The iShares Silver Trust (SLV) is an exchange-traded fund (ETF) that tracks the price performance of the underlying holdings in the London Bullion Market Association (LBMA) Silver Price as of August 2014. If you’re interested in investing in silver, SLV provides exposure to the silver market without the need to physically hold the metal.

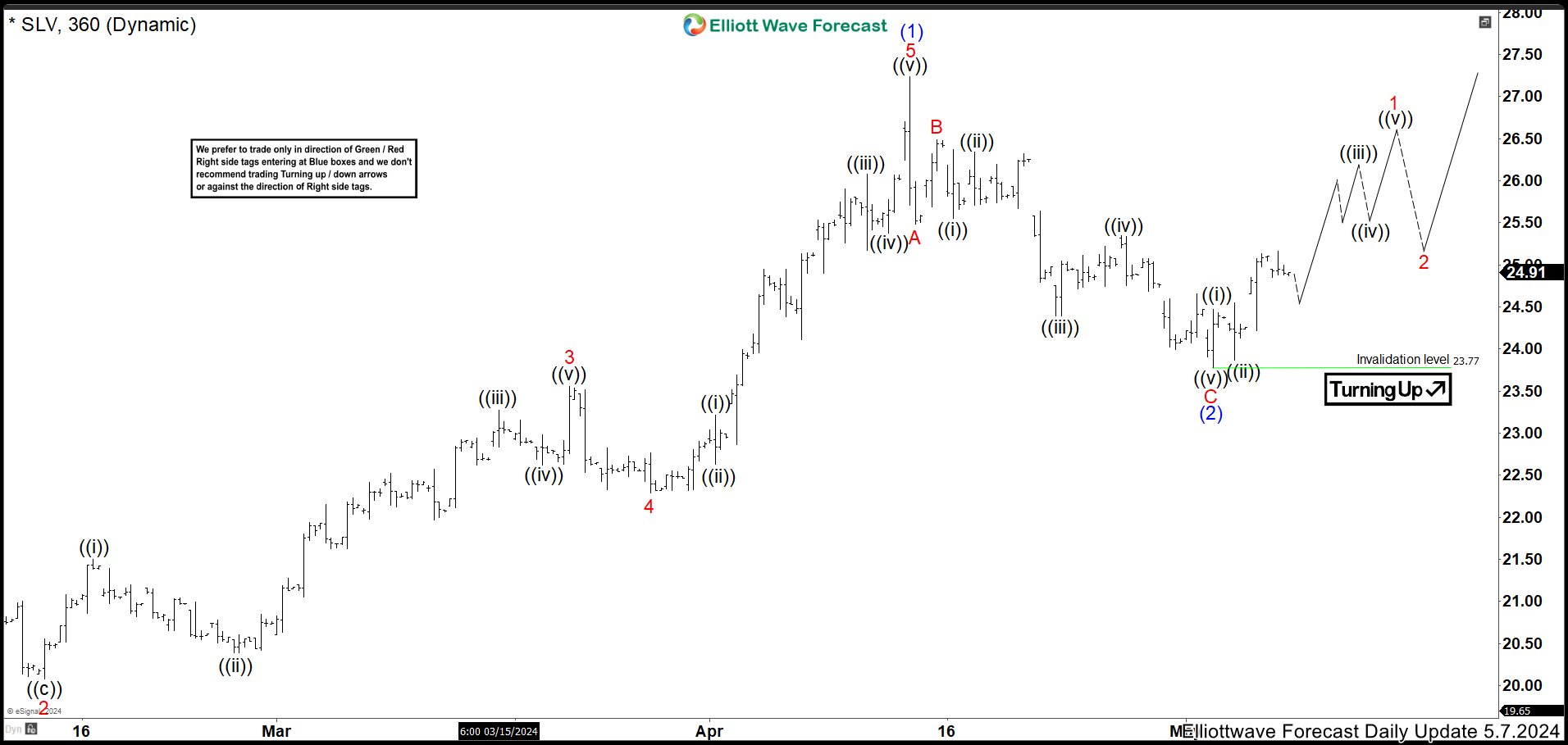

SLV 360 Min Chart May 7th

At the beginning of 2024, SLV resumed the bullish trend after a year of sideways movement. We think that the low of 01/22/2024 at 20.07 started the new cycle higher and we called as wave ((2)). From this point, we are looking to develop an impulse as ((3)). In the chart above from May 7th, we can see clearly an impulse wave (1) of ((3)) ended at 27.24. Then, market entered in a pullback as wave (2) building a zig zag correction. The ABC structure ended at 23.78 low in May and rallied again. (If you want to learn more about Elliott Wave Theory, please follow these links: Elliott Wave Education and Elliott Wave Theory).

SLV 240 Min Chart May 20th

Two weeks later, SLV has made a strong rally breaking above wave (1) high; therefore, we are already trading in wave (3) of ((3)). Up from 23.78 low, wave 1 ended at 26.28 and pullback as wave 2 completed at 24.70 low. Then, market remained bullish starting wave 3 of (3). Currently, we are calling for one more high to end wave ((v)) of 3. If there is not more extensions in wave 3, it should finish in 29.94 – 30.45 area before starting a correction in wave 4. Once wave 4 is ended in 3, 7 or 11 swings correction, we should looking for buying opportunities.

Elliott Wave Forecast

www.elliottwave-forecast.com updates one-hour charts 4 times a day and 4-hour charts once a day for all our 78 instruments. We do a daily live session where we guide our clients on the right side of the market. In addition, we have a chat room where our moderators will help you with any questions you have about what is happening in the market.

14 day Trial costs $9.99 only. Cancel anytime at support@elliottwave-forecast.com