Hello fellow traders. In this technical blog we’re going to present the past Elliott Wave charts of Copper (HG #F) published in members area of www.elliottwave-forecast.com . As our members know, we were pointing out that Copper is within bullish cycle from the December 23th low. Structure has been calling for more strength once ((x)) pull back completes as Expanded flat. We recommended our members to keep buying the dips in 3,7,11 swings.

Before we take a look at the Copper (HG #F) Elliott Wave charts, let’s explain expanded flat in a few words.

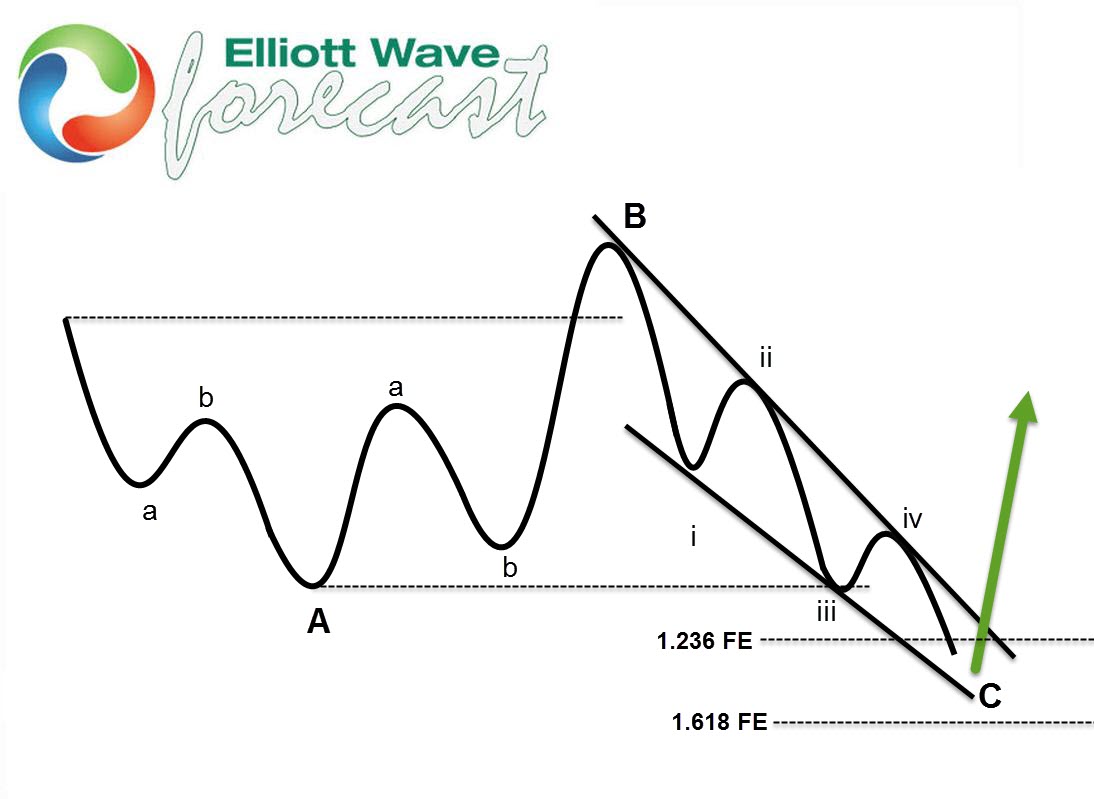

Elliott Wave Expanded Flat

Expanded Flat is a 3 wave corrective pattern which could often be seen in the market nowadays. Inner subdivision is labeled as A,B,C , with inner 3,3,5 structure. Waves A and B have forms of corrective structures like zigzag, flat, double three or triple three. Third wave C is always 5 waves structure, either motive impulse or ending diagonal pattern. It’s important to notice that in Expanded Flat Pattern wave B completes below/above the start point of wave A , and wave C ends above/below the ending point of wave A which makes it Expanded. Wave C of expanded completes usually close to 1.236 Fibonacci extension of A related to B, but sometimes it could go up to 1.618 fibs ext.

In further text we’re going to see what Expanded Flat Pattern structure looks like in real example, but before we continue, a short reminder to check out New EWF blogs and Free Elliott Wave charts.

