Hello, fellow traders! If you’re new to Elliott Wave, this article will guide you on where to begin.

Elliott Wave Theory is one of the most powerful methods used in technical analysis to predict financial market cycles and trends. By identifying extremes in investor psychology, it offers a structured way to analyze the market. Elliott Wave Theory has a pattern for nearly every conceivable price structure, giving traders a unique tool for identifying opportunities. However, learning all the different patterns can take months or even years. But as with any great journey, it all begins with a single step. So, let’s get started.

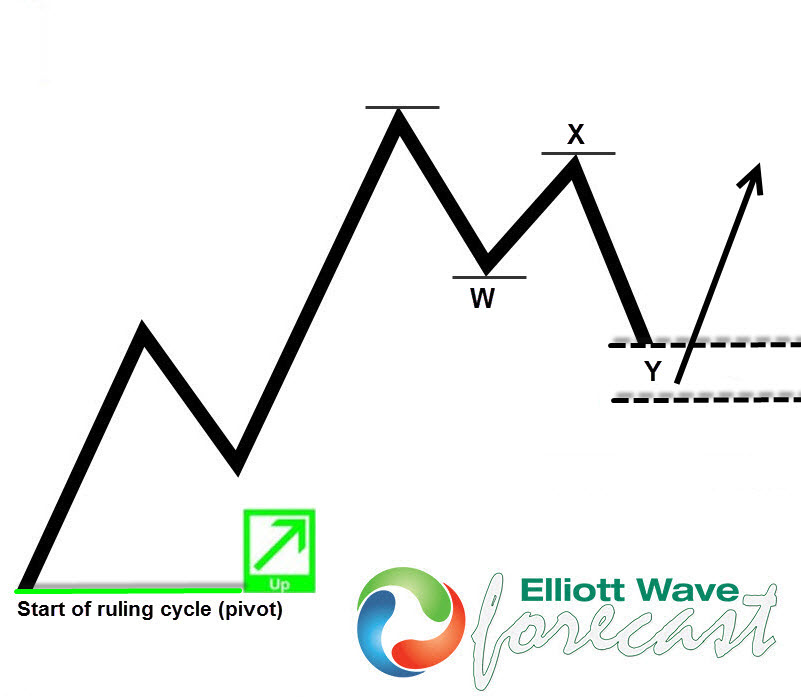

When analyzing the chart of any financial instrument, you’ll notice that every significant market reversal is preceded by a 3-wave correction. Sometimes, identifying these 3 waves will be straightforward, but at other times, it may require more attention to detail. However, recognizing this pattern is essential, as it becomes a key tool in your trading strategy. Once you’ve identified the overall trend of a particular instrument and have a strong directional bias, it’s crucial to avoid jumping into the market impulsively. Entering a trade without considering the corrective waves first can lead to getting stopped out. To maximize your chances of success, always wait for the 3-wave corrective structure to form against the prevailing trend before entering.

In the example below, you’ll see a common chart pattern with an uptrend followed by a 3-wave pullback labeled as WXY. Note that 3-wave corrections can be labeled either ABC or WXY, depending on the internal structure of the waves.

When you identify a trend, it’s tempting to jump right into the market. But entering without waiting for a 3-wave correction could lead to poor results. The key to success is to first recognize the trend and wait for the market to correct with 3 waves before you take action.

So, if you’re unsure where to start with Elliott Wave, begin by learning to identify 3-wave corrective patterns in real market charts.

You can learn more about Elliott Wave Patterns at our Free Elliott Wave Educational Web Page

Over the years, we’ve developed a proven trading strategy that combines this approach. It helps to define precise Entry, Stop Loss, and Take Profit levels, allowing you to enter trades with confidence. Even better, this strategy helps make your positions risk-free shortly after entering, providing added protection for your trading account.

Reminder for members: Our chat rooms in the membership area are available 24 hours a day, providing expert insights on market trends and Elliott Wave analysis. Don’t hesitate to reach out with any questions about the market, Elliott Wave patterns, or technical analysis. We’re here to help.