-

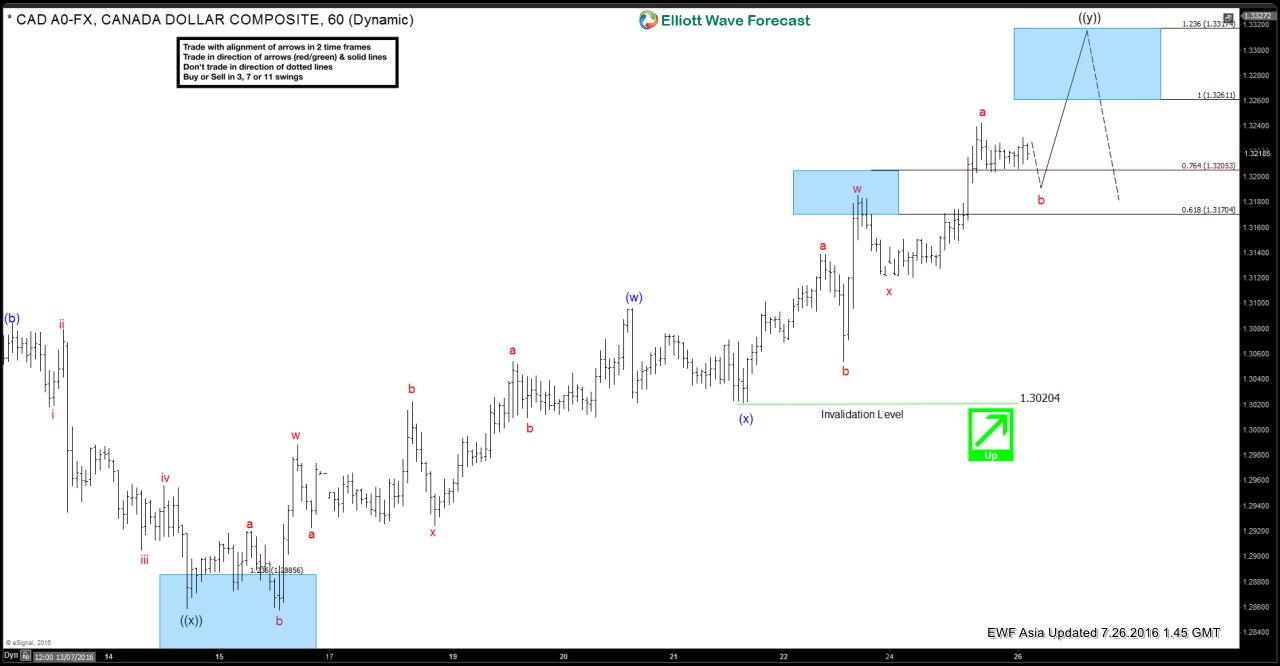

USDCAD Short-term Elliott Wave Analysis 7.26.2016

Read MorePreferred Elliott wave count suggests that move up from 1.2828 low is proposed to be unfolding as a triple three structure. 1.2828 where wave ((w)) ended at 1.3139, wave ((x)) ended at 1.28579 and wave ((y)) higher is now in progress towards 1.3261 – 1.3317 area before pair pulls back lower in 2nd wave ((x)) to […]

