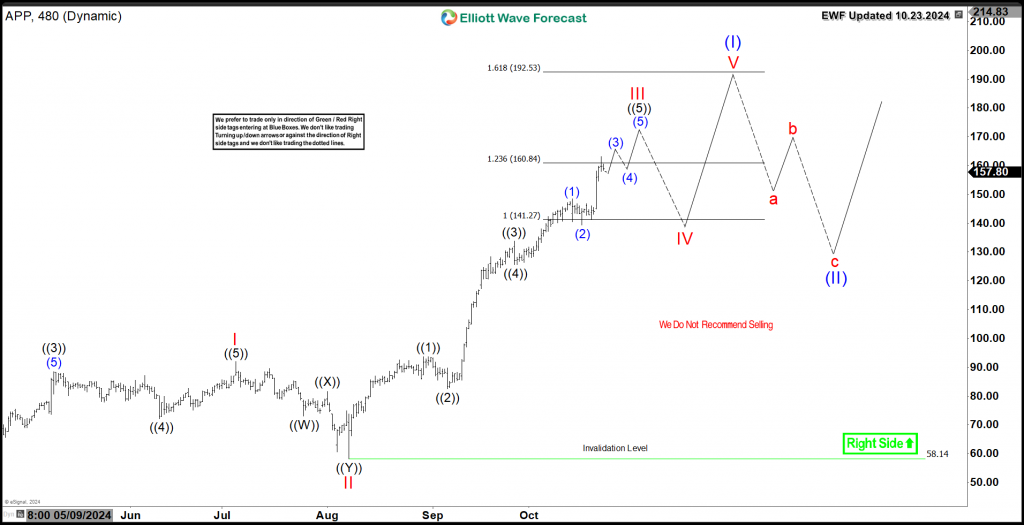

AppLovin Corporation ( NASDAQ: APP ) is an American mobile technology company founded in 2012 and headquartered in Palo Alto, California. In today’s video bog, we’ll explore Elliott Wave pattern taking place within the mid-term cycle and explain the potential path based on the theory.

APP started an impulsive bullish cycle since December 2022 and it’s currently showing 3 swings up into new all time highs. The wave I ended in July 2024 and it was followed by a wave II pullback which ended at $58.14. Then the stock traded higher into wave III and managed to reach the target area at equal legs $141 – $160.

APP is currently showing 5 swings within cycle from August low and it’s extending within wave ((5)) of III. Therefore, the stock will be looking to end the 5 waves advance from 8/7/2024 and then a correction in wave IV will take place. The stock is expected to remain supported above $58.14 and consequently buyers will be looking to enter after 3 , 7 or 11 swings pullback.

APP 8 Hour Chart 10.23.2024

The following video offers a technical outlook based on Elliott Wave Cycles :

Explore a variety of Stocks and ETFs investing ideas by trying out our services 14 days and learning how to trade our blue boxes using the 3, 7 or 11 swings sequence. You will get access to our 78 instruments updated in 4 different time frames, Live Trading & Analysis Session done by our Expert Analysts every day, 24-hour chat room support and much more.