-

BP Cycles and Elliott Wave from February 2016

Read MoreBP Cycles and Elliott Wave from February 2016 Firstly I would like to mention the data I have on the BP stock goes back to around 1968 when prices were ranging around in between 1 & 2 dollars. The stock price rose until the November 2007 highs. There it ended a cycle up from the […]

-

Ishares Silver Trust (SLV) Larger Cycles and Elliott Wave

Read MoreIshares Silver Trust (SLV) Larger Cycles and Elliott Wave Firstly as seen on the weekly chart shown below. There is data back to when the ETF fund was started in 2006. Data suggests the fund made a low in 2008 that has not been taken out in price. There is no Elliott Wave count on […]

-

CGC Canopy Growth Corporation Wave Analysis

Read MoreCGC Canopy Growth Corporation Wave Analysis Firstly I would like to mention the Canopy Growth Corporation stock began trading on the NYSE last year due to legal reasons. That said I am not going to talk about any fundamentals or financials of the stock. I do think the stock is bullish although this view I present […]

-

IYF Flat from the January 29, 2018 highs

Read MoreIYF Flat from the January 29, 2018 highs The iShares US Financials ETF, symbol IYF appears to be a flat correction lower from the January 29, 2018 highs. It has been persistent and strong enough to suggest it is correcting the bullish cycle up from the February 11, 2016 lows. At this point in time […]

-

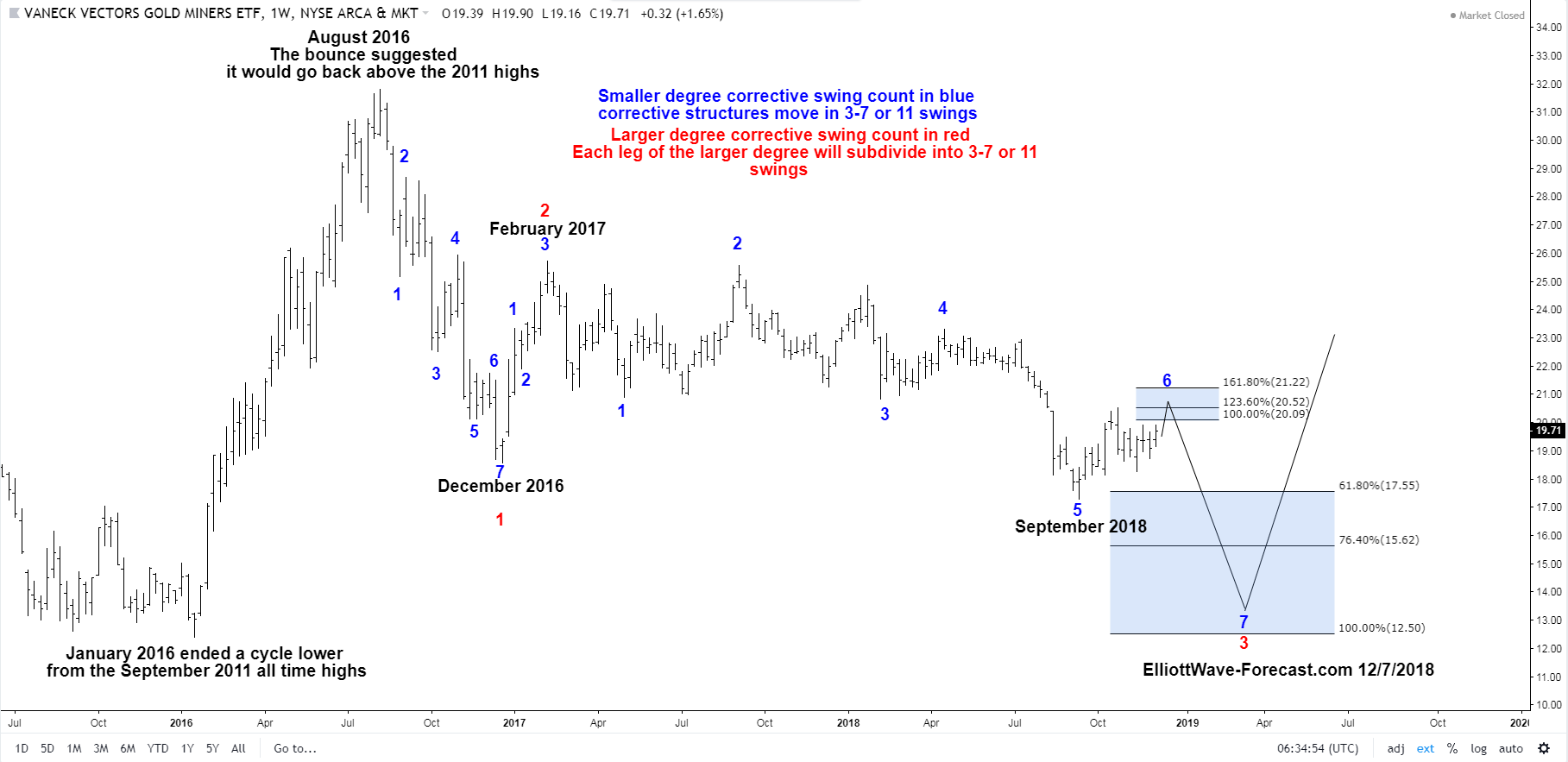

GDX Cycles from the January 2016 Lows

Read MoreGDX Cycles from the January 2016 Lows Firstly, the GDX ETF was created in 2006. From there it bounced higher into the September 2011 highs. This not shown on the chart however the price trend was obviously up. The pullback lower into the January 2016 lows corrected the cycle from the all time highs. The […]