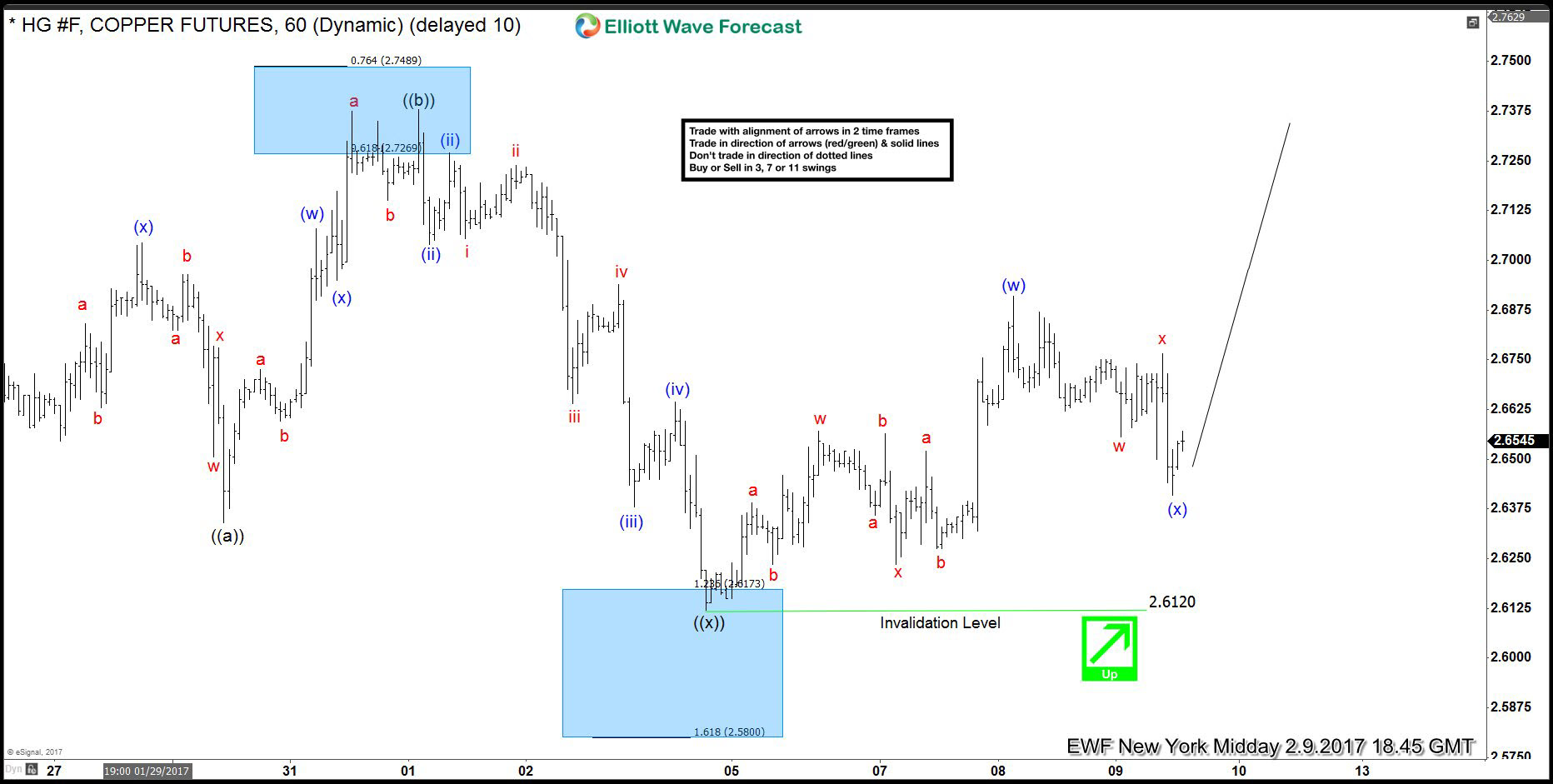

Copper (HG_F) 1 Hour chart: 2/3 NY Update

Short term Elliottwave structure suggests pull back is unfolding as a Expanded FLat structure from the 2.7320 peak. Wave ((a)) of Flat ended at 2.634 low ,while wave ((b)) at 2.7375 high which is above starting point of wave ((a)). Wave ((c)) is already showing enough swings and it’s already within buying area. However Copper has scope to extend lower still toward 1.236 fibonacci extension:2.6175 and complete there as 5 waves structure.

