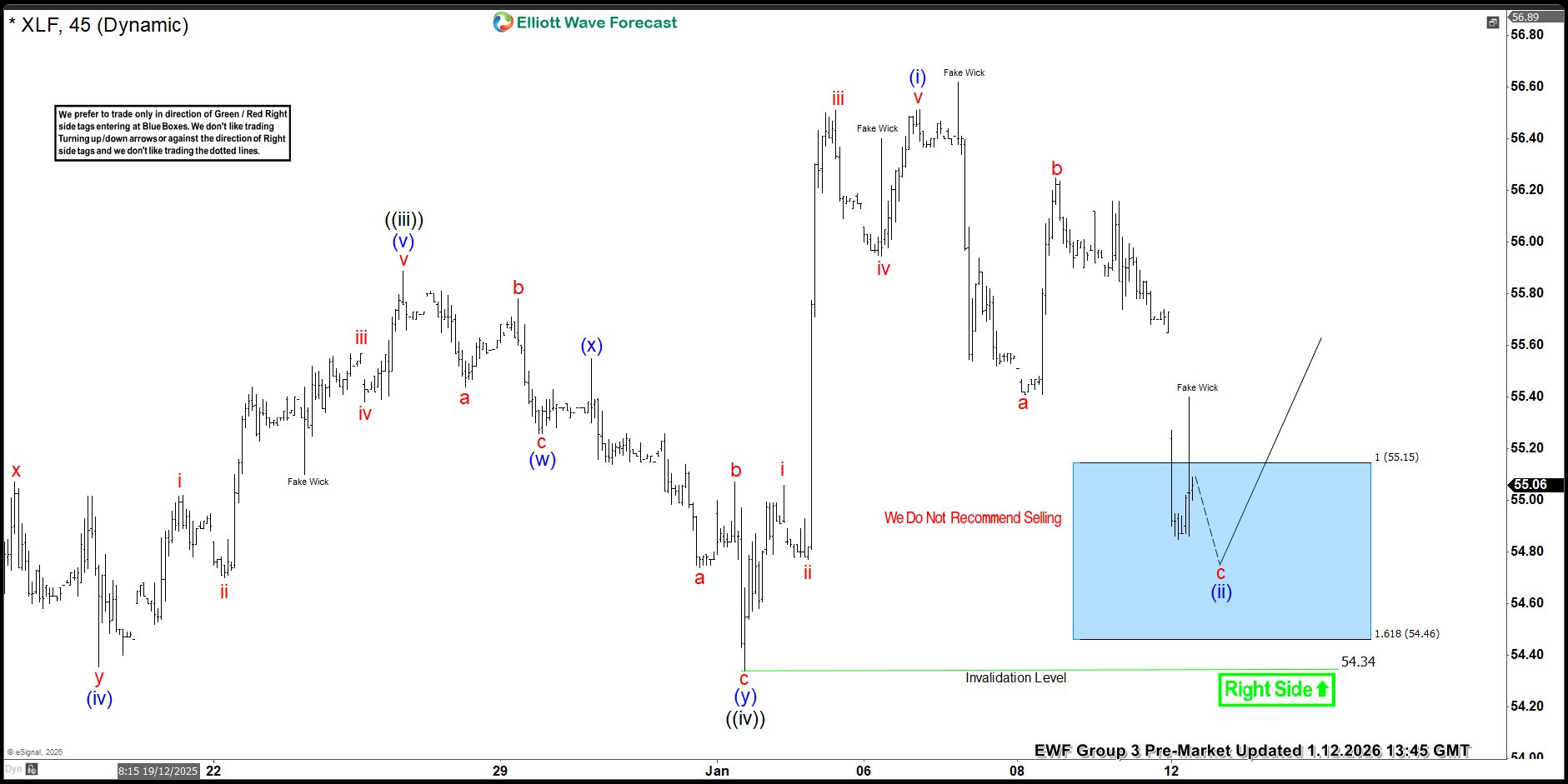

In the 1-hour Elliott Wave chart from January 12, 2026, $XLF completed a clear 5-wave impulsive cycle labeled blue (i). After such a move, a corrective pullback is typical. As expected, the ETF began to retrace in three swings, forming what we identify as an ABC correction.

The price action suggested that buyers would likely appear near the blue box area between $55.15 and $54.46. This zone represents the ideal region where a correction usually ends and a new bullish cycle begins.

In other words, the market took a brief pause before potentially resuming its primary uptrend. Therefore, this structure aligns well with a standard Elliott Wave correction, offering traders a technical roadmap.

What’s Next

At this stage, $XLF remains well-supported against the November 2025 and January 2026 lows. Traders who entered in the blue box area can now focus on the 50% retracement level as the next important target.

However, the market may not move in a straight line. Minor pullbacks are natural. In fact, these short-term corrections could offer fresh buying opportunities for those waiting to join the trend. As always, it’s important to monitor price behavior closely and apply proper risk management.

Conclusion

In conclusion, our Elliott Wave analysis of $XLF suggests the ETF continues to trade within a bullish framework. By using Elliott Wave Theory, traders can better anticipate market structure, identify continuation zones, and plan trades with greater confidence.

In addition, understanding how impulse and correction phases interact helps improve risk control, especially in volatile markets like this one. Therefore, maintaining flexibility and discipline remains key as this structure evolves.

Elliott Wave Forecast

At Elliott Wave Forecast, we cover 78 instruments across global markets. However, not every chart represents a direct trading setup. Official trading recommendations are provided exclusively in our Live Trading Room.

If not a member yet, Sign Up for 14 days Trial now and gain access to real-time updates, forecasts, and trading opportunities.