-

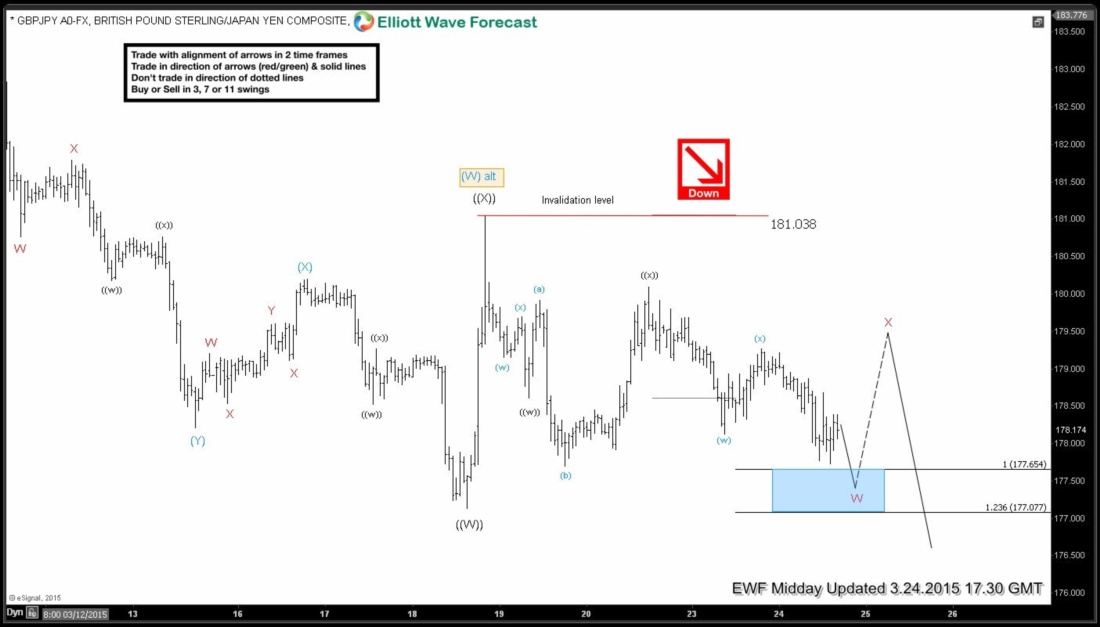

GBPJPY Short-term Elliott Wave Analysis 3.24.2015

Read MorePreferred Elliott Wave view suggests pair formed a secondary peak @ 181.03 and bounces are now expected to hold below this high for continuation lower. Decline from 181.03 peak is taking the form of a double three or ((w))-((x))-((y)) Elliott Wave structure when pair is currently in final leg of wave ((y)). Area between 177.65 […]

-

5 wave move in Elliott Wave Theory

Read MoreIn this video we take a look at 5 wave structure. We take a look at rules to label a move as an impulse and also highlight the fact that wave 1, 3 and 5 of an impulse need to further sub-divide in 5 waves and wave 5 should provide divergence in RSI with respect […]

-

$DAX Short-term Elliott Wave Analysis 3.17.2015

Read MorePreferred Elliott Wave view suggests rally to 11455 completed wave (( w )) and dip to 11186 completed wave (( x )) as a FLAT correction. Wave ((y)) ended at the top and best reading of the cycles suggests that this pull back would turn out to be another wave ((x)) finding buyers in 3, 7 […]

-

Why people lose in Trading: Money Management

Read MorePoor money management is the reason why many traders end up losing even when they have access to a system with very good accuracy. In this video we talk about the importance of money management to success in trading, how to calculate the right position size, importance of risking the same percentage of capital on […]

-

AUDUSD Short-term Elliott Wave Analysis 3.10.2015

Read MoreBest reading of Elliott wave cycles suggests decline from 0.7914 ((X)) high is taking the form of a triple three structure. Triple three is an 11 swing structure labelled here as ((w))-((x))-((y))-((z)). Drop to 0.7748 completed wave ((w)), recovery to 0.7860 was wave ((x)), dip to 0.7696 was wave ((y)) and 2nd wave ((x)) is considered completed […]

-

Dynamics of a WXY Elliott Wave Structure

Read MoreIn this educational video, we are going to take a look at (W)-(X)-(Y) Elliott wave structure which is one of the most important structures in the market. It is a 7 swing Elliot Wave structure and is commonly known as a double zig-zag but we would like to point out that every (W)-(X)-(Y) structure is […]