There are three different types of Flat Elliott Wave Structure:

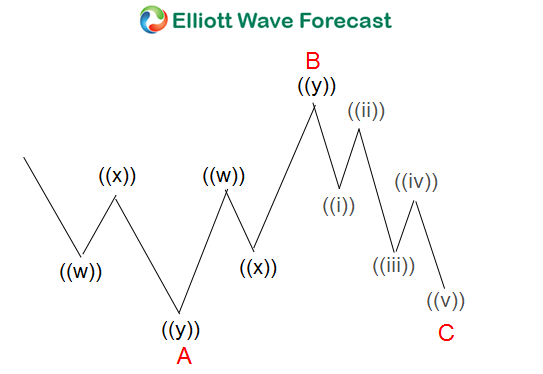

A. Regular Flat Elliott Wave Structure

Rules:

- Corrective 3 waves labelled as ABC

- Subdivision of wave A and B is in 3 waves

- Subdivision of wave C is in 5 waves

- Wave B terminates near the start of wave A

- Wave C generally terminates slightly beyond the end of wave A

- Wave C must have momentum divergence

Fibonacci Relationship:

- Wave B = 50%, 61.8%, 76.4%, or 85.4% of wave A

- Wave C = 61.8% – 123.6% of wave AB

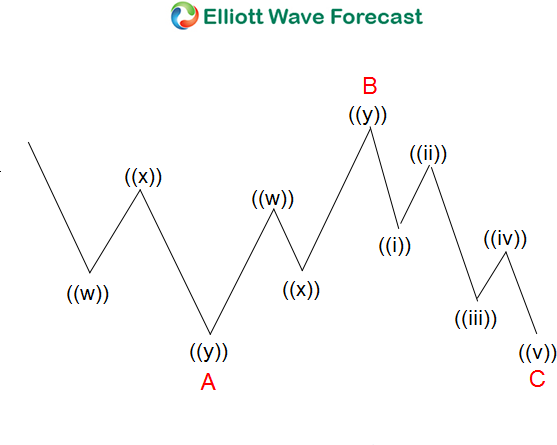

B. Expanded Flat Elliott Wave Structure

Rules:

- Corrective 3 waves labelled as ABC

- Subdivision of wave A and B is in 3 waves

- Subdivision of wave C is in 5 waves

- Wave B terminates beyond the starting level of wave A

- Wave C ends substantially beyond the ending level of wave A

- Wave C must have momentum divergence

Fibonacci Relationship:

- Wave B = 123.6% of wave A

- Wave C = 123.6% – 161.8% of wave AB

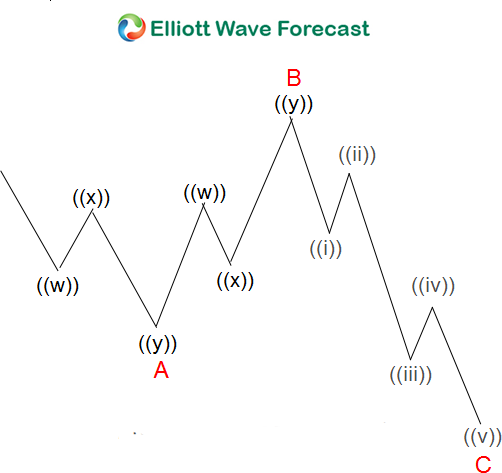

C. Running Flat Elliott Wave Structure

Rules:

- Corrective 3 waves labelled as ABC

- Subdivision of wave A and B is in 3 waves

- Subdivision of wave C is in 5 waves

- Wave B terminates substantially beyond the starting level of wave A

- Wave C travels full distance, falling short of the level where wave A ended

- Wave C must have momentum divergence

Fibonacci Relationship:

- Wave B = 123.6% of wave A

- Wave C = 61.8% – 100% of wave AB

Learning Flat Elliott Wave Structure recording

To learn more about Elliott Wave and our trading technique of 3, 7 or 11 swings, check out our Educational classes and sign up for a Free 14 day Trial. At EWF, we cover 52 instrument in different asset classes from forex, commodities, and indices. We provide Elliottwave forecast in 4 different time frames, Live Trading Room, 24 hour chat room, live sessions, and much more.