Hello Traders, in this article we will see how the NIKKEI ( JAPAN225 ) index has found support from equal legs area. Here at Elliott Wave Forecast we have developed a system that allows us to define areas of the market in which buyers and seller agree to a reaction. These are high frequency areas in which gives us at least an 85% chance of a 3 waves reaction from these areas. As soon as we can project an equal legs area we present it into our charts and our members know what they can expect. Nikkei has been trading within cycle from 02.06.2023 to complete its B leg lower. Consequently, having it’s first leg lower and connector within the corrective bounce we have presented the equal legs area. Let’s see the 1 hour update we presented to members from 02.22.2023 New York update.

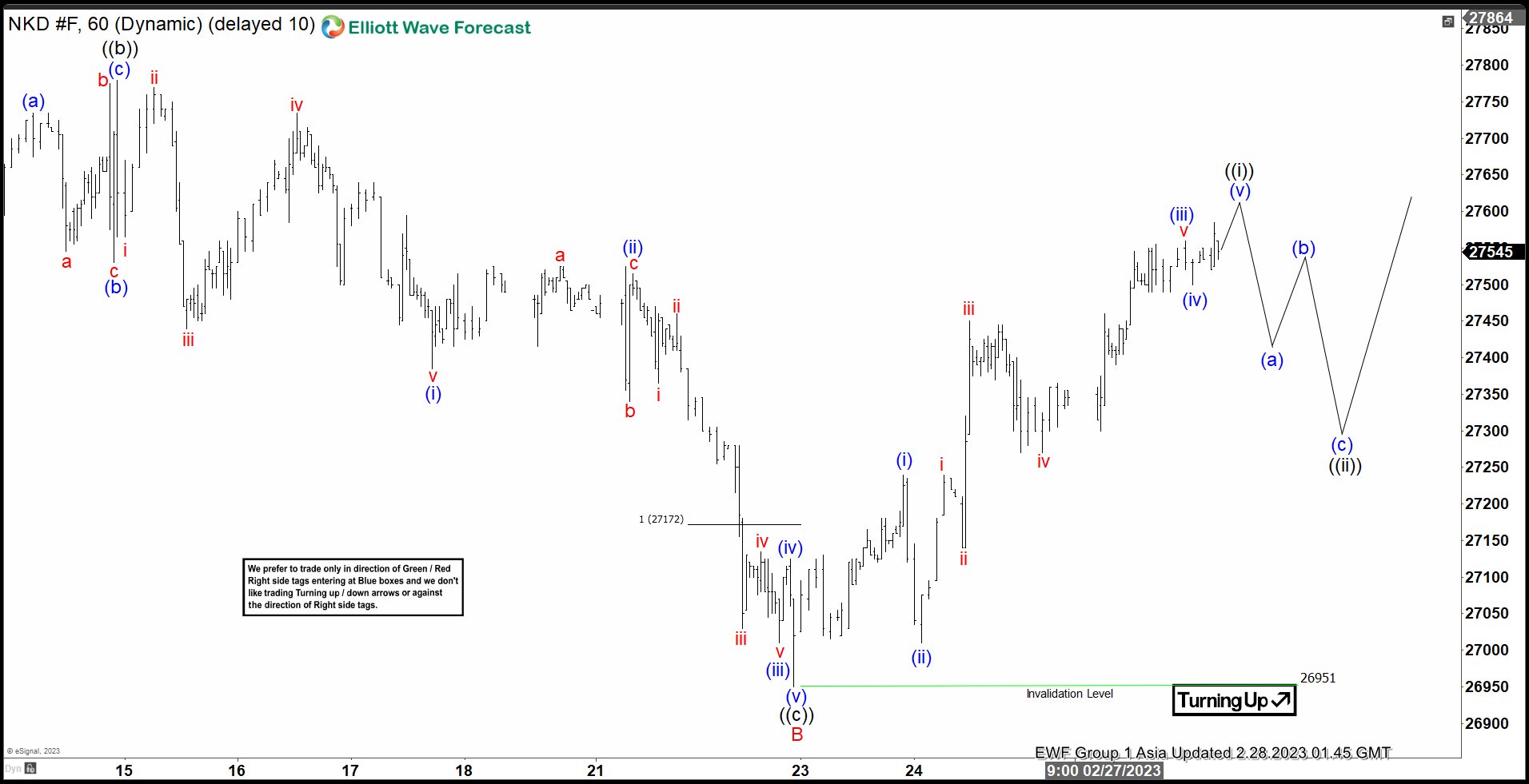

NIKKEI 1 Hour New York update 02.22.2023

As we can see at that time we were within equal legs area of 27172 – 26790 area in which we were expecting a minimum of 3 waves bounce higher at least. Traders have a defined entry level with a defined Stop Loss at this point. As it is highly important to have a proper risk management system that allows you to enter and exit the market at all times. Next let’s have a look at the aftermath after the update. We will check the latest Asia update from 02.28.2023.

NIKKEI 1 Hour Asia Update 02.28.2023

It has reacted as we were expecting within it’ possible first leg up within wave ((i)). We can subdivide it into 5 waves in blue with internal waves in red as presented in the chart. What we can expect next from the instrument is to provide us with a 3 waves pullback within wave ((ii)) before finding more support to continue higher in wave ((iii)). NIKKEI belong to our Group 1 instruments amongst other Indices such as the SPX, FTSE, DOW JONES.

You can learn how to trade the right side and when to enter and/or exit the market. Moreover, learn how to trade equal legs areas and blue boxes. Alongside with daily Live Analysis Sessions & Live Trading Room. On top of that we have a 24 hour live chat and chat room in which we answer any questions for each instrument. Click the links below to sign up or try first our 14 day trial.

Join us today: Elliott Wave ForecastElliott Wave Forecast Trial Plan Page

Or for a 14 day trial: