Technical trade vs Fundamental trade

A huge debate is which type of trading to follow, many Market participants always find themselves between the dilemmas of which way to follow. Like everything in life, a person needs to have a criteria in order to make a decision and being consistent in the criteria is what makes better decisions in the long run.

Trading is a long run when nobody wins all the trades, as well as nobody loses all the trades. Elliott wave Principal is a technical way of trading and have nothing to do with the Fundamental trade. Traders usually try to combine both and then usually spend time looking at charts and all the study and analysis goes away when they start looking at the news or Fundamental part of trading.

We are not denying the Fundamental trading at all, what we are trying to achieve with this blog is to pass a message that trading is a reflection of life and that the Math needed to be behind the trade. Otherwise, Market participant will end up losing the money and have a short life as traders.

Regardless of the decision a trader makes i.e. to trade with Technicals or Fundamentals, the Math needs to be there and it’s hard to combine Fundamentals with the Math. In Elliottwave–Forecast, we follow the technicals, as everyone knows Elliott wave is suggestive and can provide more than one count or scenarios. For years, we have understood that nature and have created a system of distribution based in RSI, CCI, volume and other tools to avoid that nature and understand what we call the right side of the Market. What does Technical trading provide? It provides a level / an area in which you can enter the Market and also provides a level as a target and an invalidation level (where the idea is considered wrong). This combined with the Money management and picking trades with right risk / reward ratio, so that you would be profitable even if you won only 4 out of 10 trades, will give you the edge to become a successful trader. We believe in the ratios, Math, and understanding that no Human can forecast the Market 100% correct and only this way, it can keep you profitable over a period of time i.e. at the end of a quarter/ year.

Fundamental trading like Elliott wave Principal provided more than one path or possibilities but the huge difference is that they do not provide a level to enter or exit the Market. At the end, you can’t control the outcome and ending been at the mercy of the news event. Most of the time Fundamental trading ends up using the Technical trading because of the lack of levels. We believe in what many decisions makers believe which is winning or misery, which can be also all or nothing approached in which either you are a technical trader or a Fundamental trader .

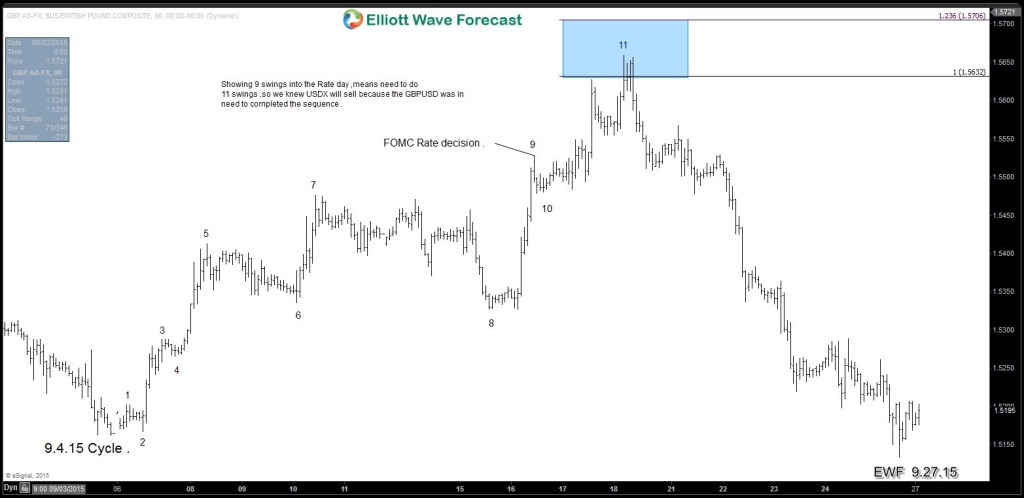

We believe that the combination of both have more negative things than positive because the lack of control to anticipate the move or market like this past FOCM decision rate. Everyone was long USD in anticipation of rate hite, then FED held the rate and USDX sold off. We as technical traders, knew ahead of news event that, the USDX path of least resistance was to the down side and we told members based in the GBPUSD which before the news was showing an incomplete sequence and was calling for USDX weakness, we knew the target and the target was reached at the 1.5644 area. A Fundamental trader can’t forecast the move before the event with such precision but a technical trader can do that.

Overall, nothing can be forecasted 100% in the Market but, at least the Technical trader can get the edge and anticipate the Market and be able to know which level negates the view. Fundamental trading, unless you got the Information ahead of the event which most Market participant won’t have off course and the lack of math behind this side of the equation, is the reason years ago we decided to go and learn the Technical part of trading and with the years, we been trying to improve the Elliott wave Principle adding new rules to validate and invalidate the decisions based on we trade and label the charts. We hope this article helps you better understand the nature behind the Technical and Fundamental trading and hope you can make a better decision with your future trading.