-

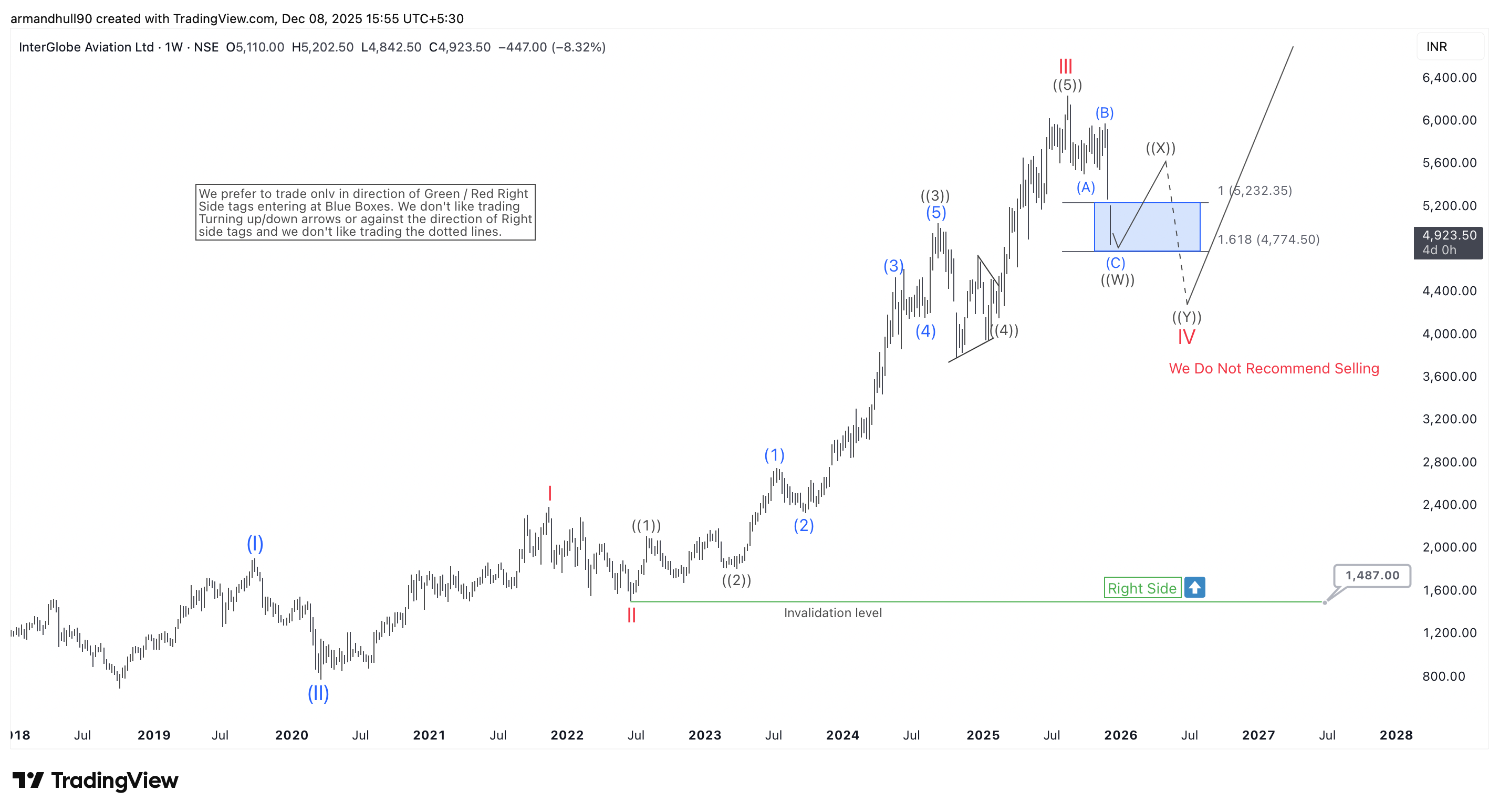

Has IndiGo Finished Its Pullback? Wave V Rally Next?

