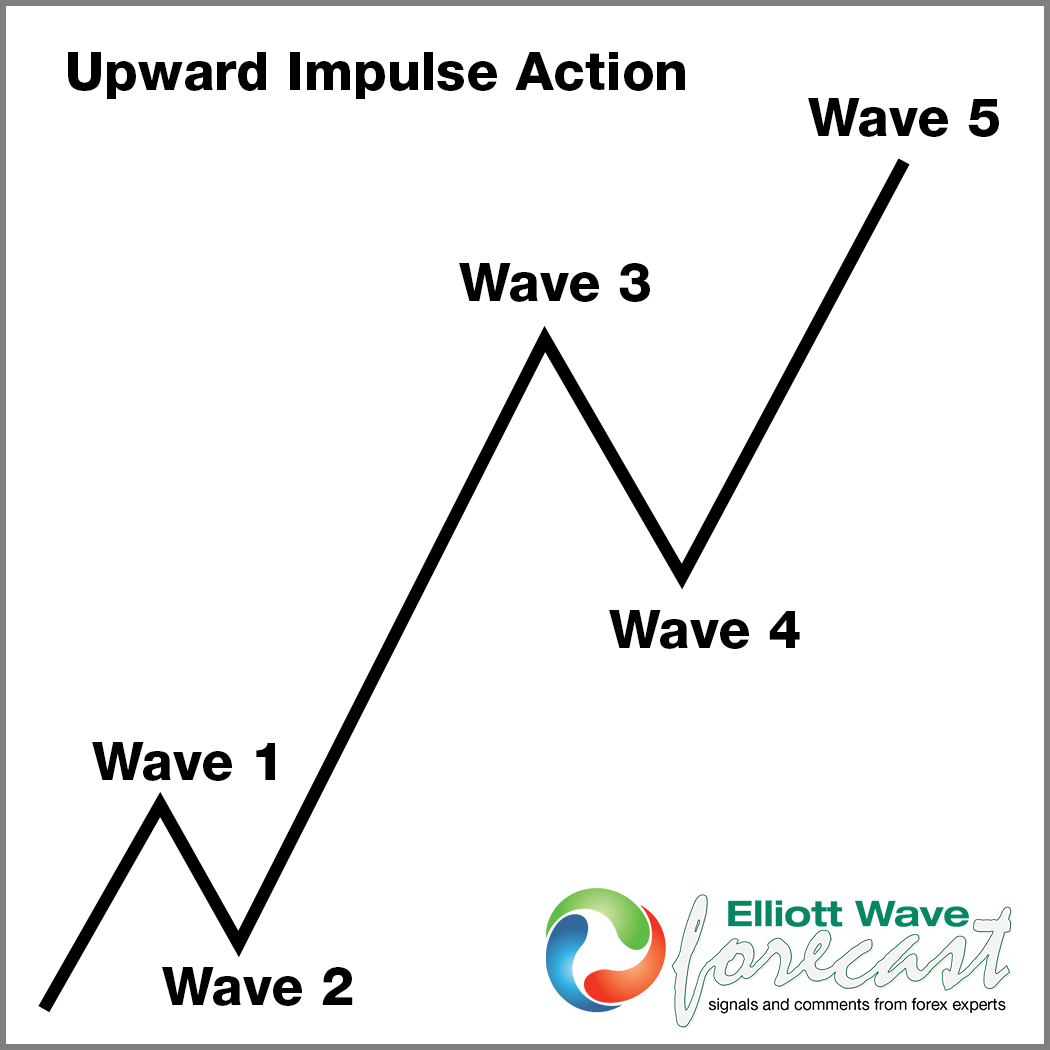

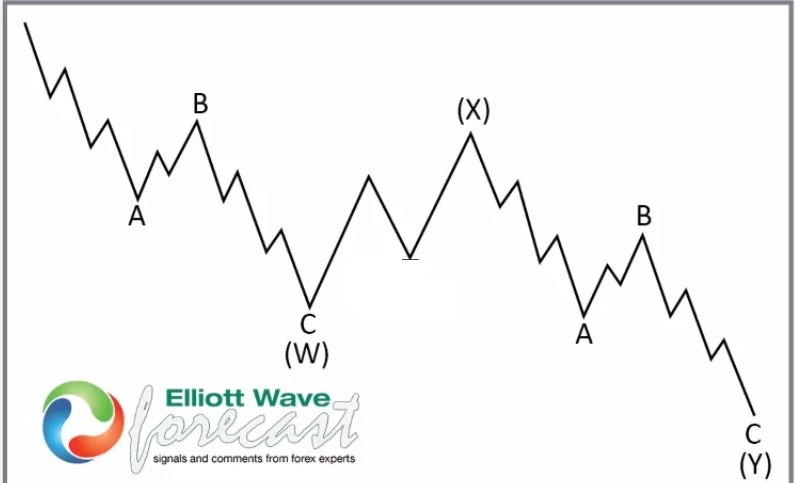

5 Wave Impulse + 7 Swing WXY correction

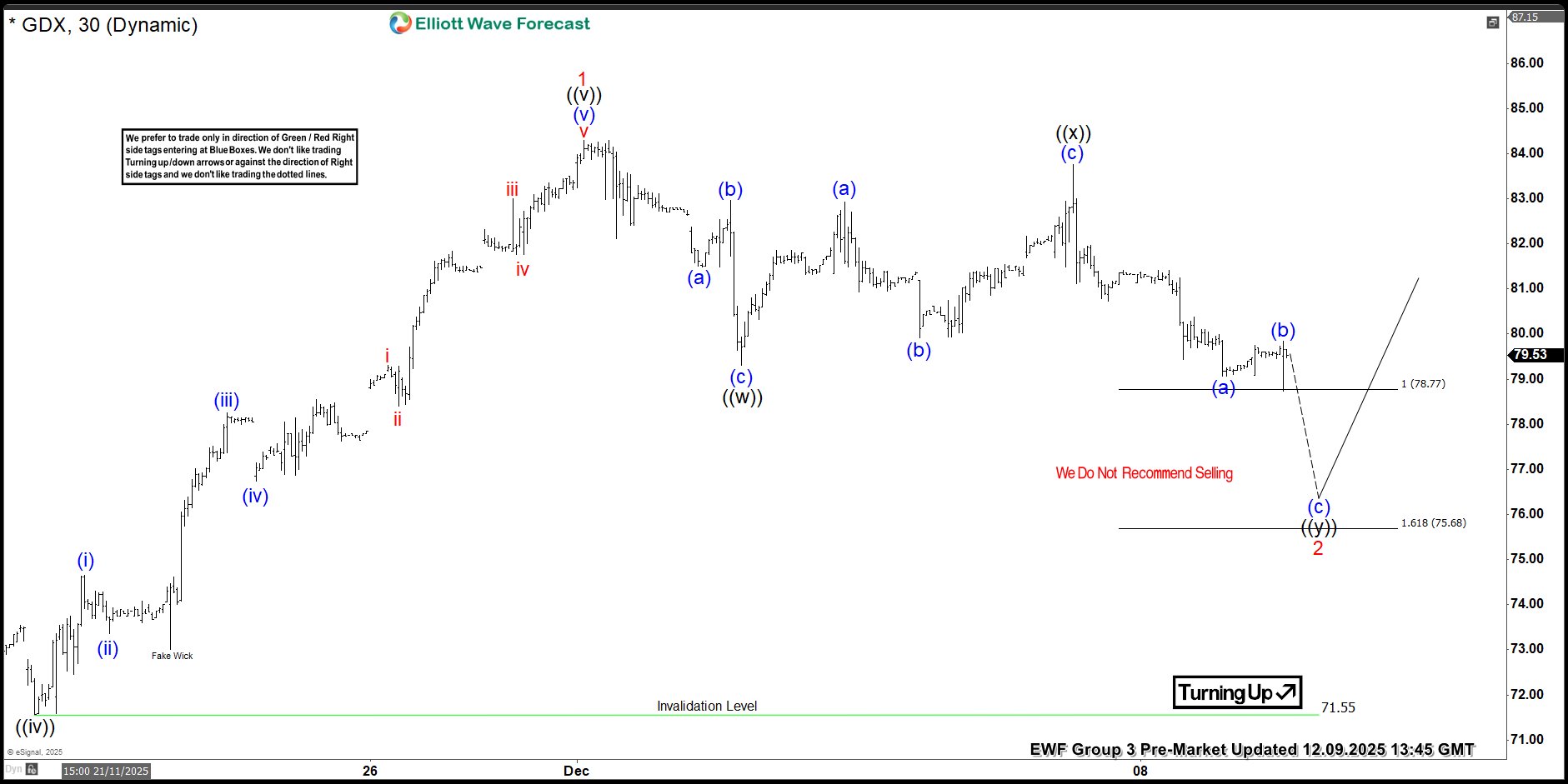

$GDX 1H Elliott Wave Chart 12.09.2025:

In the 1-hour Elliott Wave count from Dec 09, 2025, we saw that $GDX completed a 5-wave impulsive cycle at red 1. As expected, this initial wave prompted a pullback. We anticipated this pullback to unfold in 7 swings, likely finding buyers in the blue box equal legs area between $78.77 and $75.68.

In the 1-hour Elliott Wave count from Dec 09, 2025, we saw that $GDX completed a 5-wave impulsive cycle at red 1. As expected, this initial wave prompted a pullback. We anticipated this pullback to unfold in 7 swings, likely finding buyers in the blue box equal legs area between $78.77 and $75.68.

This setup aligns with a typical Elliott Wave correction pattern (WXY), in which the market pauses briefly before resuming its primary trend.

