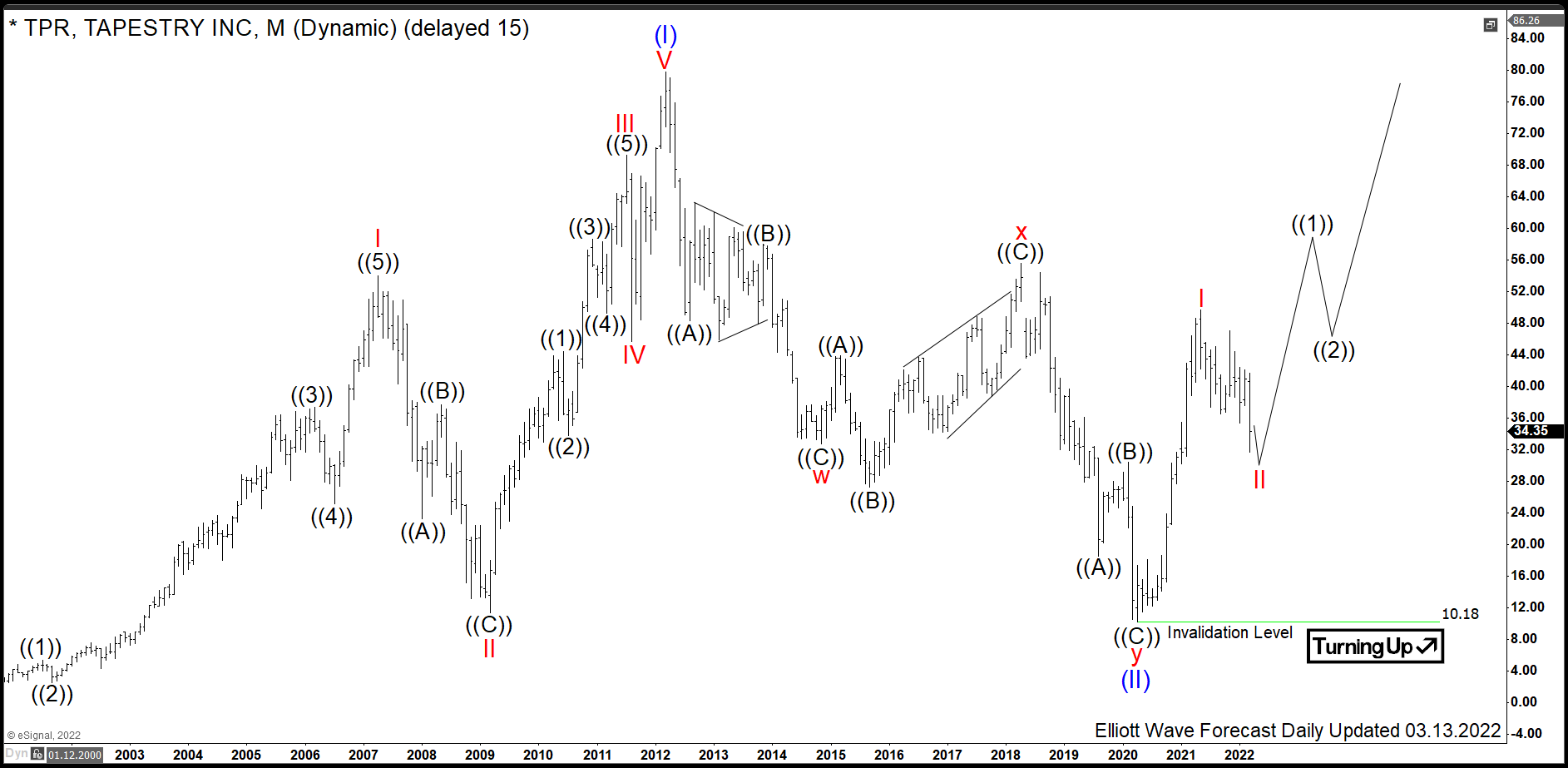

$TPR: Luxury Fashion Stock Tapestry Offers an Opportunity

Read MoreTapestry, Inc. (formerly: Coach, Inc.) is a multinational luxury fashion holding company based in New York City, USA. The parent company owns three brands: Coach New York, Kate Spade New York and Stuart Weitzman. The stock of the company being a component of the S&P500 index can be traded under ticker $TPR at NYSE. Currently, […]