Olin Corporation ( OLN ) manufactures & distributes Chemical products in the US, Europe & other countries. OLN is based in Clayton, Missouri. It trades under OLN ticker at NYSE. It comes under the Basic Materials sector as Specialty Chemicals industry.

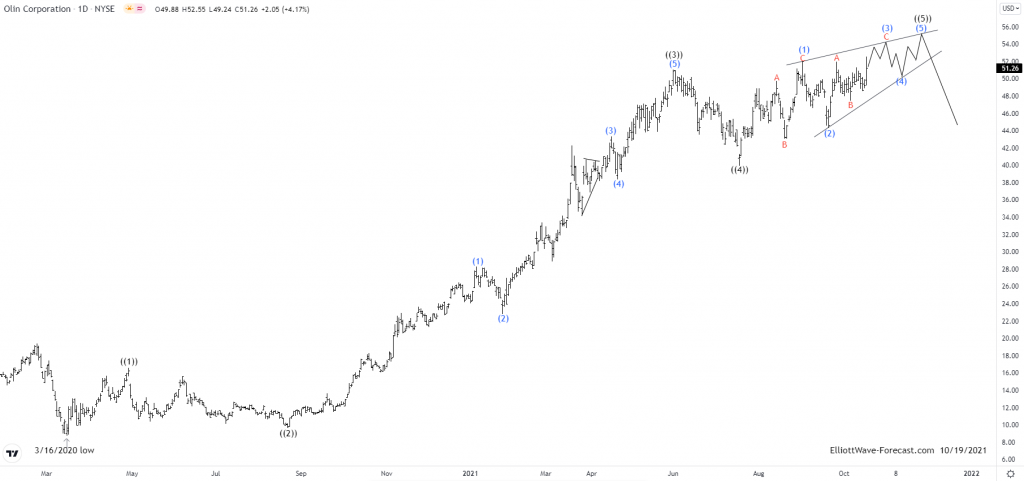

OLN – Elliott wave view from March-2020 low:

In daily, OLN started a higher high sequence from March-2020 low after a global sell off ended in early last year. Within the impulse cycle, currently it is in ((5)) wave as diagonal making 3-3-3-3-3 structure. It expect to make two more highs before any larger pullback against March-2020 low unfolds.

It started the primary degree ((1)) from 3/16/2020 low, which ended at $16.57 high on 4/29/2020. While below there it ended ((2)) at $9.67 low on 8/21/2020 as 0.854 retracement against ((1)). Above $9.67 low, it extended higher in ((3)), which ended at $51.04 high on 6/01/2021 as ((3)) wave extension. Generally, the third wave is the most common extension in stock market. Thereafter it pullbacks in ((4)), which ended at $39.90 low on 7/19/2021. ((4)) was slightly pass below 0.236 retracement against wave ((3)).

It started the primary degree ((1)) from 3/16/2020 low, which ended at $16.57 high on 4/29/2020. While below there it ended ((2)) at $9.67 low on 8/21/2020 as 0.854 retracement against ((1)). Above $9.67 low, it extended higher in ((3)), which ended at $51.04 high on 6/01/2021 as ((3)) wave extension. Generally, the third wave is the most common extension in stock market. Thereafter it pullbacks in ((4)), which ended at $39.90 low on 7/19/2021. ((4)) was slightly pass below 0.236 retracement against wave ((3)).

It confirms the higher high sequence in ((5)), which appears as 3 swings move indicating possible diagonal ((5)) is in progress. In short term, it is progressing in (3) of ((5)) as 3 swings move from $44.30 low as (2) & expect to move inside wedge. It can see two more highs before any larger reaction unfolds against impulse up cycle started from March-2020 low. After finishing (3), it should pull back near lower line of wedge before it rise again in final leg up. After diagonal structure ends, it expect to fall with higher momentum.

Get more insights about Stocks and ETFs by trying out our services for 14 days. You’ll learn how to trade the market in the right side using 3, 7 or 11 swings sequence in pull back. You will get access of our 78 instruments updated in 4 different time frames, Live Trading & Analysis Session done by our Expert Analysts every day, 24 hour chat room support and much more.