Dow Future Short Term Elliott Wave view suggests that Intermediate wave (4) ended with the decline to 23205. Up from there, Intermediate wave (5) is unfolding as an Ending Diagonal Elliott Wave structure where Minor wave 1 ended at 24536 and Minor wave 2 ended at 24073. The Index has been able to break above Minor wave 1 at 24536 which adds validity to this view.

Near term, rally from 24071 low remains in progress as 5 waves impulse Elliott Wave Structure and expect more upside before Minute wave ((i)) ends. Index should then pullback in Minute wave ((ii)) in 3, 7, or 11 swing to correct cycle from 12/7 low (24071) before the rally resumes. We don’t like selling the pullback and expect Index to find buyers in Minute wave ((ii)) pullback in 3, 7, or 11 swing as far as pivot at 24073 low stays intact.

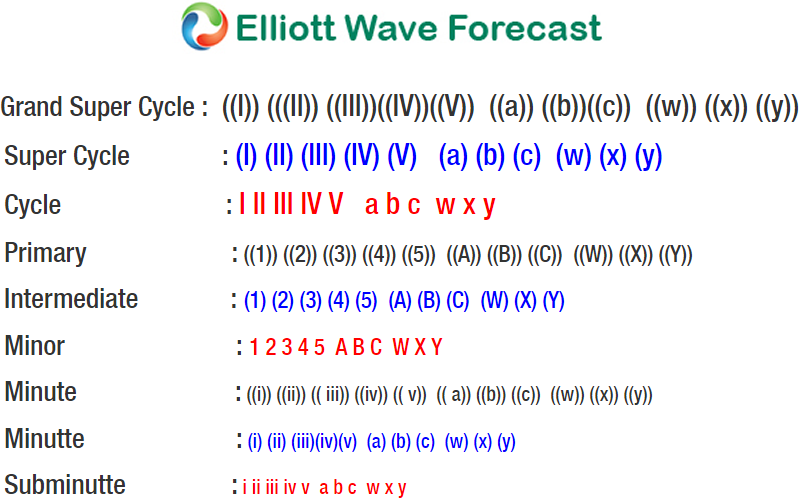

YM_F Dow Future 1 Hour Elliott Wave Chart

We provide precise forecasts with up-to-date analysis for 78 instruments. These include Forex, Commodities, World Indices, Stocks, ETFs and Bitcoin. Our clients also have immediate access to Market Overview, Sequences Report, 1 Hour, 4 Hour, Daily & Weekly Wave Counts. In addition, we also provide Daily & Weekend Technical Videos, Live Screen Sharing Sessions, Live Trading Rooms and Chat room where clients get live updates and answers to their questions. The guidance of ElliottWave-Forecast gives subscribers the wherewithal to position themselves for proper entry and exit in the markets. We believe our disciplined methodology and Right side system is pivotal for long-term success in trading