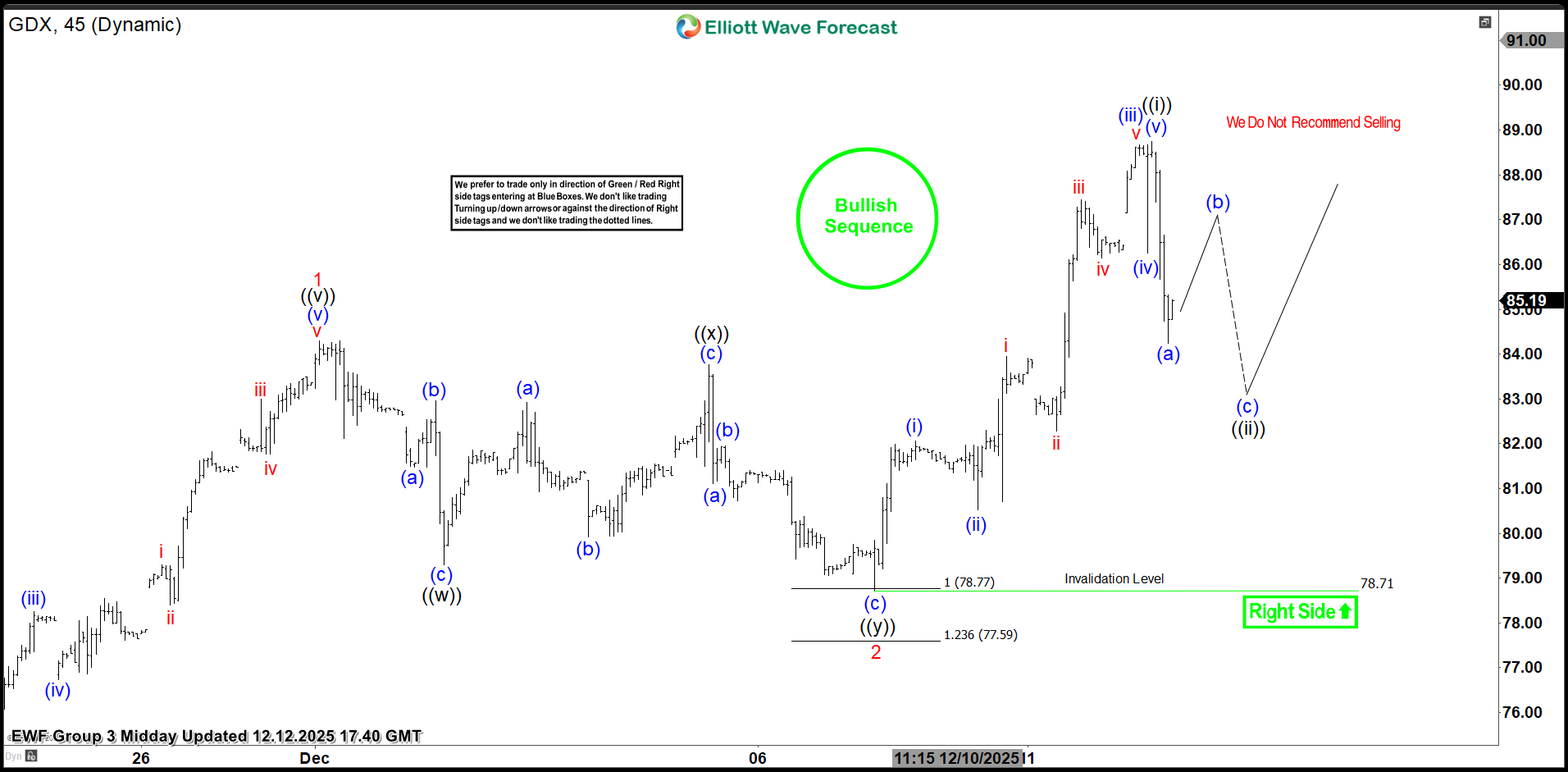

$GDX 1H Elliott Wave Chart 12.12.2025:

The update, few days later, from Dec 12, 2025, shows that the ETF bounced and made new highs as expected. Currently, it is looking for support against 12/09 low and higher in wave 3. Longs should be risk free and looking for $96-100 area as the next possible target.

The update, few days later, from Dec 12, 2025, shows that the ETF bounced and made new highs as expected. Currently, it is looking for support against 12/09 low and higher in wave 3. Longs should be risk free and looking for $96-100 area as the next possible target.

Conclusion

In conclusion, our Elliott Wave analysis of VanEck Gold Miners ETF ($GDX) suggests that it remains supported against Dec 2025 lows. As a result, traders should keep an eye out for any corrective pullbacks that may offer entry opportunities. By applying Elliott Wave Theory, traders can better anticipate the structure of upcoming moves and enhance risk management in volatile markets.

We cover 78 instruments, but not every chart is a trading recommendation. We present Official Trading Recommendations in the Live Trading Room. If not a member yet, Sign Up for 14 days Trial now and get access to new trading opportunities.

Welcome to Elliott Wave Forecast!