Understanding Fifth Wave Projections

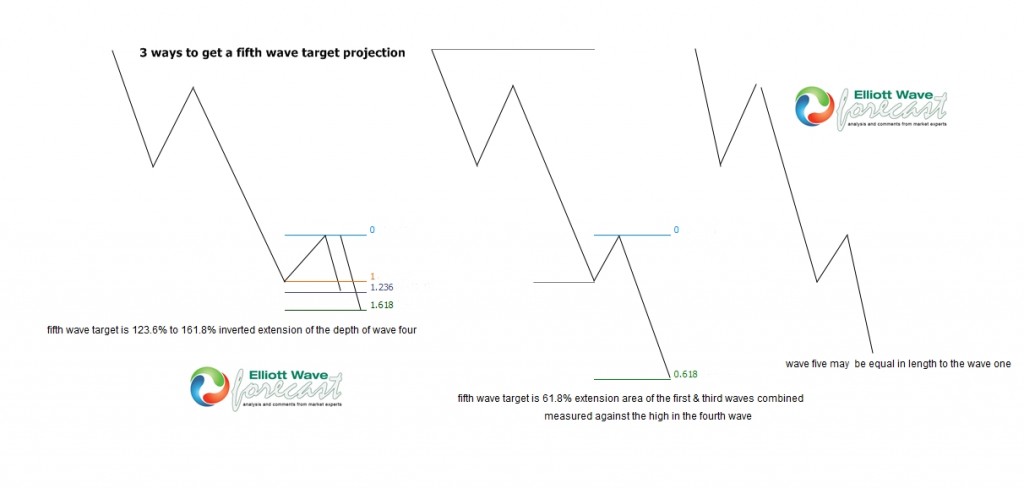

In both bullish and bearish markets—whether the Elliott Wave trend is up or down, or the cycle and degree of the wave is bullish or bearish, you can determine fifth-wave targets in three ways, regardless of the trend’s degree.

However, this list is not definitive, nor is it ranked in any particular order of preference. Since markets are dynamic, other correlated markets often provide clues about which target method works best at a given time.

Three Methods for Fifth Wave Projections

1. Fibonacci Extension Method

One way to forecast a fifth wave target with Elliott Wave is from the .618% extension area of the first & third waves combined measured against the high in the fourth wave.

2. Wave Equality Method

The second way is wave five may be equal in length to the wave one. Simply either count the points or pips in the first wave or draw a line from the wave cycle peak preceding the beginning of the wave one to the ending of the wave one, then highlight it & drag the top of the line to the end of the wave four corrective cycle peak & check the price where the end of the line projects to give the wave five target as being equal.

3. Inverted Fibonacci Extension Method

The third way to get a wave five target is what we expect at a minimum as we do not label truncated wave fives here as there is usually a better option in the Elliott Wave count. This is an inverted 1.236% -1.618% extension of the depth in the wave four measured up from the wave three lows to the peak of the wave four.

Thanks for reading and feel free to come visit our website and take a trial subscription and see if we can be of help.

Kind regards & good luck trading.

Lewis Jones of the ElliottWave-Forecast.com Team