The major component stocks of XLF begin to report earnings for Q4 2018 the week of January 14th. This includes banking stocks such as C (reporting on 1/14/2019) and JPM (reporting on 1/15/2019). January 16th will see more banking stocks such as WFC, BAC, GS, and USB report. This brief explores the near-term price structure for XLF and therefore determines a directional bias for the sector leading into the reporting period. At EWF we map out cycles and sequences for 78 different trading instruments. The structure of these cycles and sequences is communicated to our subscribers via the language and construct of the Elliott wave theory.

The Current Pattern in XLF

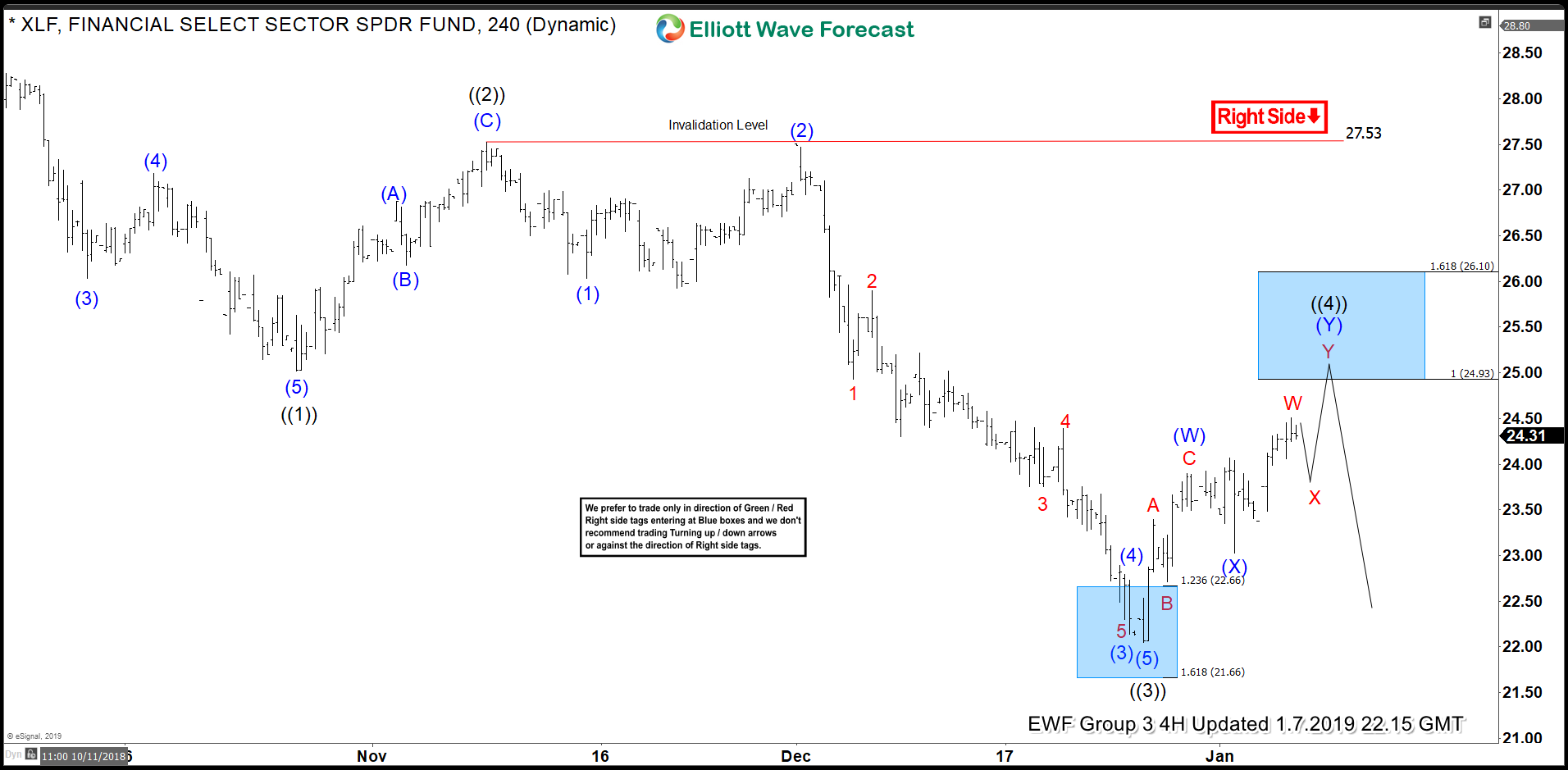

XLF 4 HR View of Primary Wave ((4)) Projection

XLF peaked on 1/29/2018 at $30.33 completing a cycle from its lows of 2009. We are and have been tracking the correction of that cycle from the 2018 high. XLF is proposed to be in a zigzag 5-3-5 corrective pattern from $30.33. The first five wave decline completed as a diagonal on 5/3/2018 at $26.46. The 3 in the (5-3-5) pattern ended its correction higher $29.07 on 9/20/2018. We now need five waves from $29.07 to finally call the corrective cycle complete from $30.33 as well as the sub-cycle from $29.10. Drilling down into the subwaves in the image above from the $29.07 we see three distinct swings lower. Consequently this leads us to conclude that we need one more swing lower to complete the five waves from $29.07. For that reason we are looking for XLF prices to turn lower in the near-term going into next week’s earnings reports.

Charting the corrective 3 wave expectations for this fourth wave we find we are near the area to expect a top. This ideal range is measured to be the $24.90-$26.10 area. Reaching this area while below the $27.53 high from 11/8/2018 should provide traders with another low risk entry area as the downside would be favored in the near-term. In plainer English we see price action to the upside to fail and consequently push down into the release of earnings for the major components of XLF.

Learning more about how we use Elliott wave to produce actionable analysis is now easier than ever. Check out our Free Educational Site on Elliott wave. More in depth learning can be found here at a discount for a limited time!

To your success!

James

EWF Analytical Team