Ovintiv Inc. (NYSE: OVV) is a leading North American exploration and production company. It is an oil and gas producer that explores, develops, produces, and markets natural gas, oil, and natural gas liquids. In this article, we delve into OVV’s technical structure based on Elliott Wave Theory and highlight its potential for further growth.

Since It’s all time high back in 2008, the stock spent 12 years in decline within a downtrend and lost 99% of it’s value. However, 2020 marked an important turn for the stock as we’ll see in the following chart :

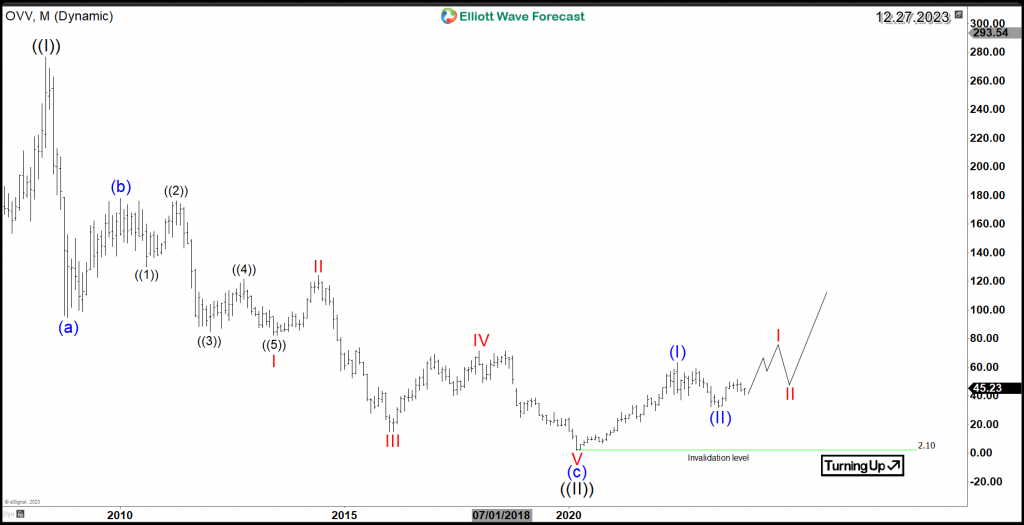

OVV Monthly Elliott Wave Chart 12.27.2023

The decline from the 2008 peak of $276 evolved as a 3-wave Zigzag structure. Both waves (a) and (c) unfolded as 5-wave structures, while wave (b) was in 3 waves. The downmove of wave ((II)) is considered to be the entire correction of the Grand Supercycle, and it ended in March 2020 at $2.1. Up from there, the stock saw it initial first 5 waves advance of the new cycle which marked wave (I) at $63.3 and it was followed by wave (II) correction at $32.07.

As long as price stays above that recent May 2023 low then we can expect OVV to resume it’s monthly move to the upside and it will be important to see a break above June 2022 peak to create a bullish sequence within a higher high and a higher low structure.

In conclusion, the long term technical picture for OVV is turning bullish and investors should be on the lookout for the next investment opportunity within daily cycles.

Get more insights about the Energy Sector and learn how to trade our blue boxes using the 3, 7 or 11 swings sequence by trying out our services 14 days . You will get access to our 78 instruments updated in 4 different time frames, Live Trading & Analysis Session done by our Expert Analysts every day, 24-hour chat room support and much more.

Back