Read MoreA detailed weekly Elliott Wave analysis of IndiGo highlighting the Wave IV blue-box zone, right-side bullish outlook, and long-term upside potential. InterGlobe Aviation Ltd (NSE: INDIGO) remains in a strong long-term uptrend. The weekly chart shows a clean Elliott Wave structure that supports this view. The stock recently completed a higher-degree Wave III near the […]

-

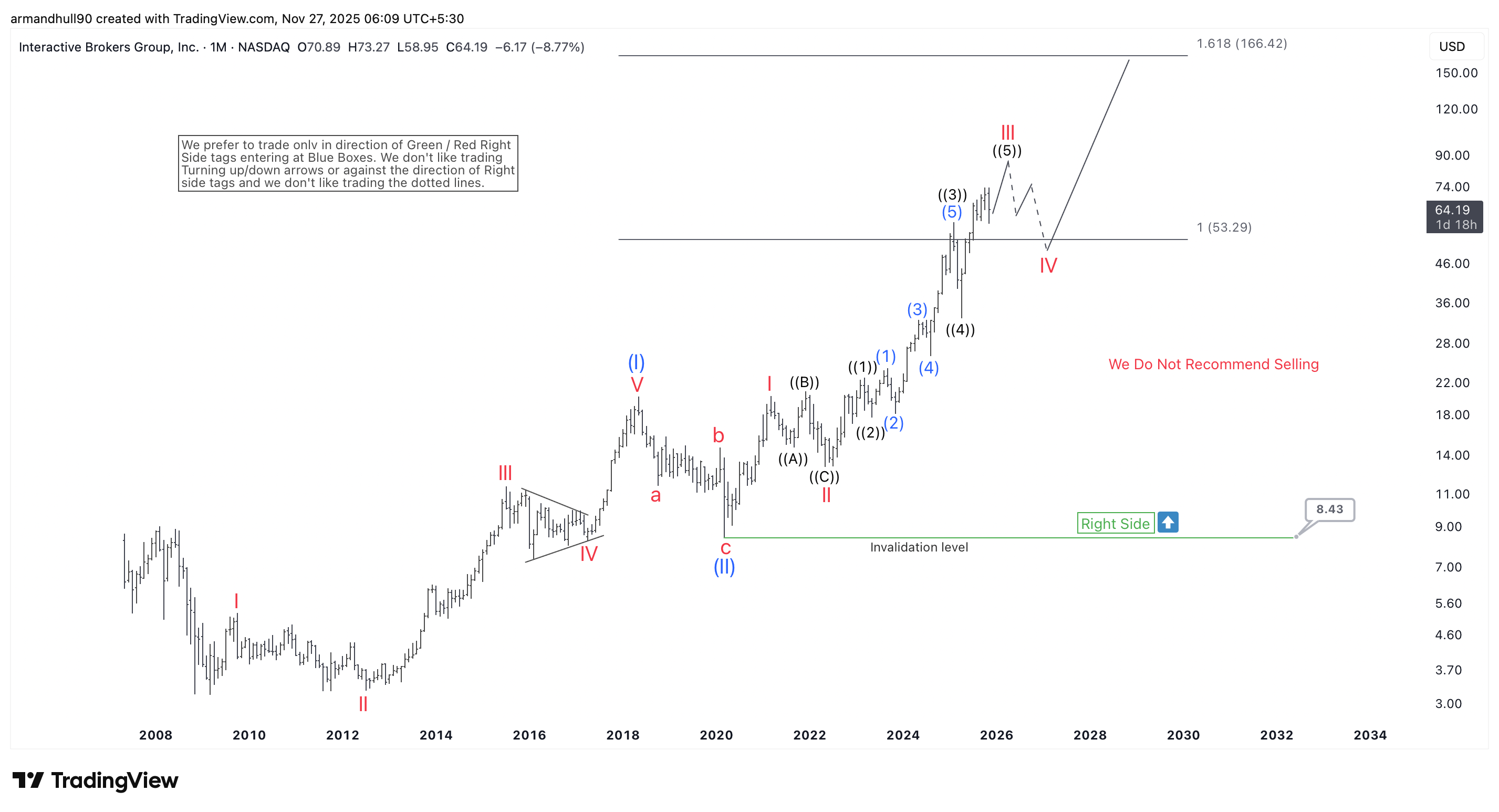

IBKR Wave Forecast: Wave III Targets 86 Next, With Long-Term Bullish Aim Toward 166

Read MoreIBKR advances in a powerful Wave III structure, with Fibonacci projections pointing toward 86 in the near term and a long-term target of 166 USD—while maintaining bullish validation above 8.43. Interactive Brokers Group (NASDAQ: IBKR) continues to maintain a resilient bullish structure, supported by a clear Elliott Wave progression. The stock has recently completed a […]

-

Chennai Petroleum Corporation Limited (NSE: CHENNPETRO) Elliott Wave Analysis: Bullish Cycle Poised to Continue

Read MoreWave (III) Set to Unfold as Chennai Petroleum Targets New Highs in the Next Bullish Cycle. Chennai Petroleum Corporation Ltd (NSE: CHENNPETRO) shows a strong long-term bullish setup on its monthly Elliott Wave chart. The price completed a clear five-wave advance, forming wave (I), followed by a deep correction in wave (II). This correction ended […]

