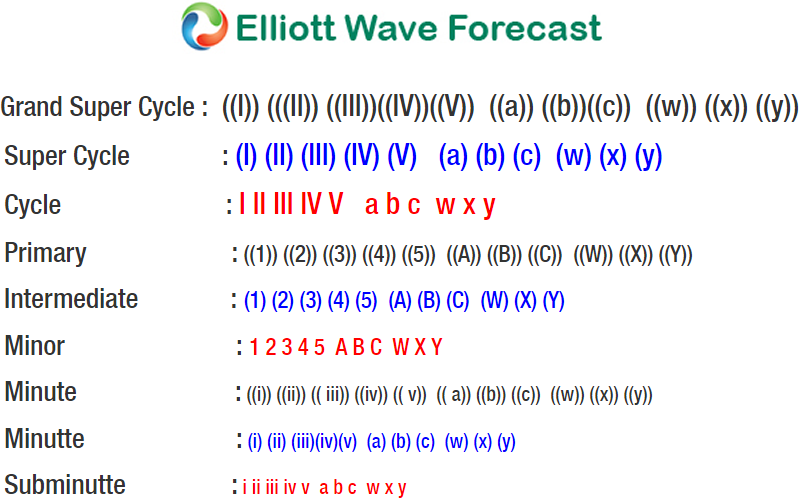

Short-term Elliott Wave view in FTSE suggest that the decline to 3/26/2018 low 6866.94 ended intermediate wave (B). Above from there, Intermediate wave (C) of ((B)) remains in progress with a strong rally to the upside unfolding as Impulse Elliott Wave structure. The internal distribution of each wave within the rally is unfolding as 5 waves pattern with extension in third wave, thus confirming the impulsive sequence.

Up from 6866.94 low, the index ended Minor wave 1 of (C) ended at 70442.37, Minor wave 2 of (C) ended at 6923.33. From there, Minor wave 3 of (C) unfolded as an Impulse Elliott Wave sequence with extension where Minute wave ((i)) ended at 7109.93, Minute wave ((ii)) ended at 6971.75, Minute wave ((iii)) ended at 7274.99, Minute wave ((iv)) ended at 7190.46 low, and Minute wave ((v)) of 3 ended at 7439.58 high.

Minor wave 4 of (C) pullback appears complete at 7334.64 low and the Index has started Minor wave 5 of (C) looking to extend 1 more leg higher towards 7499.48 – 7575.68 area approximately before ending primary wave ((B)). Afterwards, the index should start the next leg lower or at least do a 3 waves reaction lower as per Elliott wave hedging. We don’t like buying it.