The phrase “Sell in May and go away” originated in England in 1776, more specifically in London’s financial district. The full version of the saying was “Sell in May and go away, come back on St. Leger’s Day,” referring to the St. Leger’s Day horse race (September 15th). This adage got famous in 1930s. It is based on the historical pattern that stocks tend to underperform from May to October compared to the other half of the year. The pattern was popularized by the Stock Trader’s Almanac.

But how reliable is to sell in May each year and return at the end of September to buy? Is the market underperforming in this period of time or are we losing buying opportunities? In this article we are going to reveal if this saying remains or has become an urban legend. We are going to analyze the results of the SP500 in 21st century in the period of time from May opening to September closing.

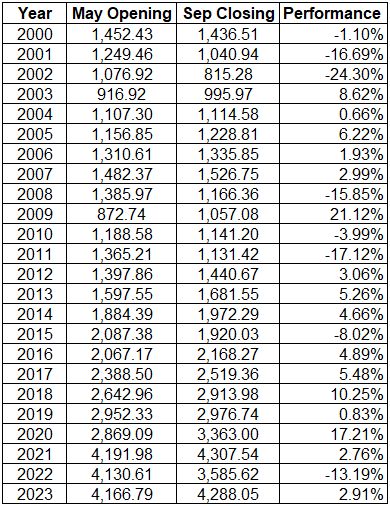

SP500 Performance Since May to October

We can see in the table above, the performance from 2000 to 2023 in the period of time where “sell in may” should work. In these 24 years, 8 years the SP500 underperformed and 16 years the market upperformed. Then, 33,33% of the time the market underperformed and 66.67% upperformed. It is pretty clear that the more than 200 year old adage “Sell in May and go away” is just an Urban Legend. Maybe in the past without the current technology worked, but in these times when machines trade and we can set orders in seconds do not work any more.

However, we can see that 7 year cycle is still intact. If you check the years 2001, 2008, 2015 and 2022, all those years the SP500 underperformed from May to October. Therefore, if the cycle of every 7 years is repeated, we can say that “Sell in May and go away” could be applied for 2029.

Elliott Wave Forecast

www.elliottwave-forecast.com updates one-hour charts 4 times a day and 4-hour charts once a day for all our 78 instruments. We do a daily live session where we guide our clients on the right side of the market. In addition, we have a chat room where our moderators will help you with any questions you have about what is happening in the market.

14 day Trial costs $9.99 only. Cancel anytime at support@elliottwave-forecast.com

Back