-

NXP Semiconductors (NXPI) Elliott Wave Outlook: Wave (III) Targets Massive Upside Potential

Read MoreNXP Semiconductors N.V. (NASDAQ: NXPI) shows a strong long-term bullish setup according to Elliott Wave analysis. The monthly chart suggests that the stock completed a large corrective structure and has now entered a new bullish phase. The company, a key global player in the semiconductor industry, appears ready to extend its uptrend as long as […]

-

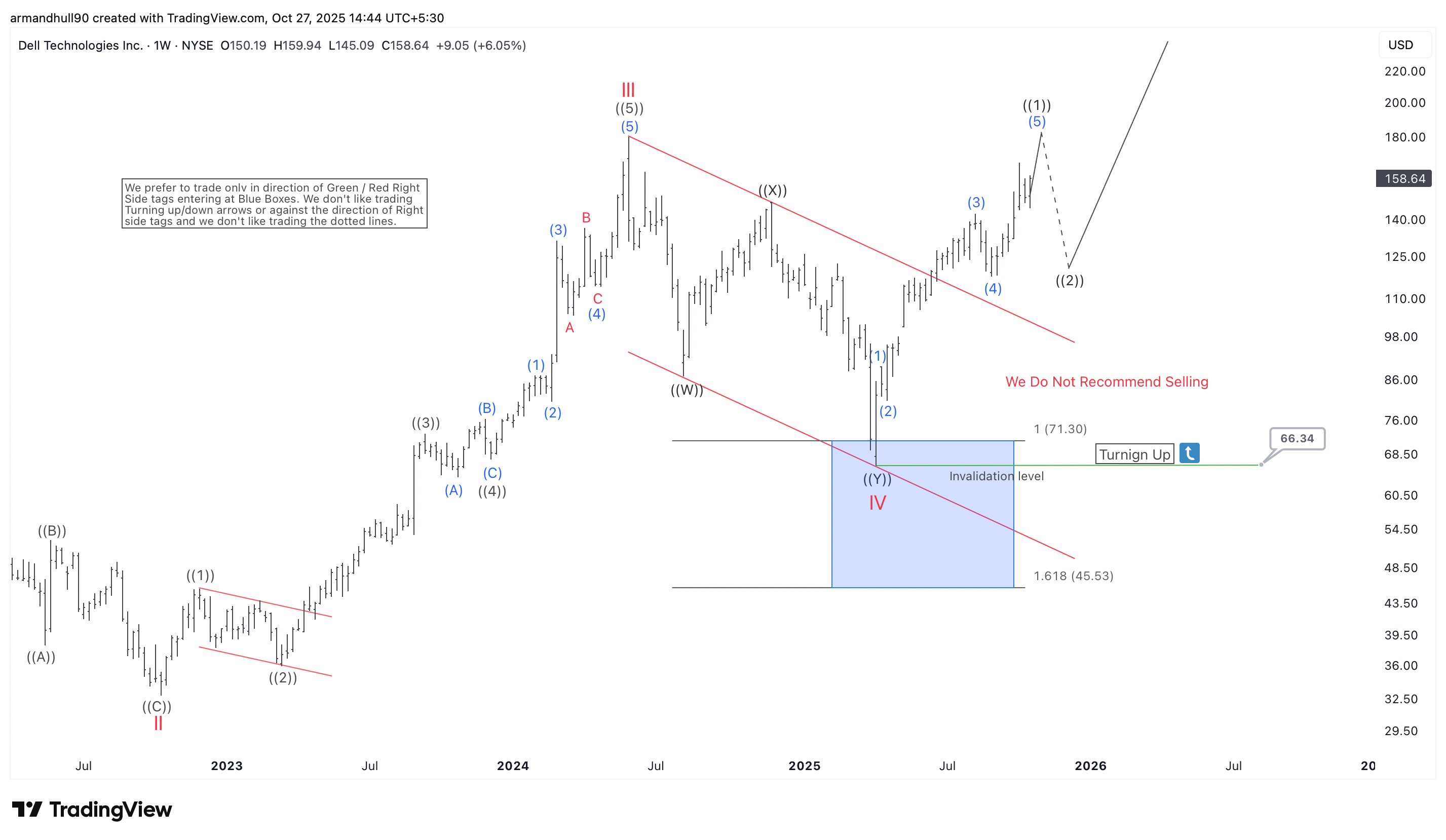

Dell Technologies Elliott Wave Analysis: Wave IV Completion Signals Start of a New Bullish Cycle