-

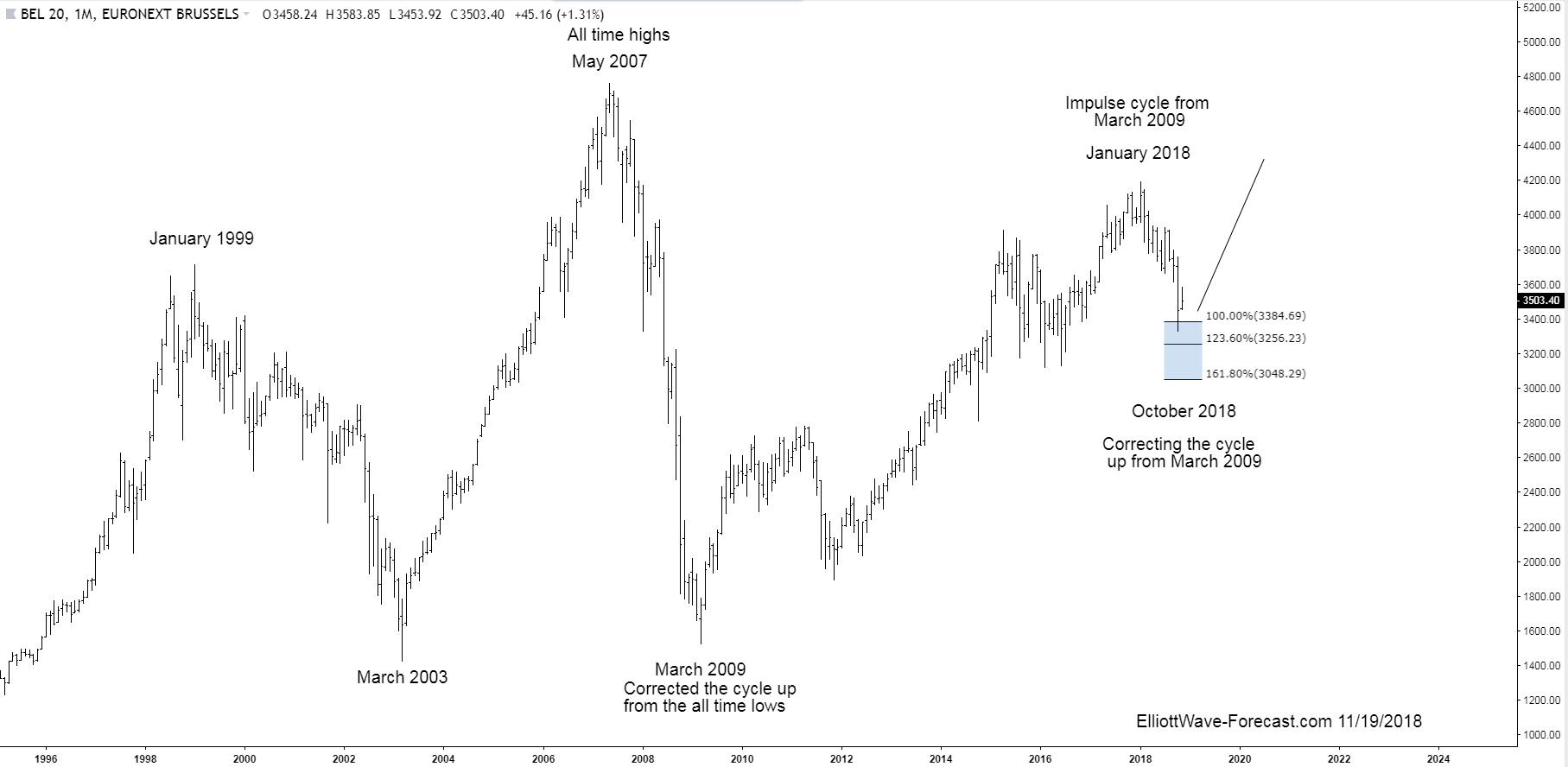

The BEL20 Index Long Term Bullish Trend and Cycles

Read MoreThe BEL20 Index Long Term Bullish Trend and Cycles Firstly, the BEL20 Index has trended higher with other world indices since the benchmark was established. The index remained in a long term bullish trend cycle into the May 2007 highs. From there it made a sharp correction lower that lasted until March 2009 similar to other […]