-

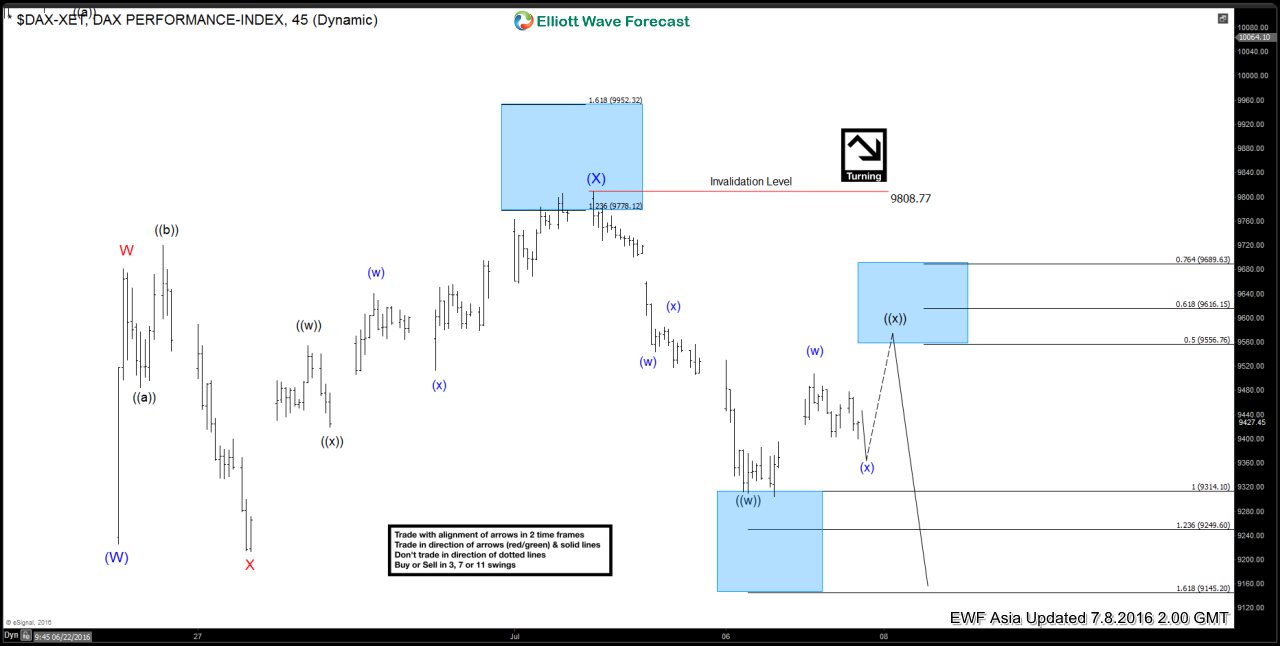

DAX Short-term Elliott Wave Analysis 7.8.2016

Read MoreShort term Elliottwave structure suggests Index ended wave X bounce at 10340. Decline from there is unfolding as a double correction where wave (W) ended at 9226.15 and wave (X) bounce ended at 9808.77. Near term wave ((w)) is proposed complete at 9310, and wave ((x)) bounce is in progress to correct the decline from 9808.77 in 3, 7, or […]

-

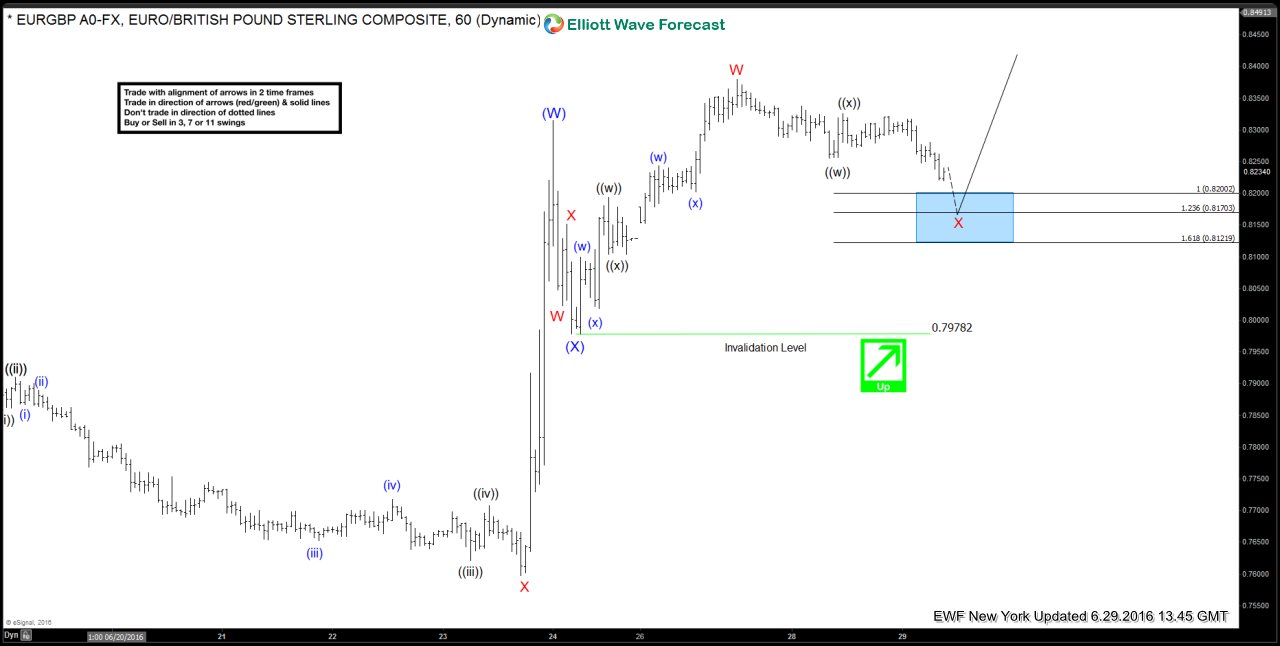

EURGBP Strategy Of The Day (6/27/2016)

Read MoreHere is Strategy Of The Day presented to clients on 6/27/2016. Long EURGBP 6/27/2016 EURGBP is showing an incomplete bullish sequence up from July 2015 and also from May 2016 lows which means the sequence is bullish against 0.7978 (6/24) low and against 0.7563 (5/25) low. Therefore, our strategy is to buy dips in 3, […]