Near Term Top XAU/USD Correlated to Short in GDX

Subscribers of our Group 3 offerings at EWF know that we are intensively tracking the Elliott wave structure and cycle in GDX anticipating a top in the Vaneck Vectors Gold Miners ETF. Likewise our Group 1 Subscribers are aware we are simultaneously charting for a near term top in the composite spot price for Gold, XAU/USD. If we find the near term top in XAU/USD then it should prelude a top in GDX assuming all other fundamental relationships between these two financial instruments are equal or negligible. We now believe we have a valid case to say a tradable top has developed in GDX.

XAU/USD

The bottom in XAU/USD at $1,160.37 on 8/16/2018 signifies the Intermediate degree wave (W) of the proposed Primary degree wave ((Y)). Since then we’ve been plotting for 3 distinct swings higher. These Minor degree waves W, X, and Y would complete Intermediate degree wave (X) before a move lower in XAU/USD.

A simple but powerful relationship projection (highlighted in blue) between corrective swings regularly employed by EWF analysts caught our attention over the past few sessions. We now conclude prices have finished the near term upside in this area of relative power. A reaction is to occur. In this case its a reversal back lower and to call Intermediate degree wave (X) complete. Minor degree wave Y reached our typical measured extreme area between a calculation of wave Y= wave X at $1,279.52 and wave Y = 1.618*wave X at $1,330.85 to complete wave (X). The 1/4/2019 high within this highlighted area appears to be the top at $1,298.54. Subscribers are well aware that if a chart of any instrument in our Services has a blue highlighted box expectations for a reaction are high. This example is no different.

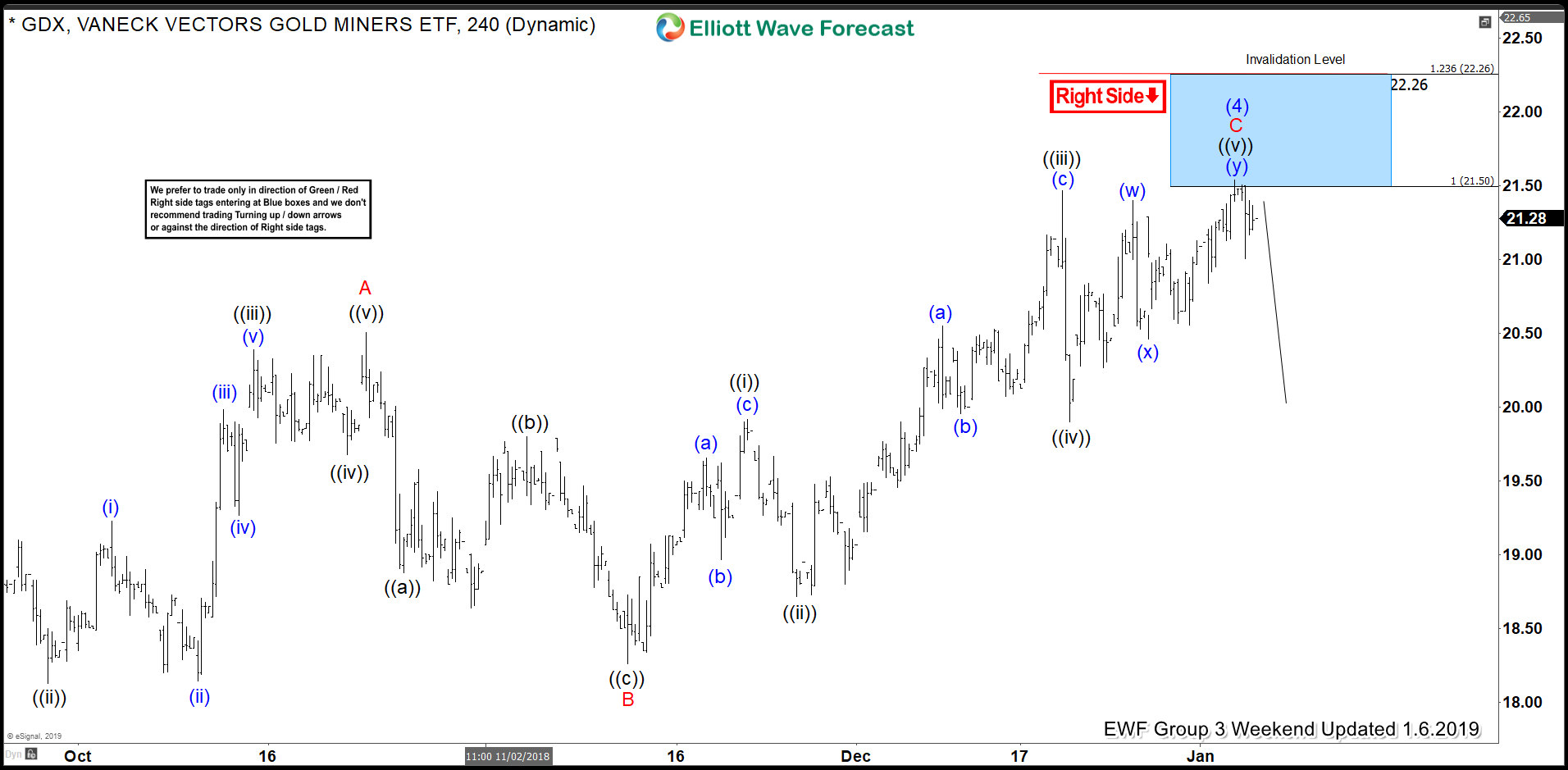

GDX

The zero point for this analysis is the Intermediate degree wave (3) low at $17.28 on 9/11/2018. Three clearly corrective swings into the measured extreme area known to our members for nearly 2 months has culminated in the projected $21.50-$23.50 range. The move higher appears to now be over at the 1/7/2019 high of $21.55. Subscribers were previously advised to initiate shorts in the projected range. Targets to the downside now lie below $17.28. Confirmation of the corrective structure happens on a move below $18.26 while prices remain below $23.50. Ultimate confirmation is obtained below $17.28. We will see if GDX plays out as planned. Our analysts will alert our Group 3 Subscribers when to take risk off this trade.

For more simple correlated setups like GDX check out our Subscription Services. A free trial is also available to those that would like more convictions.

To your trading success!

James

EWF Analytical Team