Read MoreAfter completing a three-leg correction within the blue box and breaking out of the red channel, Dell Technologies (NYSE: DELL) resumes its next impulsive bullish phase. Dell Technologies (NYSE: DELL) shows a strong Elliott Wave structure on the weekly chart, suggesting that a long-term uptrend is in progress. The larger count reveals that the stock […]

-

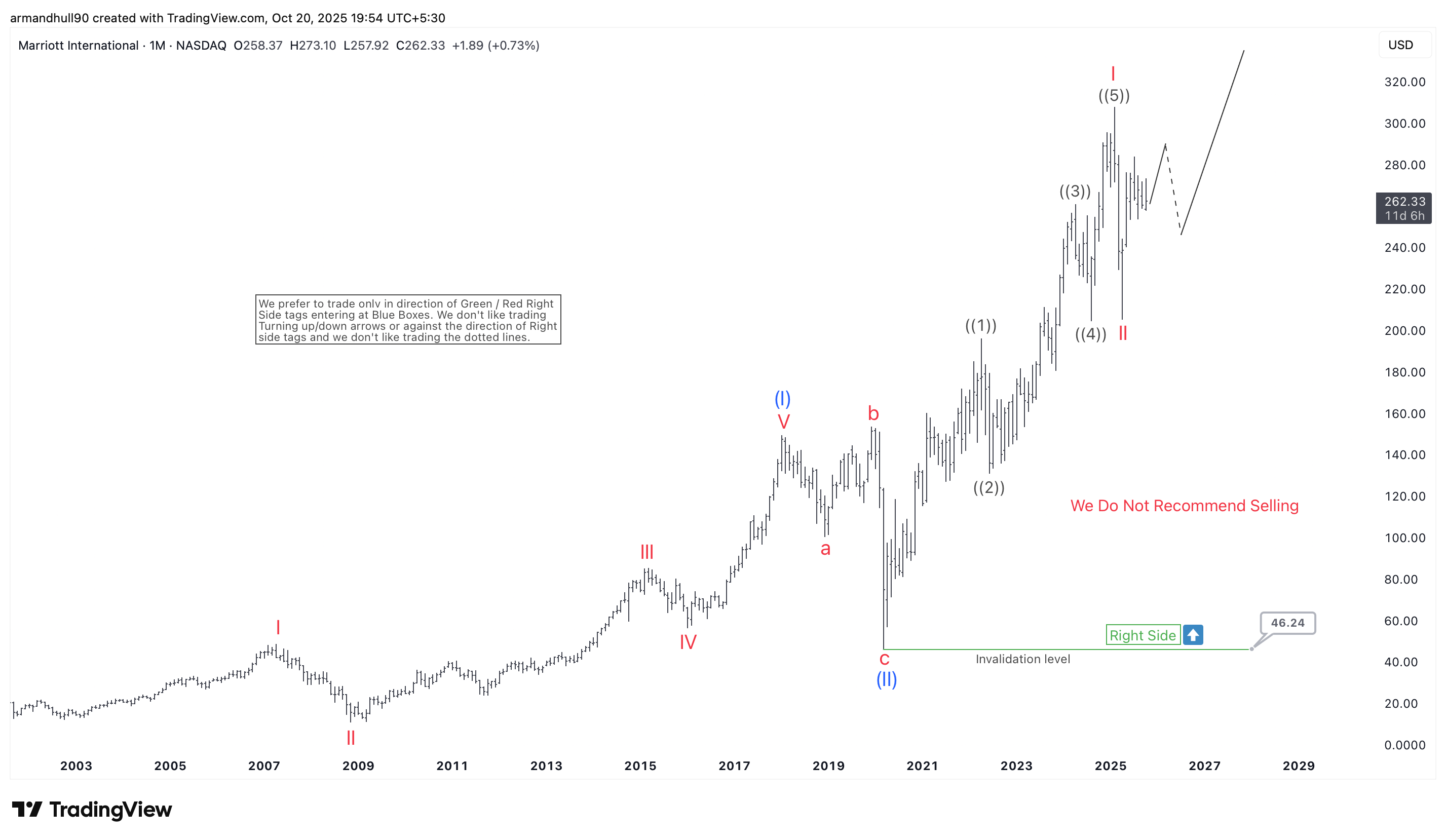

Marriott International (MAR) Elliott Wave Analysis: Strong Bullish Outlook Ahead

Read MoreMarriott International Inc. (NASDAQ: MAR) shows a strong long-term bullish setup based on Elliott Wave analysis. The monthly chart indicates that the company has finished a major correction and started a new upward cycle. The structure suggests that Marriott may continue rising in the coming years as global travel demand stays strong. The rally from […]