The last time I looked at Bit Digital was back in October 2021. At the time, I was favouring that a pullback against the 7/20/2021 low was complete, and that the new swing higher was underway. Lets take a look at the chart I was presenting:

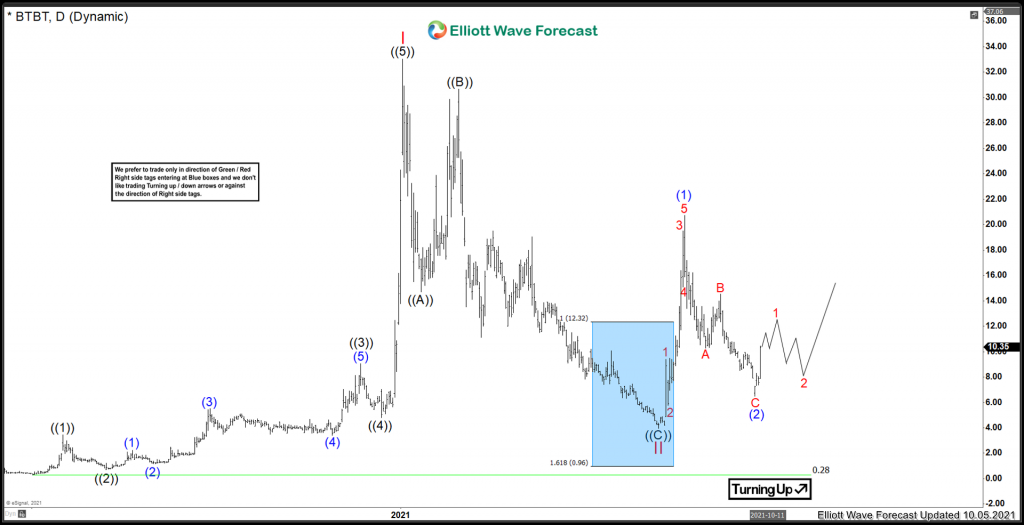

Bit Digital October 2021 view:

Back in October, the market had looked like wave (2) was set. This brings up a good practice we like to use at EWF. We do NOT trade the middle areas. Even though (2) was appearing to be set, the market had other ideas and was wanting to do a double correction lower. The price had not confirmed the next move higher was underway, by taking the August 9 peak. If you can’t trade a blue box at a 100% area, we need to be patient and wait for the next opportunity. Now lets fast forward to present chart and see how things turned out.

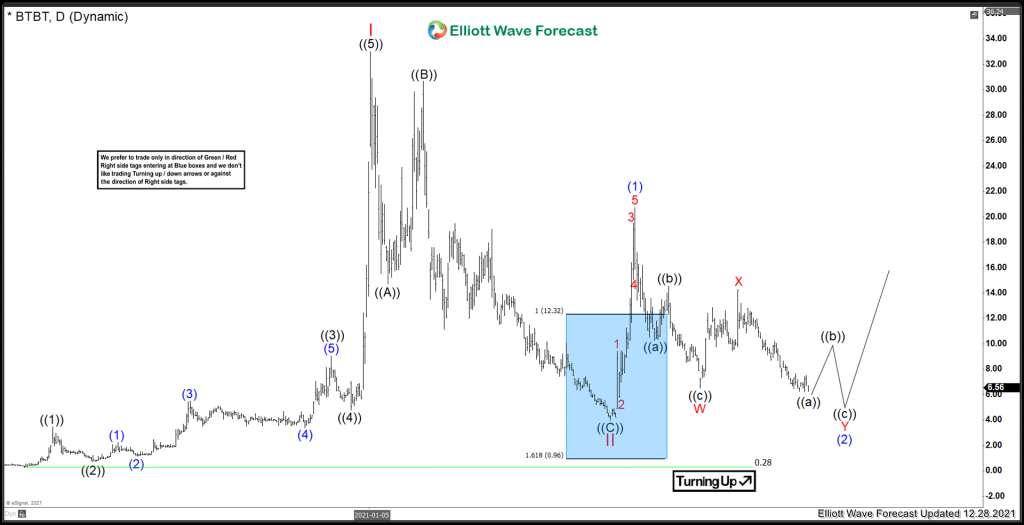

Bit Digital Elliottwave View December 2021:

As mentioned, Bit Digital had other ideas. The rally from the 9/20 low turned out to be 3 swing higher, and now with prices breaking the 9/30, has confirmed that a double correction lower to correct 7/20 low is underway.

Bit Digital prices appear to be ready to bounce in a ((b)) wave of Y of (2). However, it is possible that this swing lower can be a sharp Y wave without a proper connector in ((b)). Right now, there is no 100% area to enter the market for a bounce. However, as long as prices remain above the 7/20 low @ 3.97 and more importantly, the 0.28 low, I do favour further upside.

Should the 3.97 low break, then the instrument would favour still correcting the entire cycle in Red II. I do not favour this at this time, but without a blue box to trade, there isn’t a great risk reward area where buyers can enter for a bounce.

Risk Management

Using proper risk management is absolutely essential when trading or investing in a volatile stocks. Elliott Wave counts can evolve quickly, be sure to have your stops in and define your risk when trading.

Improve your trading success and master Elliott Wave like a pro with 14 day trial today. Get Elliott Wave Analysis on over 70 instruments including GOOGL, TSLA, AAPL, FB, MSFT, GDX and many many more.