Why trendlines?

One thing I’ve found through my past years as a trader and market analyst is the importance of using a trendline. These simple tools can really help make or break your trading, and often signal a larger move to come. I’ve met traders who ONLY use trendlines, and they have made massive profits just from this simple tool. For me it is a critical part of my trading process, so let’s cover how to use them.

What is a trendline?

A trendline is as simple as it sounds, just a line. This line placement can be important however, it usually goes along with a trend in the market, drawn across price highs or lows. A market trend is made of higher highs, and higher lows, and these trend-lines hope to track those as pictured below.

Here Nasdaq Futures are increasing from the 19th of April to the 11th of June, 2024. I drew two lines for this major trend. This upper line uses two pivots from May 31st to 01 July, and the other from 19 April to 31 May (lower trend line). For each trendline, the price started trading in a downward trend after breaking through these lines.

Characteristics of trendlines:

As per Kirkpatrick and Dahlquist in “

- Length of time the line is held

- A line that is held for a longer time period has more significance than one that is short.

- Number of tests

- A line with more price tests along it has more significance than one with only two tests, the minimum.

- Slope of the line.

- A line that is very steep is less significant than a line that is relatively flat or one that has a medium slope.

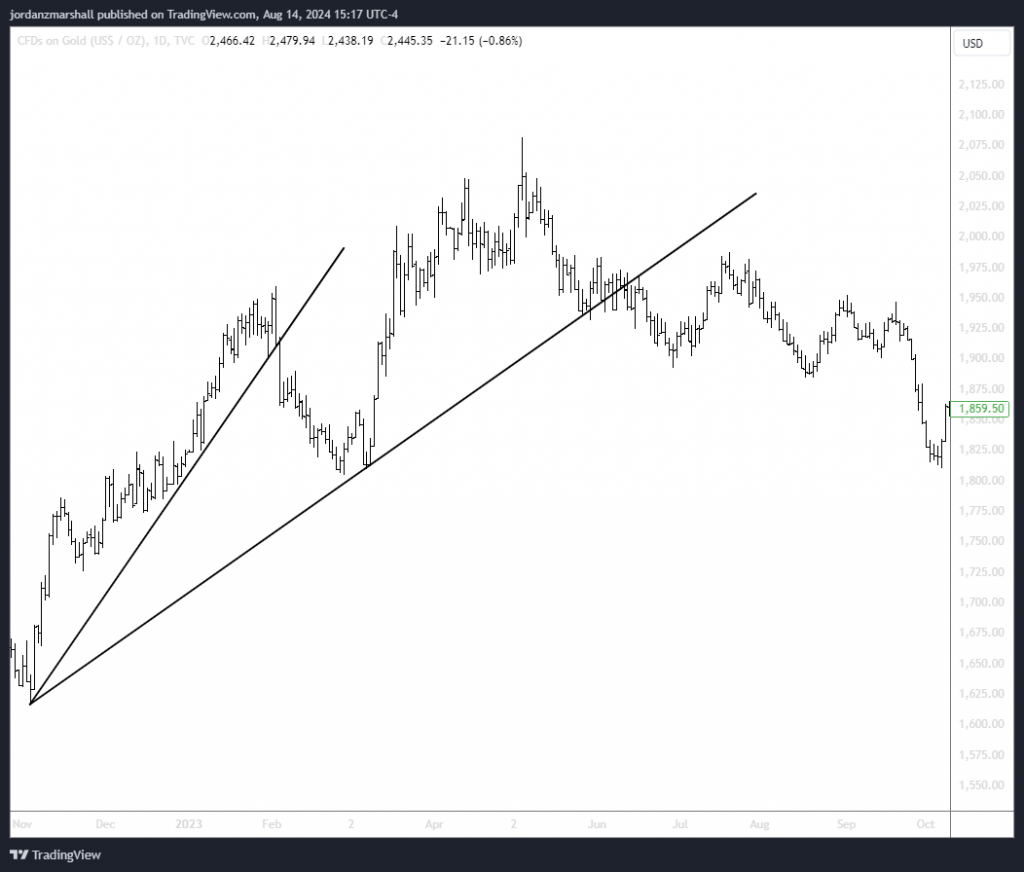

This chart here shows an excellent example:

The first trendline in GOLD from November 2022 shows only two tests and a very steep line. When price broke this line downward is only fell very shortly. The next trend line is much more flat, from November 2022 to March 2022. It also has 3 tests that are close, but 3 more a bit further away. When price broke this trend line it decreased for a long period of time.

Trendline flexibility

Trendlines are relatively flexible, and tests and pivots don’t always have to line up. In this example the trend line only fits moderately well:

You can see on this 4-Hour chart from Gold on 26 June – 17 July 2024, the line is broken in a few areas, and price misses the line as well. While this isn’t an ideal situation, we can still use it as a clue for when this larger trend could end.

Remember, trendlines are not an exact science, but a good guide for price movement. Major trend lines broken downward is a sign to leave the market.

About Elliott Wave Forecast

www.elliottwave-forecast.com Updates one-hour charts 4 times a day and 4-hour charts once a day for all our 78 instruments. We do a daily live session where we guide our clients on the right side of the market. In addition, we have a chat room where our moderators will help you with any questions you have about what is happening in the market.

Moreover, experience our service with a 14-day Trial for only $0.99. Cancel anytime by contacting us at support@elliottwave-forecast.com.