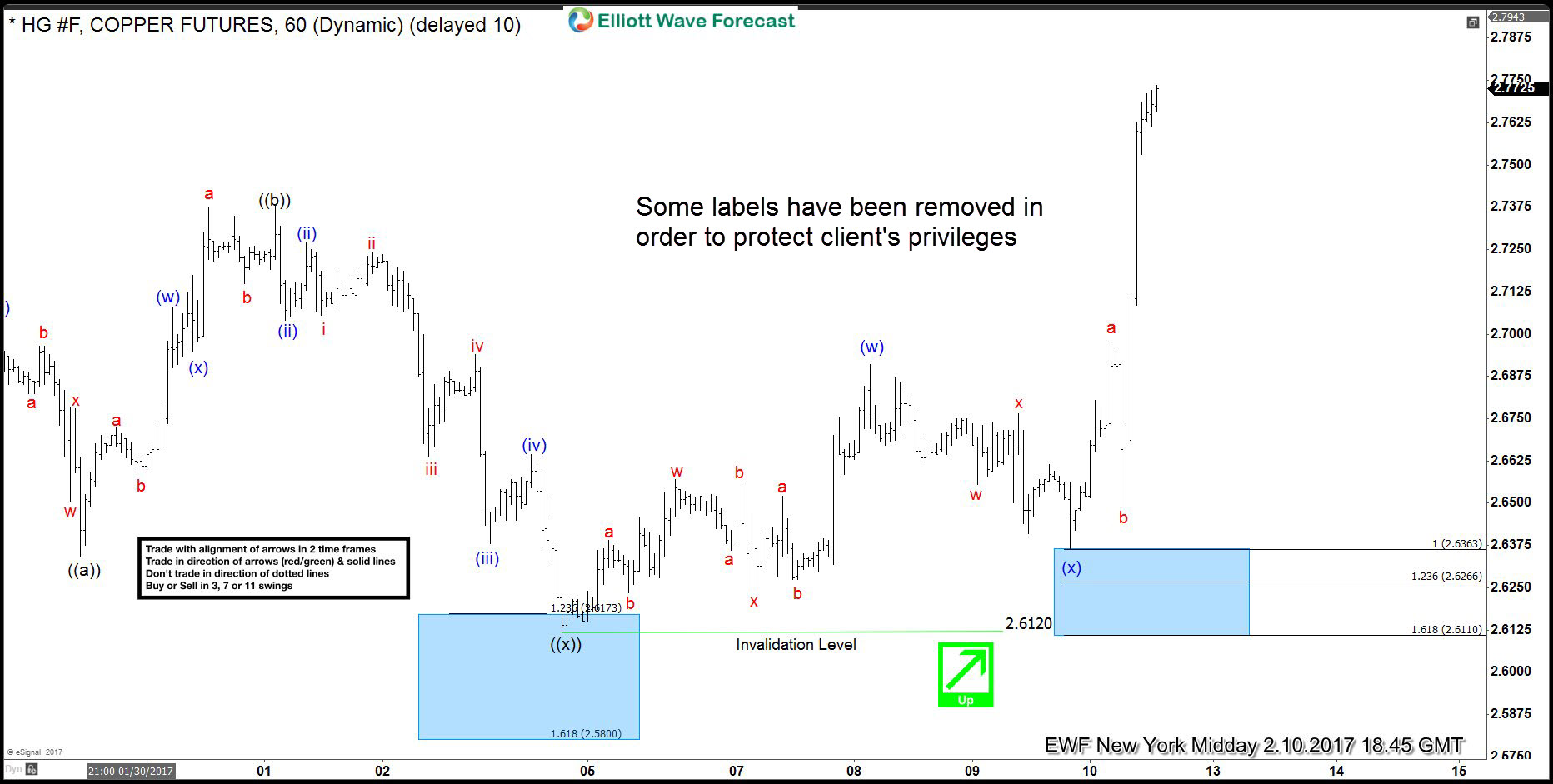

Copper (HG_F) 1 Hour chart: 2/9 New York Midday Update

We got proposed push lower toward proposed 1.236 fibonacci extension area and Copper found buyers shortly after. Wave ((x)) black pull back completed at 2.6120 as Expanded Flat structure. The price has made nice separation from the lows and long positions are risk free. 2.6120 low is expected to hold during the wave (x) blue pull back, so we can get further rally in direction of the main trend.

