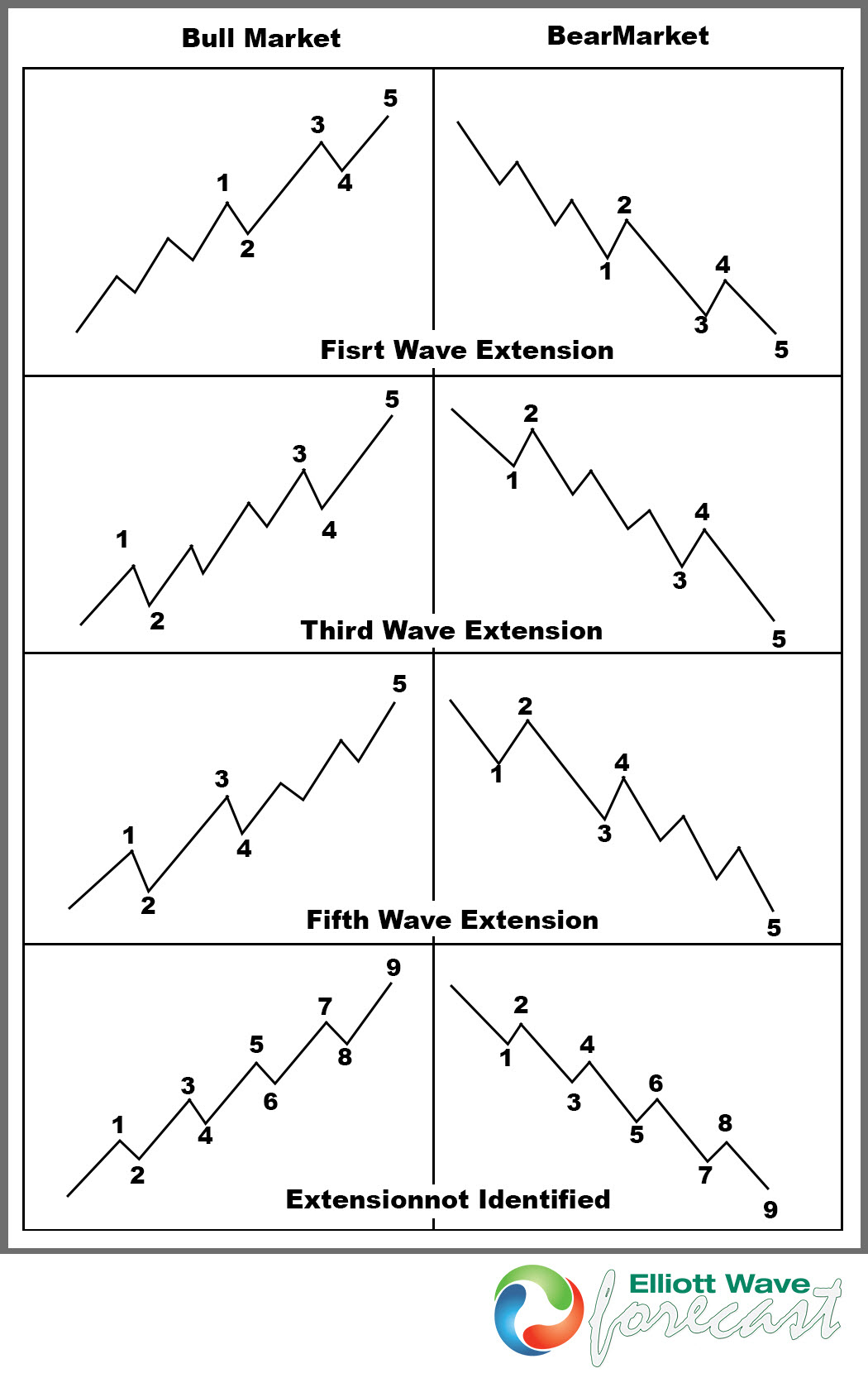

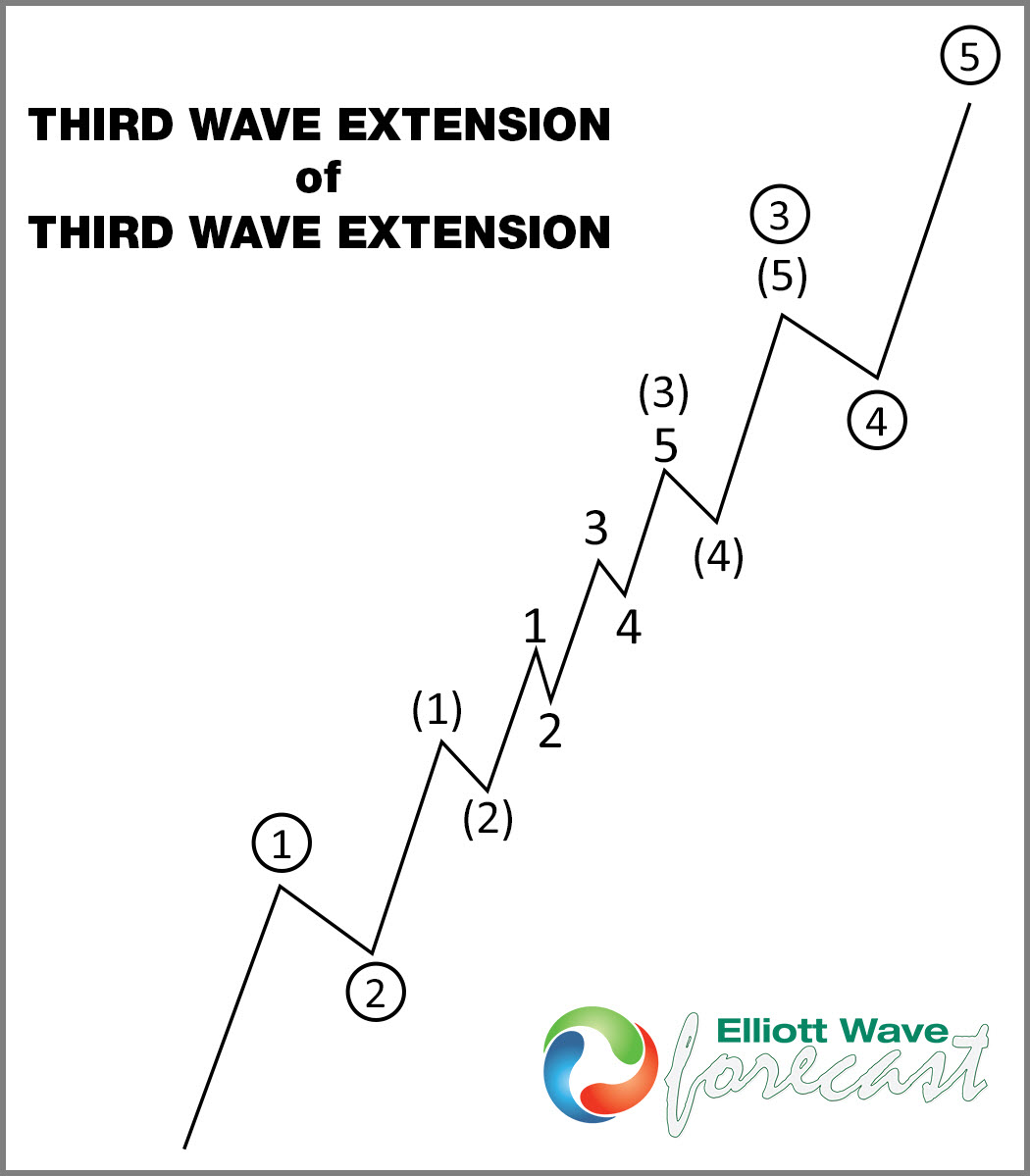

Statistics show that 90% of extensions occur in Wave 3, making it the strongest wave. When Wave 3 extends, it typically reaches at least a 1.618 Fibonacci extension of Wave 1 and can extend up to 2.618 or beyond. Extensions in Wave 5 are more likely than in Wave 1.

Elliott Wave Extensions: Key Rules to Follow

– If wave 5 is extended – wave 3 needs to be longer than wave 1, otherwise Elliott Wave count is wrong.

– When wave 1 extends – wave 5 must be shorter than wave 3, otherwise Elliott Wave count is wrong.

– For an extended wave 3 – wave 5 target could be got in 2 ways. It could be eather equal in length to the wave 1 or it’s 61.8% fibonacci extension of the length wave 1+wave 3 related to the wave 4.

– Impulsive waves with at least 1 wave extended should at least contain 9 swings and would increase to 13 or 17 swings if there are more extensions within.

Elliott Wave Extensions: Final Summary

Accurate Elliott Wave counting is critical for trading success. To master how to apply Elliott Wave Theory in live markets, join our community. As a member, you’ll gain access to:

- Professional Elliott Wave analysis across 4 timeframes

- 2 daily live webinars with expert analysts

- 24/7 trading chat room support

- Market overviews + daily/weekly technical videos

Not a member yet? Sign up for a 14-day Premium Plus Trial and start applying these strategies today. Welcome to Elliott Wave Forecast!