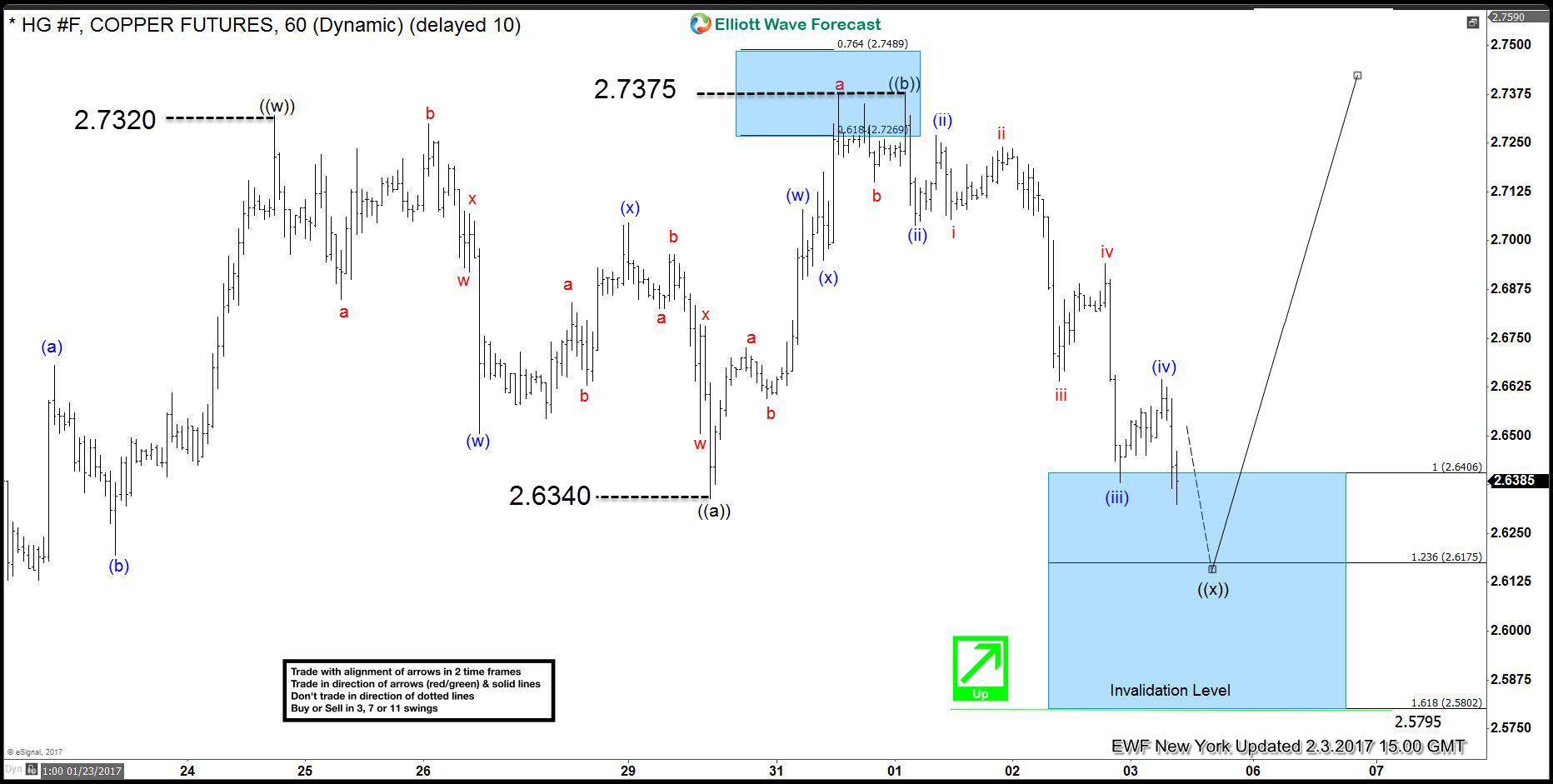

Copper (HG_F) 1 Hour chart: 2/10 New York Midday Update

2.6120 low held nicely and we got proposed continuation to the upside. Once short term (x) blue pull back ended, we got sharp rally and new high has been made.

Update charts and of $Copper can be found in the membership area of EWF. ( If not a member yet just sign up for 14 days Free Trial)

Proper Elliott Wave counting is crucial in order to be a successful trader. If you want to learn more on how to implement Elliott Wave Theory in your trading and to learn more about next trading opportunities in the Market, try us free for 14 days. You will get access to Professional Elliott Wave analysis in 4 different time frames, Strategy of the Day/Week Video ,Live Trading Room , 2 live Analysis Session done by our Expert Analysts every day, 24 Hour Chat Room support, Market Overview, Weekly technical videos and much more…

If you are not member yet, use this opportunity and sign up now to get your Free 14 days Trial.

Welcome to Elliott Wave Forecast !